China Is Quietly Funding the Global Bull Market And Nobody Wants to Admit It

How a collapsing economy is leaking trillions into global markets and artificially inflating asset prices.

Imagine your friend keeps insisting they’re broke.

They say the bills are piling up, the job market’s terrible, and their credit card’s maxed out.

Then you check your Venmo and they’ve been sending you money every day.

That’s China right now.

The world’s second biggest economy is in rough shape.

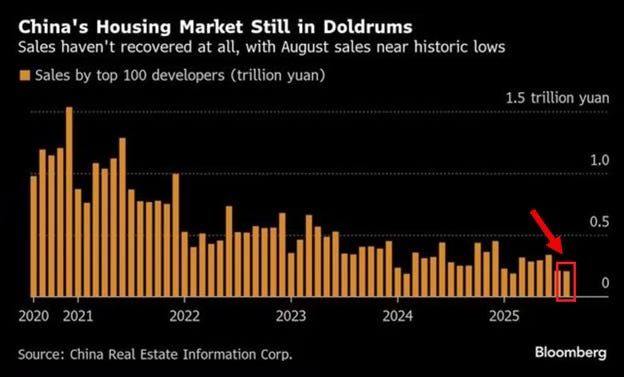

Growth has stalled, prices are falling, and the once booming property market is a slow-motion disaster.

Yet somehow, China keeps pumping money into the global financial system like it’s got cash to burn.

Trillions of dollars are flowing out of the country and into markets everywhere, the U.S, Europe, Japan, Brazil lifting stock prices, fueling rallies, and confusing every economist who’s trying to make sense of it.

This is the ultimate paradox: a struggling country making the world rich but here’s the twist, the moment China starts to recover, that global money pump stops.

The Money Mystery No One Can Explain

Let’s start with the weird part.

