America’s $1.5 Trillion Reality Check

Tariffs, rare earths, and algo-driven chaos reminded everyone how fragile this boom is.

📬 In today’s issue, we dive deeper into:

PART I:

1. Charts Of The Week (U.S. Corporate Dominance, AI Infrastructure Backbone)

2. Tariffs, Panic, and $1.5 Trillion Gone

3. China Pulls the Rare Earth Trigger

4. Machines Sell, Humans Panic, Gold Wins

PART II:

5. The Rundown (AMD–OpenAI $100B Deal, Gold’s $4K Surge, Fifth Third–Comerica Merger, First Brands Collapse)

6. On The Horizon (Fed Talks, Delayed Data, Earnings Kickoff)

7. Reading Recommendations (Bubble Trading, AI Winners, Dividend Plays, Market Declines)✅ We just launched our free Discord for Options Traders.

We primarily focus on option selling strategies, but we do options trades here and there as well.

If you’re an options trader or just want to keep up with the markets, this is the place to be.

👉 Join now, before the community is invite-only.

Charts Of The Week

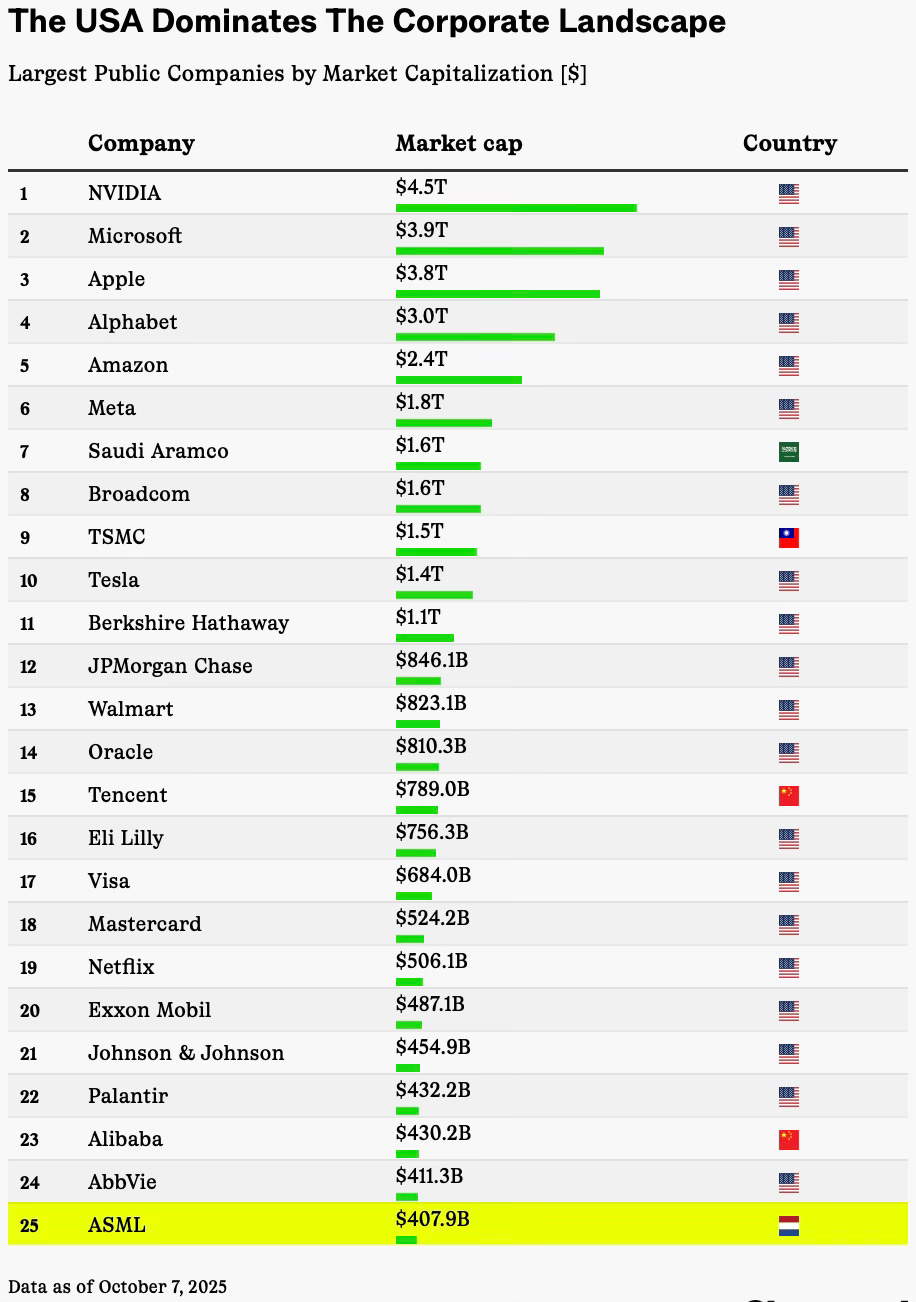

