Can the Most Boring Asset Become the Best Trade of 2026?

The next bull run might not come from Silicon Valley but from a vault, 10 feet underground.

Let’s start with a number that doesn’t sound real: $4,378 per ounce.

That’s where gold peaked this week before falling back to around $4,100.

If you’ve been anywhere near a financial chart, you’ve probably seen the headlines. Gold’s breaking records, “safe haven” this, “panic buying” that. But here’s the truth gold didn’t suddenly become the hot new trade.

Your money just got worse at being money.

And here’s the brutal proof.

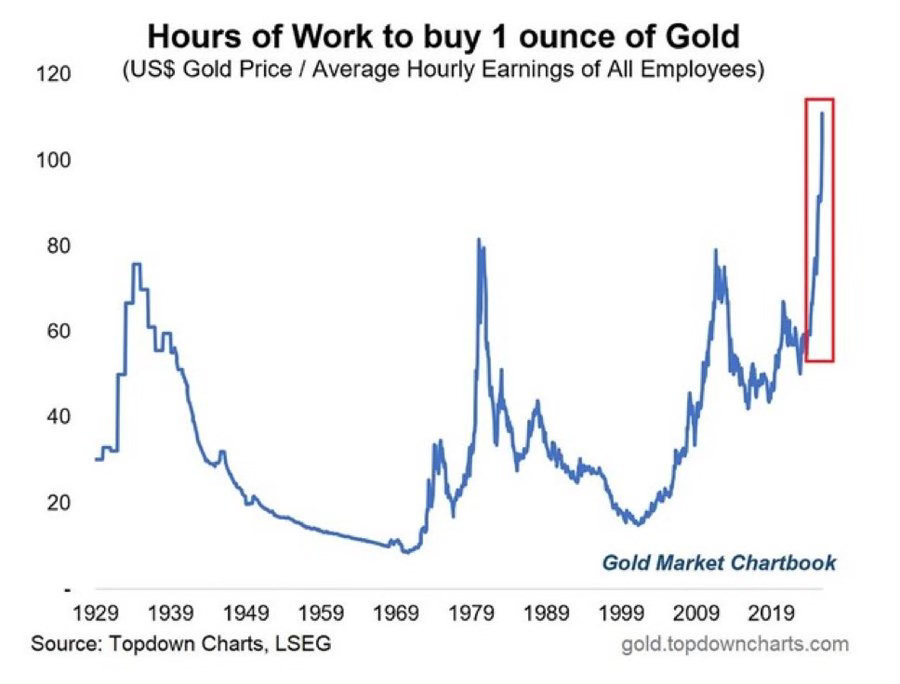

Back in the 1970s, the average American worker needed about 12 hours on the job to afford an ounce of gold. Today? Try 100 hours. That’s four full workdays, just to buy one ounce.

Gold isn’t getting “more expensive.” Your paycheck is getting weaker.