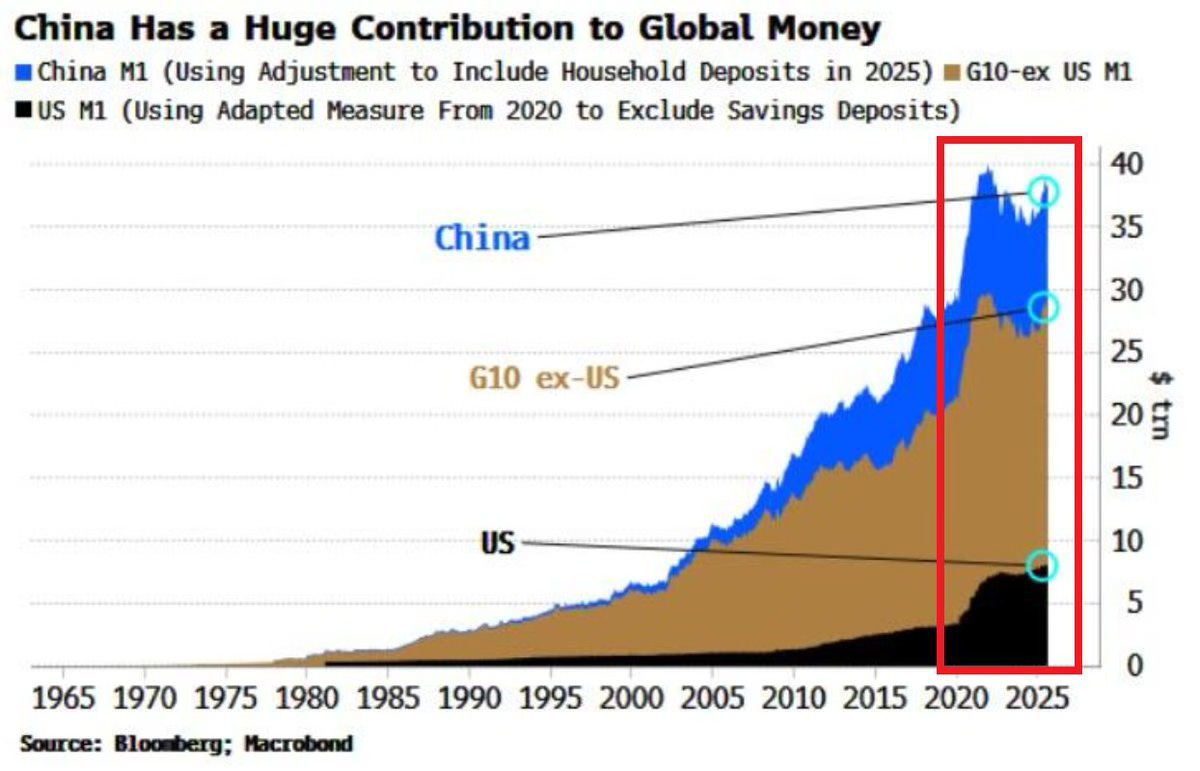

China’s central bank, the People’s Bank of China, has been printing money like crazy.

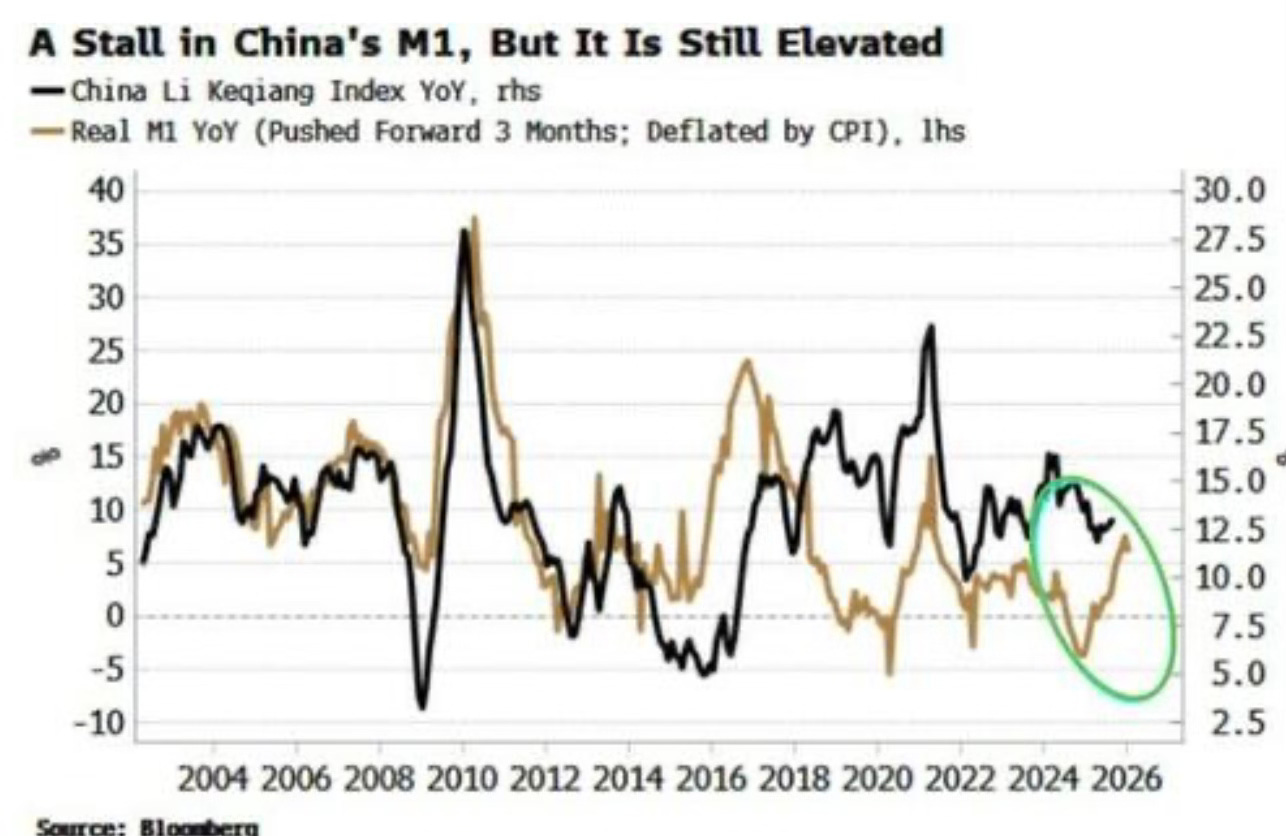

The country’s M1 money supply (basically cash in circulation and checking accounts) has jumped more than 7% in a year.