This chart shows just how thoroughly the United States dominates the global corporate landscape. As of October 7, 2025, 20 of the world’s 25 largest public companies are American, from Nvidia ($4.5T) and Microsoft ($3.9T) down through giants like Apple, Alphabet, and Amazon. Together, they form the core of the AI-driven market boom that has reshaped global valuations.

In stark contrast, Europe has only one representative, ASML ($407.9B), ranking last on the list. Taiwan’s TSMC and China’s Tencent and Alibaba are Asia’s top entries, while Saudi Aramco remains the only Middle Eastern firm near the top.

The chart highlights how the AI era has concentrated corporate power in the U.S., where Big Tech’s unmatched scale and data advantage have created trillion-dollar titans. Europe’s industrial and luxury heavyweights can’t match that pace, a sign of how uneven the global innovation race has become.

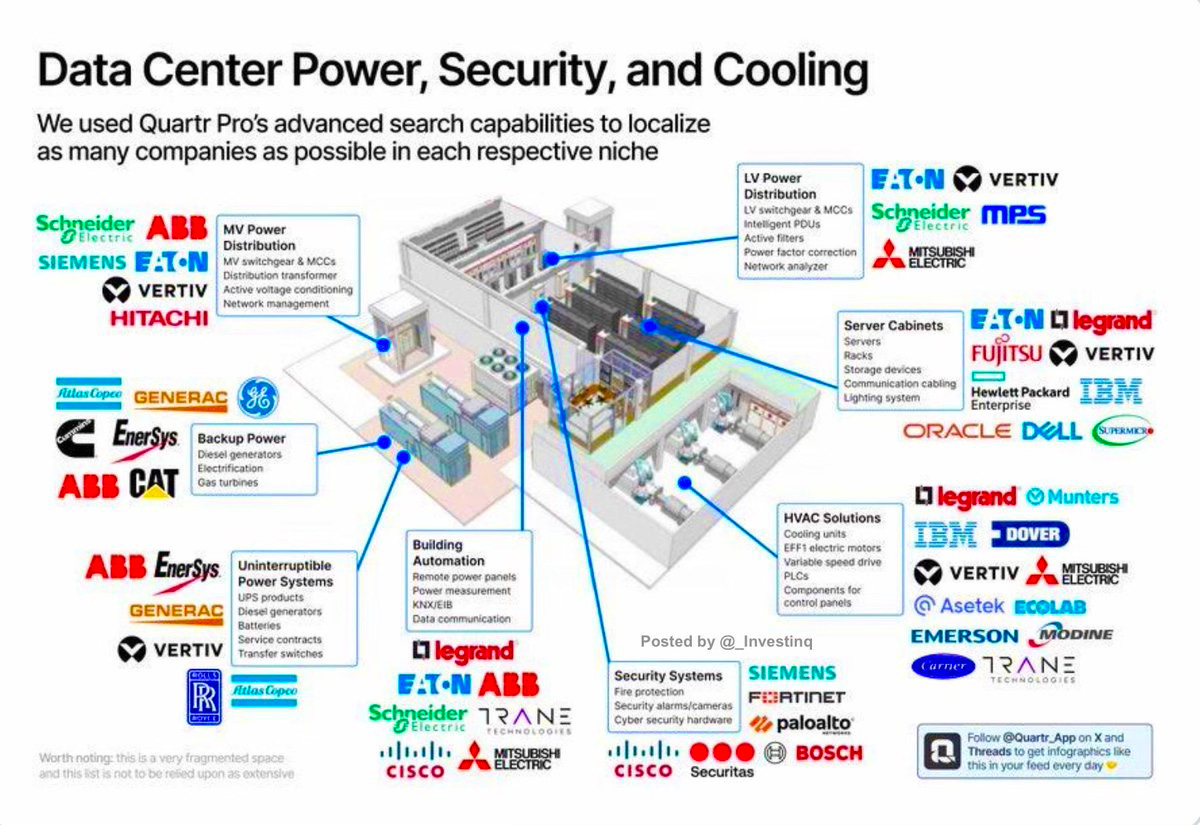

This chart shows how fragmented yet interconnected the data center ecosystem is. Power distribution is led by Schneider Electric, ABB, Siemens, Eaton, and Vertiv, while backup systems rely on Generac, GE, and Caterpillar to keep servers running through outages.