A Slow Collapse Hiding in Plain Sight

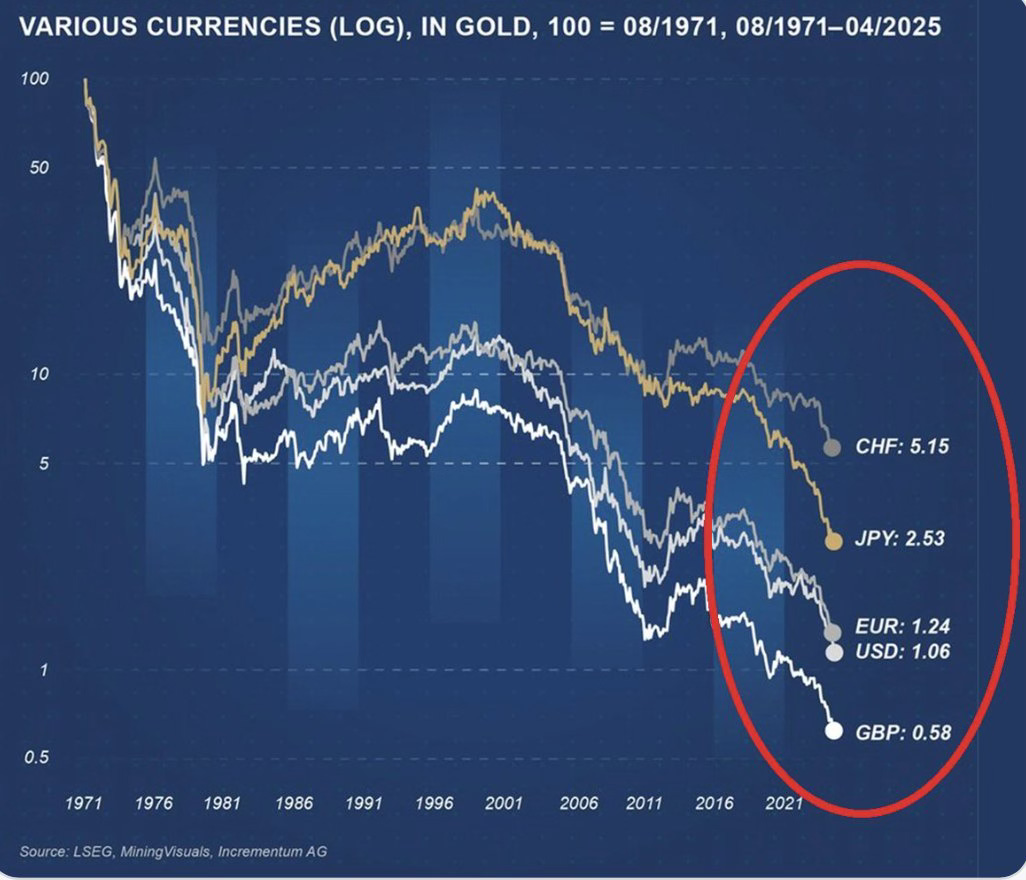

Since 2007, the world’s strongest currencies, the ones that were supposed to anchor global stability have quietly lost 85% of their purchasing power when measured against gold.

The Swiss franc, long seen as a financial fortress, is down 73%. The British pound has collapsed even more, losing over 88%.

Zoom out further, and the picture gets darker. Since 1971, when the U.S. fully abandoned the gold standard, the dollar has lost 98.95% of its value compared to gold.

People still talk like gold’s rallying. It’s not. The metal hasn’t changed, the measuring stick has.

Every debt ceiling hike, every “temporary” money-printing program that becomes permanent, all of it chips away at the value of fiat. Gold doesn’t rise to the occasion; it just stands still while everything else sinks.

And as you’re well aware, there are plenty of other variables swirling in this mix , China’s geopolitical maneuvering, the global de-dollarization push, the weaponization of reserves, and a worldwide shift toward alternative settlement systems.

These forces aren’t happening in isolation, they’re compounding each other, eroding confidence in the fiat system piece by piece.

The Perfect Setup for a Pullback

And out of nowhere this week, gold got punched in the face.

On Tuesday, prices fell 5.7%, the biggest one-day drop since April 2013. Statistically, it was a 4.5-sigma move, something that should only happen once every 240,000 trading days in a normal world. But markets aren’t normal, and gold isn’t either.

Since 1971, moves this big have happened just 34 times out of 13,000+ sessions. That’s 0.26% of the time. Rare, yes. Surprising? Not really.

The clues were already there.

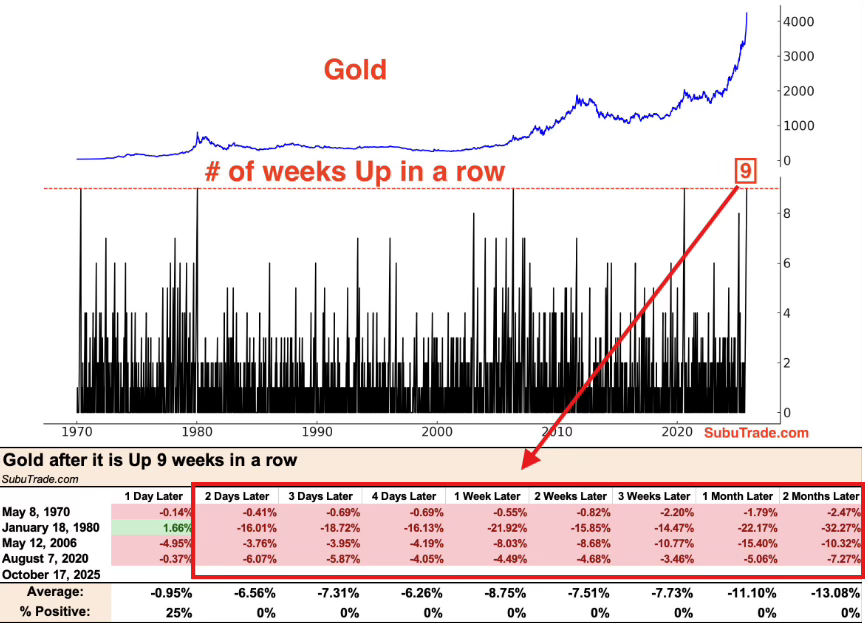

Gold had also been up for nine straight weeks, something that’s only happened five times in history. It’s never made it to ten. Each of those streaks ended the same way, with gold averaging a 13% correction in the months that followed.

So this wasn’t random. It was gravity.

The trade got too heavy on one side of the boat.

A Breather, Not a Breakdown

Here’s what most people missed: the selloff didn’t actually change anything fundamentally.

GLD holdings, the world’s largest gold ETF dropped only 0.6% despite record trading volume. Chinese gold ETFs? They added exposure. COMEX open interest barely moved.

In other words, nobody important sold.

An analyst explained it simply: a large GLD block trade triggered volatility models, algorithms did what algorithms do, and suddenly a technical reset looked like a meltdown.

This was algorithms tripping over each other.

Meanwhile, the reasons to own gold have only gotten louder.

A World Running Out of Rope

The Fed’s cornered again.

We’re offering a free trial for a limited time, so if you’ve been meaning to see what Investinq’s premium research looks like, this is your only chance. Click here

Please read this message to continue: I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade. I only charge about $99 a year, while competitors charge over $100 a month for email such as this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.