That’s a massive amount of new yuan flooding the financial system.

Normally, when a government prints that much money, prices rise.

That’s how inflation works = more money chasing the same goods means higher prices but in China, prices are doing the opposite.

Producer prices (what factories charge) are down about 2.3%. Consumer prices are flat.

Deflation, not inflation is spreading.

It’s as if someone poured gasoline on the economy, and instead of catching fire, it froze.

Here’s why all that new money has nowhere to go. Factories aren’t expanding.

Consumers aren’t spending. Real estate developers have stopped building.

The result is a mountain of idle cash sloshing around the financial system looking for a purpose. Economists call this “excess liquidity.”

In most healthy economies, it’s about 1–2% of GDP.

In China, it’s closer to 4%. That may not sound like much, but it means there’s roughly $16 trillion worth of cash sitting around, money that can’t find a productive home inside China.

For perspective, that’s 40% of all the narrow money in the world.

When that much cash gets trapped in a sluggish economy, it doesn’t stay trapped for long, it leaks.

The Great Domestic Dead End

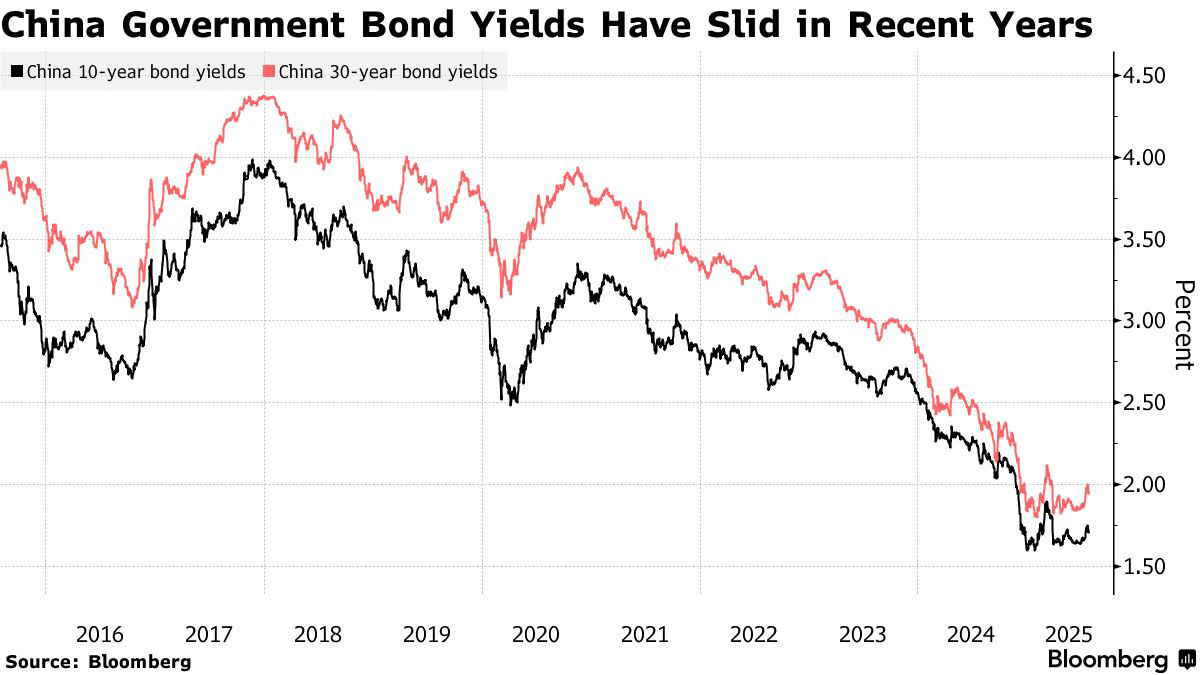

If you’re a Chinese household or company sitting on savings, your choices are grim.

You can buy Chinese government bonds that pay around 1.8% interest less than inflation. In real terms, you’re losing money.