Cooling and HVAC solutions come from Trane, Carrier, and Mitsubishi Electric, and security is handled by Cisco, Fortinet, and Siemens. Server infrastructure racks, cabinets, and cabling is dominated by IBM, Dell, Oracle, and HPE. Together, these firms form the backbone of the AI and cloud era, powering the digital world behind the scenes.

MARKETS JUST GOT HIT WITH REALITY

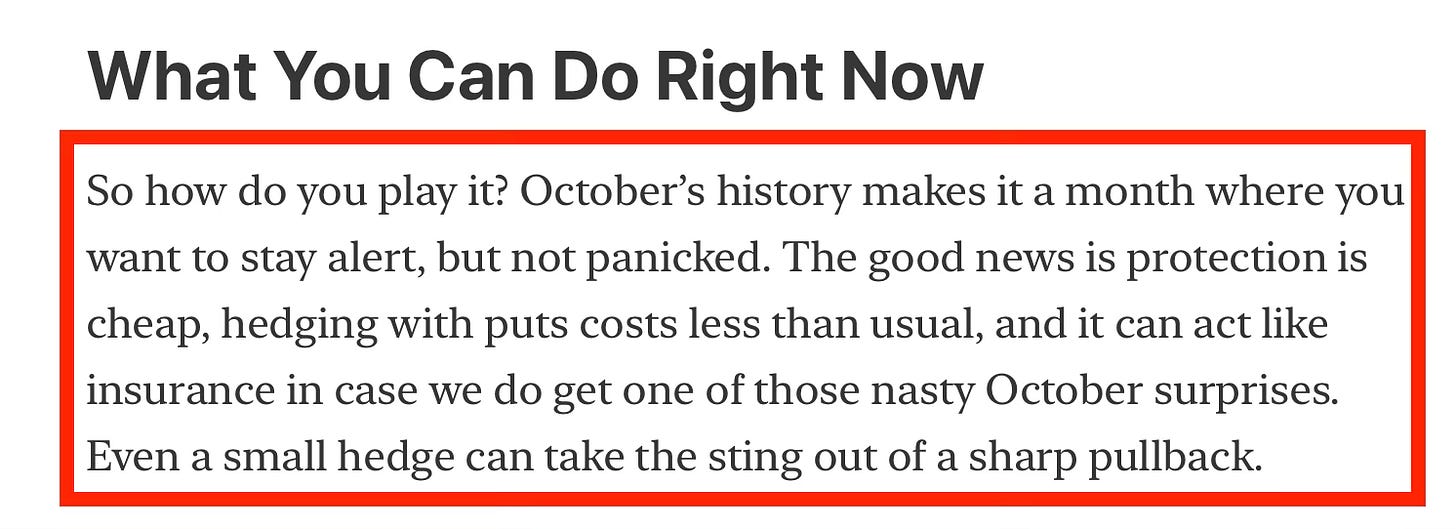

In our edition of the newsletter last week, we talked about October, the month that loves chaos and warned that it has a habit of sneaking in sharp dips when everyone least expects it. We also emphasized the importance of staying hedged, since protection in markets like this acts more like cheap insurance than fear. That warning didn’t take long to come true (this was in our premium section of our newsletter) and and if you missed it, here’s exactly what we said:

Friday didn’t feel like a normal selloff, it felt like the moment everyone remembered just how fragile this whole thing really is.

At 10:57 AM ET, Trump said he was canceling his meeting with China and hinted at “massive” tariffs. Hours later, it wasn’t a hint anymore. By 3 PM, he dropped the hammer, a 100% tariff on all Chinese imports starting November 1st, along with sweeping export controls on “any and all critical software.”

The reaction was instant from all this chaos. The S&P 500 sank 2.7%, wiping out over $1.5 trillion in value. The Nasdaq collapsed roughly 4%. Volatility spiked. The longest streak of calm the market had seen in two months ended in one brutal session.

And here’s the thing, this was never just about tariffs. It’s about leverage. It’s about control. It’s about who actually holds the keys to global trade. Because for all the talk about independence, everyone’s realizing the same uncomfortable truth: both sides need each other more than they’d like to admit.

Friday was the day the illusion cracked.

THE RARE EARTH WAR BEGINS AGAIN

Beijing lit the fuse.

