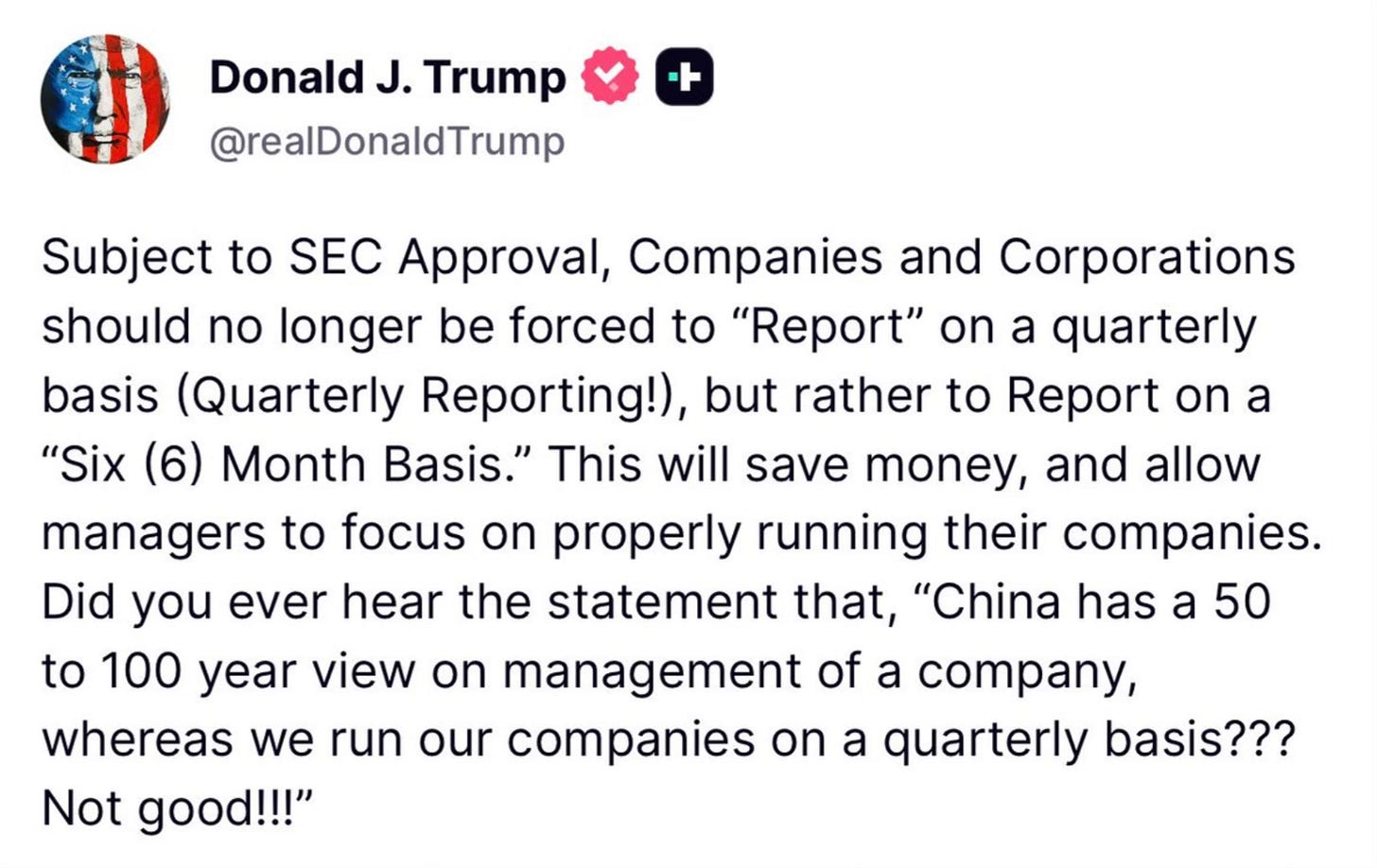

Are Quarterly Earnings Going Away?

Trump said today that U.S. companies should no longer be forced to report earnings every quarter, pending SEC approval. He argued the system is costly, distracts management, and keeps executives focused on short-term performance instead of long-term growth. Quarterly reporting has been mandatory since 1970. It was designed to give investors consistent visibility into corporate health and became one of the foundations of U.S. market transparency.

Only a few countries still require it, Canada, Japan, China, and South Korea. Europe ended the mandate in 2013, and the UK followed in 2014 but when the option to stop reporting quarterly appeared, almost no one took it. In the UK, just 9 percent of companies opted out, mainly smaller names without analyst coverage. The firms that stopped saw liquidity shrink, analyst interest fade, and risk premiums rise.

The cost savings are real. A large company spends a few hundred thousand dollars preparing quarterly filings, so across thousands of firms, billions could be saved each year. But that is minor compared to the bigger risk. Quarterly reports force companies to open the books on a regular basis. Cut that in half, and markets lose one of the few mechanisms that lets them adjust in smaller steps. Less information does not mean fewer problems, it means larger surprises when they finally surface.

Trump has raised this idea before. In 2018 he pushed the SEC to study a switch to semiannual reporting, with Warren Buffett and Jamie Dimon supporting the concept. Their case was that fewer deadlines would reduce short-term pressure on CEOs but fewer disclosures also give management more room to control the story, smooth over weak periods, and rely on accounting maneuvers to buy time. For investors, employees, and pensions, that means less visibility. Quarterly reporting has always been imperfect. It can force executives to focus on the next three months at the expense of long-term strategy but it also disciplines companies by keeping financial information flowing to the public. Pulling that back now, with debt at record highs and growth already under strain, risks creating more opacity at a time when transparency is most needed.

So fun to see another AH user here.

Awesome article . As usual, of course

Quarterly earnings going away? Options IV ratios would be crazy when they did occur. Not sure if I’d like this as an investor standpoint, but I’m sure it would be less headache for the company.

I would be curious to hear other people’s reactions

Ugh. Yeah, let’s

leave us in the dark.