You can buy real estate, but prices have collapsed in nearly every major city. In some places, home values have fallen so far that entire developments are now ghost towns.

Real estate used to be the cornerstone of Chinese wealth.

Now, every additional price drop erases trillions of dollars in household value. It’s like watching a national retirement fund dissolve in slow motion.

But what about stocks? The Chinese stock market is tiny compared to the amount of money floating around.

In the U.S. the stock market is about eight times larger than the narrow money supply.

In China, it’s roughly equal. There just aren’t enough assets for all the money to flow into. If everyone tried to invest at once, prices would explode overnight.

So investors do the next best thing: they send their money abroad.

The Great Escape

Here’s where the story turns from strange to fascinating.

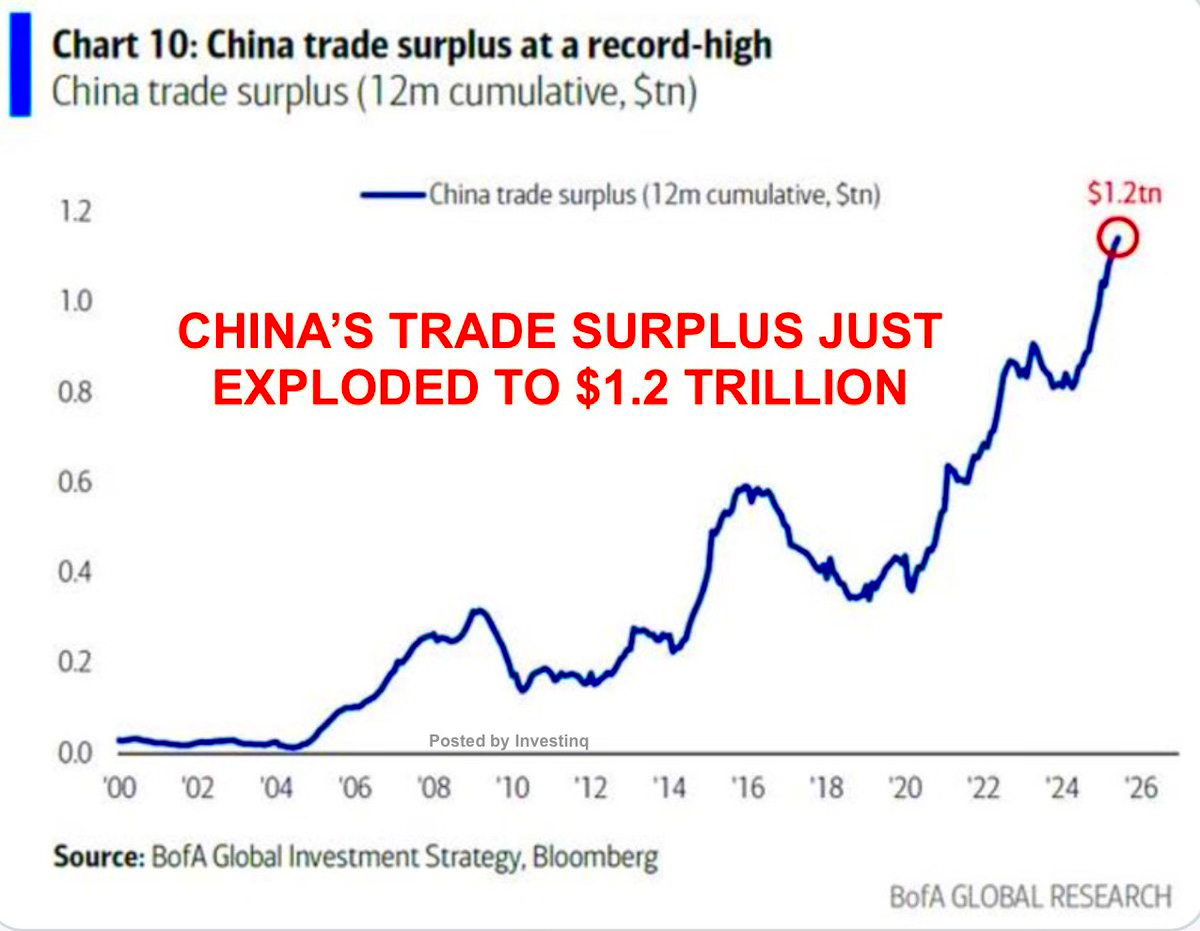

In 2025, China reported a record $1.2 trillion trade surplus meaning it sold far more goods than it imported.