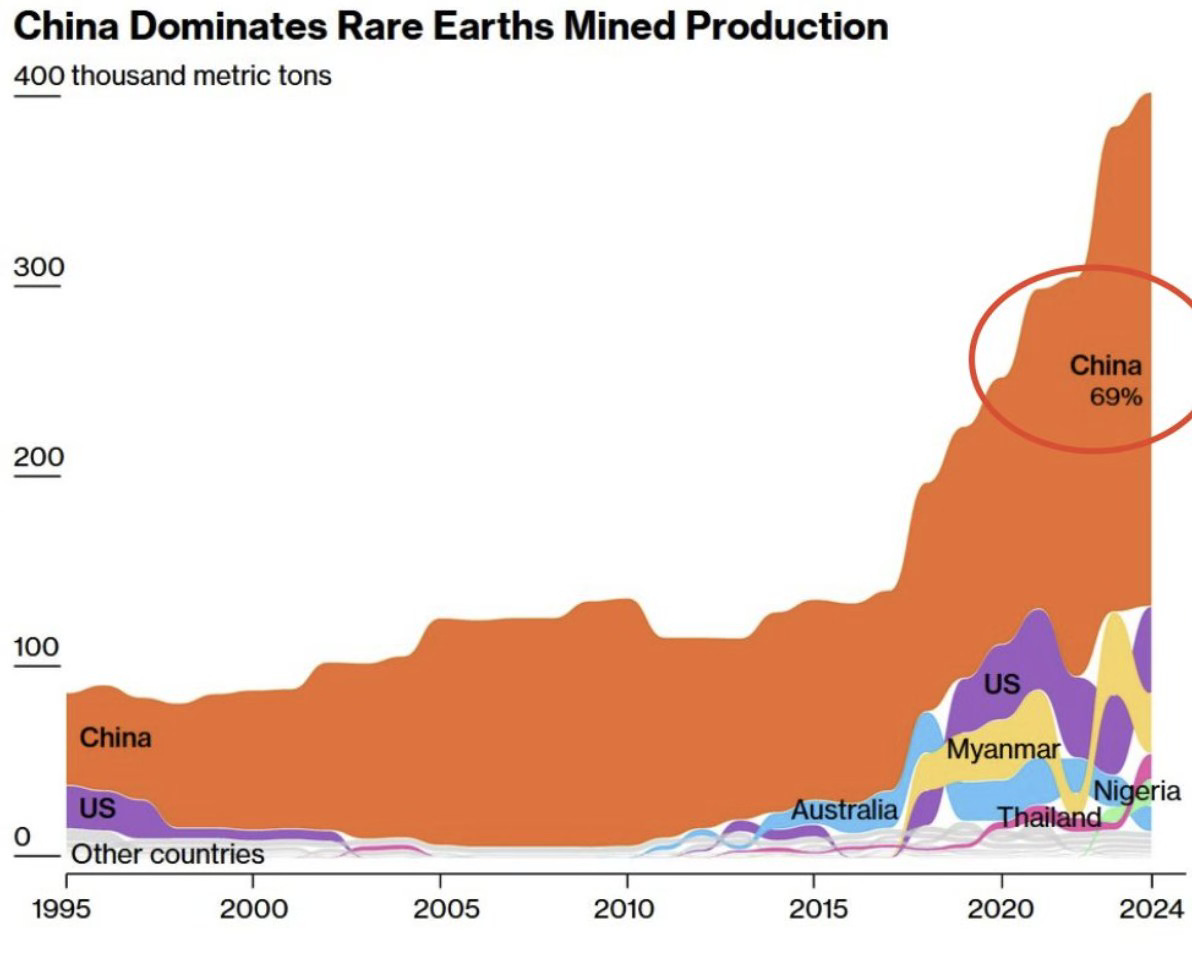

This week, China announced it’s restricting exports of any product that contains even trace amounts of rare earth metals. That’s not a small move, it’s an earthquake. Rare earths are in everything: iPhones, EV motors, semiconductors, radar systems, fighter jets, and AI chips. If you can name a piece of modern technology, it probably depends on these metals.

And the U.S.? It gets roughly 70% of them from China.

Former Trump officials called it “a gun to the head” before negotiations. Everett Eissenstat, who once served on Trump’s National Economic Council, said China is reminding everyone that it’s a global choke point. And it worked, Washington is furious.

