China’s Money Flood: The Hidden Force Keeping Global Markets Afloat

China’s property market is collapsing but its money flood is saving everyone else.

Something’s happening in the world economy right now, and almost no one is paying attention.

Everyone’s arguing about inflation, Fed rate cuts, and whether AI is in a bubble but behind the scenes, China has quietly set off one of the biggest liquidity waves in modern history.

And that wave is doing something extraordinary: it’s quietly holding up global credit markets, cooling financial stress in the U.S., and keeping the global economy breathing at a time when it could’ve easily slipped into panic mode.

This isn’t just another “China stimulus” story. This is one of the real reason the world’s not falling apart right now.

The Big Shift: China Turns the Tap Back On

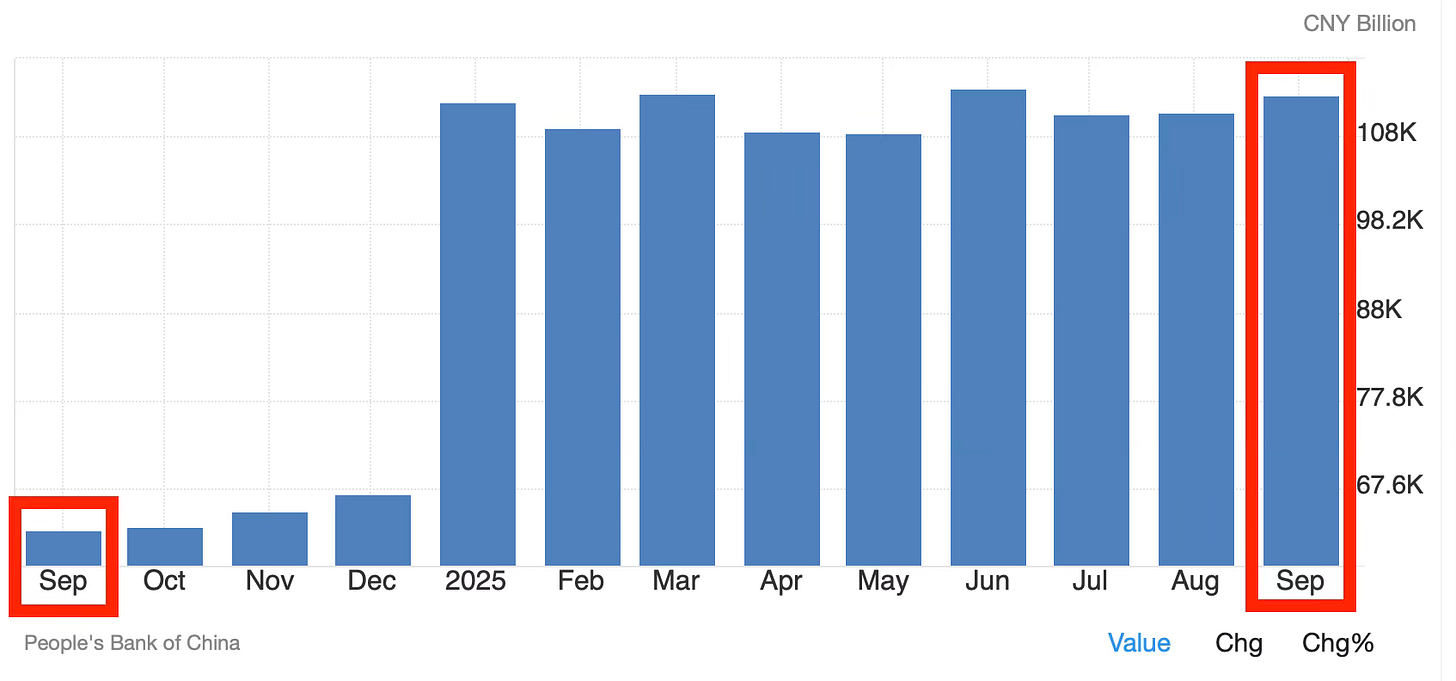

China’s M1 money supply, the most liquid, ready-to-spend form of cash in the system has exploded. By September 2025, it hit 113.15 trillion yuan (15.84 trillion USD), an increase of about 80% in just one year.

So what exactly is M1? Think of it as the fast money, the cash sitting in checking accounts and payment apps, the kind that can be spent right now. When M1 rises, it usually means people and companies are actually using their money instead of hoarding it.

Now, part of the spike is because China changed how it counts that money. The central bank started including balances held in Alipay and WeChat Pay, digital wallets that almost every Chinese citizen uses. But even if you strip that out, the surge is real.

Beijing has been injecting stimulus nonstop:

cheaper loans for businesses,

more local government spending,

and steady monetary easing to keep credit flowing.