That kind of surplus usually makes a country richer and boosts its foreign currency reserves but China’s reserves barely moved.

So where did the money go? The answer is both clever and illegal.

Roughly $1 trillion a year is leaving China through unofficial channels hidden, disguised, and often mislabeled.

One common trick is called trade misinvoicing.

Suppose a Chinese company sells $200,000 worth of goods to a foreign customer.

It tells the Chinese government the deal was only $100,000. The other $100,000 lands in a foreign bank account, outside Beijing’s control. It’s capital flight dressed up as commerce.

Another popular trick is buying overseas real estate through shell companies.

You overpay for a house in Canada or Australia, move the excess money offshore, and nobody in China is the wiser.

Others use underground banking networks, fake insurance policies, or inflated service payments.

The result is the same: money keeps escaping.

The Accidental Global Stimulus

Here’s the plot twist nobody saw coming, that money isn’t disappearing. It’s showing up in your stock portfolio.

As you know roughly about a month ago, global stock markets have been hitting record highs, not just the S&P 500 or Nasdaq, but Japan’s Nikkei, the UK’s FTSE, Brazil’s Bovespa, South Korea’s Kospi all at once.

That kind of synchronized boom hasn’t happened in decades.

It’s not because every country suddenly got rich at the same time.

One of the reason being is China’s excess money has to go somewhere, and the rest of the world is where it ended up.

When Chinese capital flees the mainland, it flows into global equities, bonds, and funds. It buys American tech stocks, European ETFs, and emerging-market assets.

It’s the invisible fuel behind one of the biggest bull markets in history.

And the timing checks out. Every time Chinese money growth spikes, global stocks rally. Every time it slows, markets wobble.

While the U.S. talks about tightening, China is flooding the system with liquidity that slips through the cracks and washes up everywhere else.

Beijing’s weakness has become the world’s stimulus package.

The Twist Nobody Wants to Think About

Now for the scary part.

If China’s economy actually recovers, this upside down dynamic collapses.

When confidence returns, property prices stabilize, and local assets start performing again, Chinese households stop sending money abroad.

They’ll want to keep it home, where the returns are better. The great capital leak will slow to a drip.

At the same time, the central bank will stop printing as much money.

No more excess liquidity. The global cash tide that’s been lifting every market suddenly recedes.

And that’s when investors realize one of the world’s biggest bull markets was partly built on borrowed liquidity.

And we’re already seeing early hints of this.

China’s M1 money supply growth just slowed from 7.2% to 6.2% in October.

Still high, still supportive of risk assets globally, but it’s a reminder that liquidity waves don’t last forever.

This liquidity leak has been one of the hidden catalysts behind the global repricing of stocks in Japan, South Korea, the U.S., and Europe.

These markets didn’t all magically get stronger at the same time.

They got flooded by a torrent of Chinese money with nowhere else to go.

The world needs China just weak enough that the money keeps escaping but not so weak that the whole system cracks.

As long as Beijing stays stuck in that uncomfortable middle zone, global markets keep partying.

But the second China genuinely recovers, the music cuts off and everyone finds out who was dancing on someone else’s liquidity.

If you’re still here, do me a solid, like and restack this on Substack so other people can learn too. It helps way me more than you think.

Disclaimer: Nothing in this newsletter is financial advice. All opinions, analyses, and commentary shared here are my own personal views, based on publicly available information and independent research. You should not rely on any of this content as a recommendation to buy, sell, or hold any security or investment. Always do your own due diligence and consult a licensed financial advisor before making investment decisions.

.

Awesome article! I read a lot of articles every day and I haven't seen any others talking about this. Glad to be a Subscriber!

Just another amazing article on how the markets work. Would be great to see a companion article on what China gains by printing such large quantities of cash. Lots of speculation about structural unemployment and their fear of unstable internal markets.