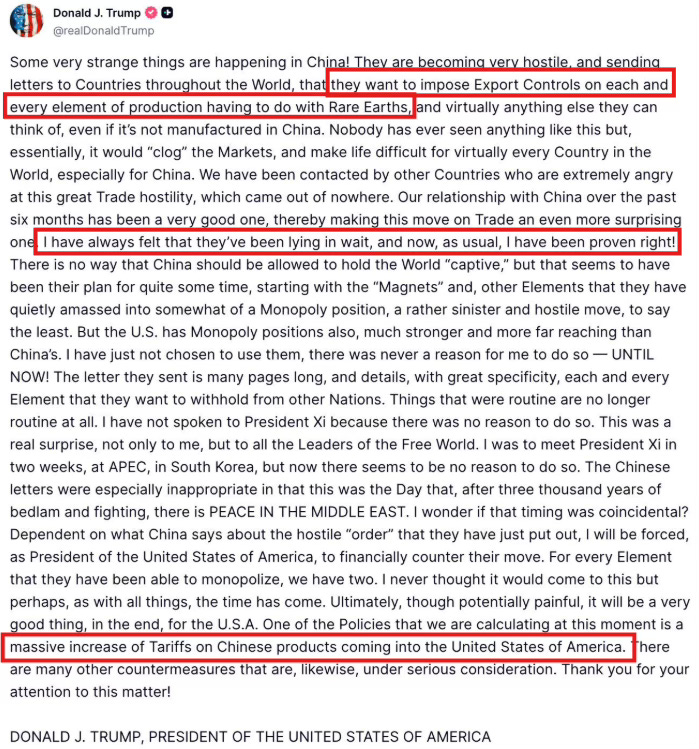

Trump accused China of “lying” and “hostility,” called its actions “a moral disgrace in trade,” and said there’s “no reason” to meet with Xi Jinping. He hit back with the only weapon America still controls in this fight, tariffs.

But this isn’t just a trade dispute anymore. It’s a strategic chess match. China’s move hits at the heart of U.S. manufacturing and defense systems. And the White House, operating with a slimmed-down national security team and no cohesive China doctrine, is playing catch-up.

One former NSC official summed it up: “We’re playing 2-D chess while Beijing is playing 4-D chess.”

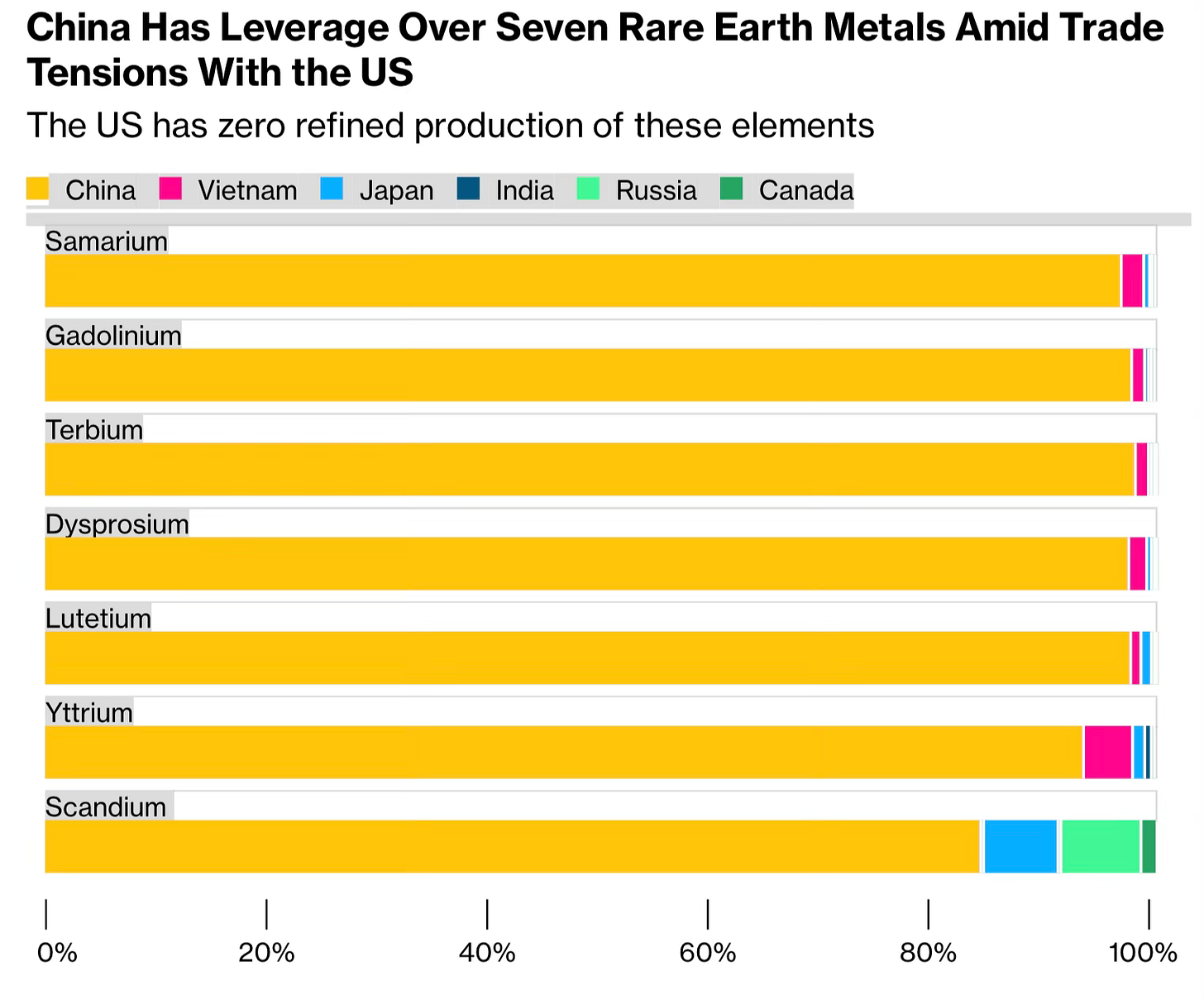

CHINA’S POWER PLAY

China didn’t just restrict the export of raw materials, it went after anything that uses them. That means not just the metals, but also the magnets, components, and finished devices made with them. The new rules take effect December 1st. Trump’s counterstrike starts November 1st.

It’s a race to see who blinks first.

But Beijing’s strategy is smarter than it looks. They’re not trying to start a trade war, they’re showing the world how much control they really have. They can weaponize interdependence, squeeze the U.S. supply chain, and remind everyone that while America builds software, China builds the hardware the software runs on.

RAND’s Bradley Martin called it bluntly: “China’s bet is that we won’t be able to deal with it that quickly, that we need to buy the stuff more than they need to sell it.”

And he’s right. The U.S. is years away from replacing China’s rare earth production. Trump issued an executive order back in February to ramp up domestic mining, but even his allies admit it’ll take years. As one industry insider put it: “We’re addicted to sourcing from other places. People don’t realize how screwed we are.”

WHEN MACHINES PANIC

Friday was the day the illusion cracked but the warning signs were flashing long before that.

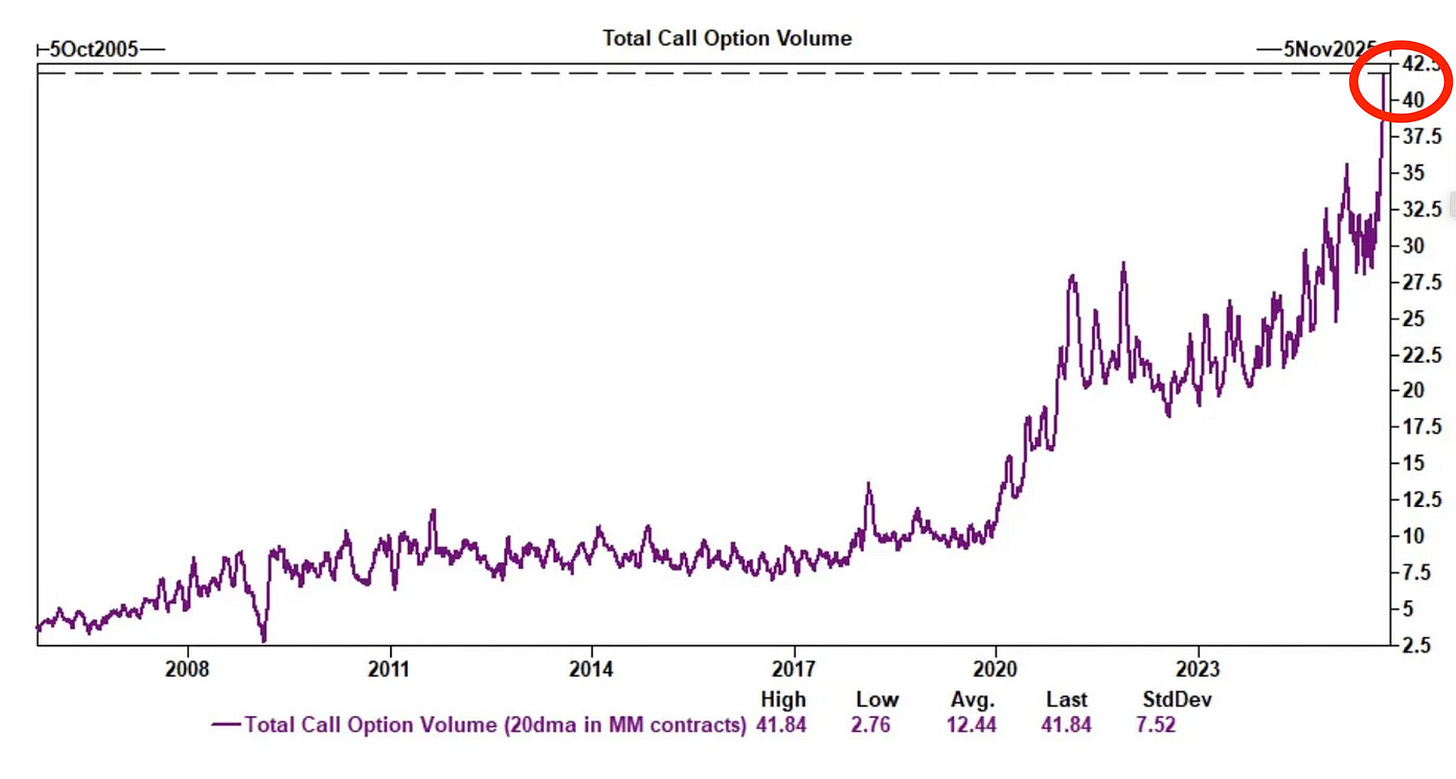

For weeks, markets had been way too calm for comfort. The CBOE Volatility Index Wall Street’s “fear gauge” sat quietly in the mid-teens, even dipping below 14 in September. That kind of silence feels safe, but in markets, calm often breeds complacency. When volatility disappears, investors take on more risk, add leverage, and assume nothing can go wrong. But that’s exactly how accidents happen, one political headline, one credit hiccup, one algorithmic misfire, and suddenly everything’s moving at once.

You could see it building. Call option activity, basically bets that stocks would keep going up surged to record levels. That’s not just optimism, that’s speculation. As traders piled in, dealers hedged by buying more stocks, creating a feedback loop that pushed prices higher.

And on Friday, reality showed up. The tariffs were just the spark, the real explosion came from the machines.

Here’s what that means: when markets drop, algorithms automatically start selling to limit losses. UBS estimated that every 1% decline in the S&P 500 could trigger roughly $25 billion in forced selling. At 3%, that number could balloon to $280 billion. Goldman warned that Friday’s close might set off another wave of systematic selling if markets open lower Monday.

For months, volatility had been artificially suppressed by complex option strategies especially 0DTE trades that made money as long as the market stayed stable. Dealers kept buying every dip, feeding the illusion that risk was under control. But once volatility picks up, that illusion collapses.

The VIX is now back above 21, and those same trades that once kept things calm are turning into accelerants. Bloomberg’s Michael Ball explained it best: if the S&P 500 dips below roughly 6,600, the math behind these hedges flips. Instead of cushioning the fall, they start amplifying it.

We actually pointed this out earlier this week on our X and Threads accounts, the buildup of leverage, the record options activity, and how it could all unwind fast once volatility returned. If you’re not already following us there, you should, we post timely market updates and insights as these stories unfold in real time.

THE CRACKS EVERYONE IGNORED

For months, the market looked unstoppable. Every dip got bought, every scare got brushed off, and everyone assumed the money machine would just keep running. But under the surface, things were already cracking, most people just weren’t paying attention.

It started in the credit markets, the part of finance where companies borrow money by selling bonds. High-yield bonds, also called “junk bonds” because they’re riskier, have now fallen in eight of the last nine sessions. Even the safer, investment-grade ones are slipping. That might sound boring, but it’s actually a huge deal, when the credit market stumbles, it usually means investors are getting nervous about companies’ ability to pay their debts.

Private credit is also taking hits. For years, with interest rates at zero (the ZIRP era), investors poured money into these private loans because they seemed like a safer way to earn big returns. Now, as liquidity dries up and borrowers face higher interest costs, that “safe” trade isn’t looking so safe anymore.

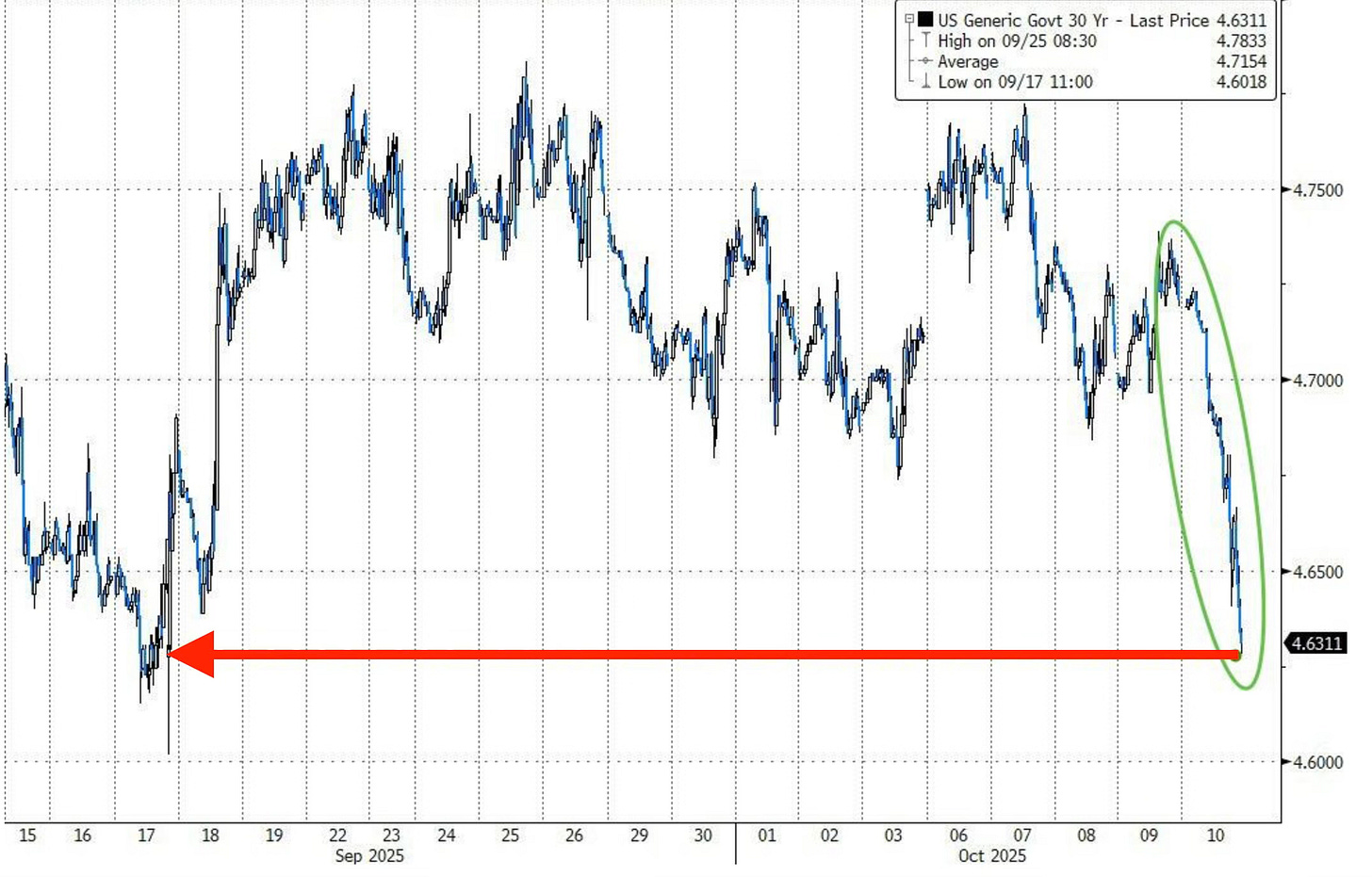

Meanwhile, money is rushing into Treasuries, the world’s go-to safe asset. When people get scared, they buy government bonds. Prices went up, and yields dropped to their lowest level in three weeks. The dollar strengthened as everyone piled into safety, and the flow of cash that normally keeps the system moving started to freeze. You could almost hear leverage, borrowed money being pulled out of the system.

Then came the real panic.

The “Magnificent 7”, Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla finally broke. For months, they’ve carried the entire market on their backs. But on Friday, they all fell together. The Nasdaq went from record highs to its most oversold point since April in one single day.

Momentum flipped. Usually, strong stocks keep climbing and weak ones keep dropping but suddenly, the losers were outperforming the winners. That’s not normal. It’s what happens when funds start dumping everything they can just to stay afloat.

This wasn’t investors calmly taking profits. This was forced selling, hedge funds, quant funds, and institutions liquidating positions because they had to, not because they wanted to.

When credit markets crack, liquidity dries up, and the biggest stocks start falling in sync. That’s the sound of pressure finally being released after months of denial.

I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade to read rest of my analysis. I only charge about $9 a month, while competitors charge over $100 for emails like this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.