While the U.S. and Europe are draining liquidity to fight inflation, China is flooding its own system to kickstart growth. It’s like watching one country hit the brakes while another floors the gas pedal and somehow, the world stays balanced.

The Catch: Liquidity Isn’t Confidence

Here’s where it gets tricky. China has tons of liquidity, but not enough confidence.

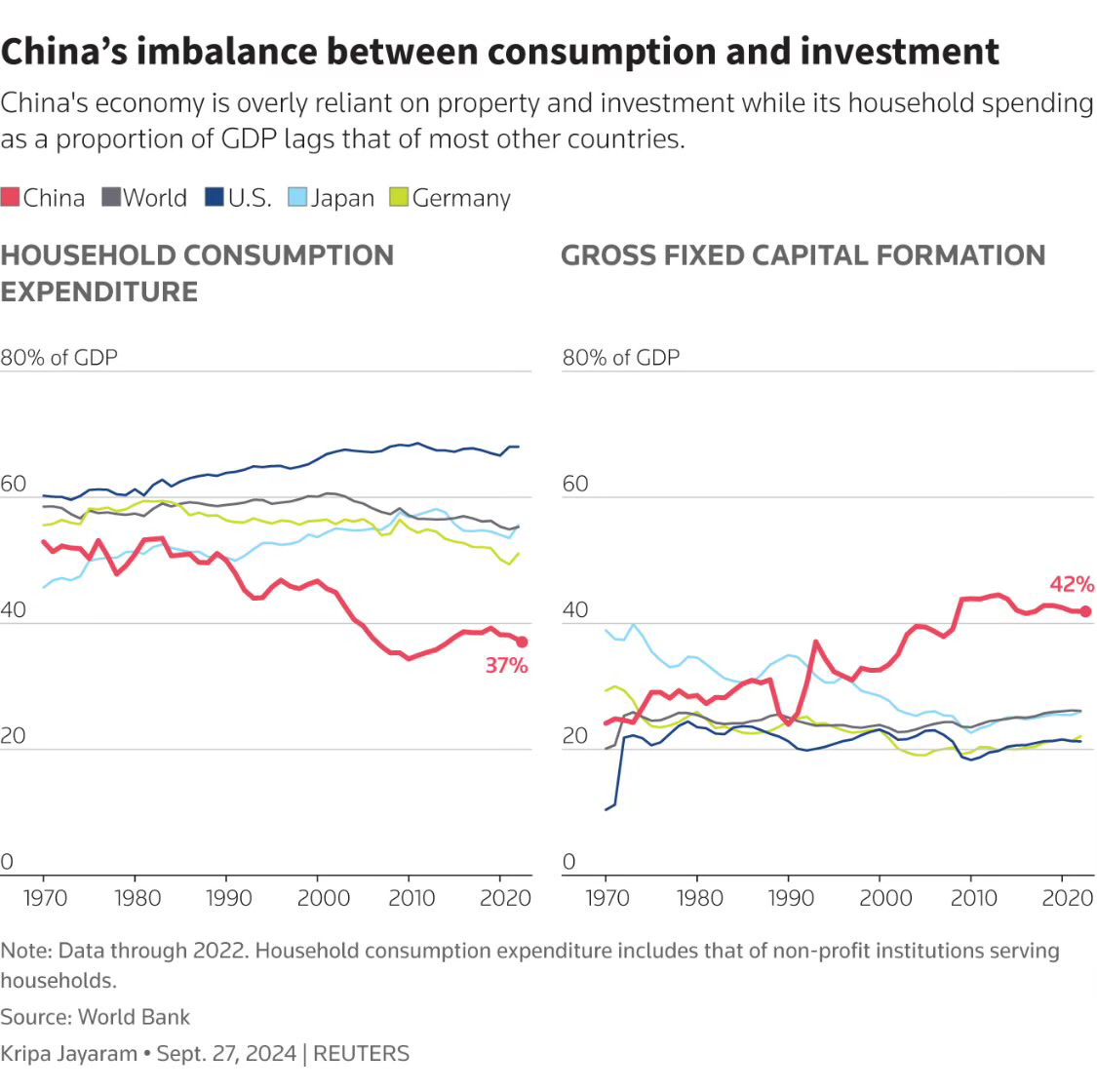

Consumers aren’t spending the way you’d expect. In fact, household spending only makes up 37% of China’s GDP way below the global average. Meanwhile, investment makes up 42%. That means China’s growth is still driven by construction, manufacturing, and government projects, not by its own people buying stuff.

This imbalance isn’t new, it’s baked into the system. For decades, China’s economy ran on building things: cities, bridges, railways, ports. The problem? That model works until it doesn’t. You can’t build forever.

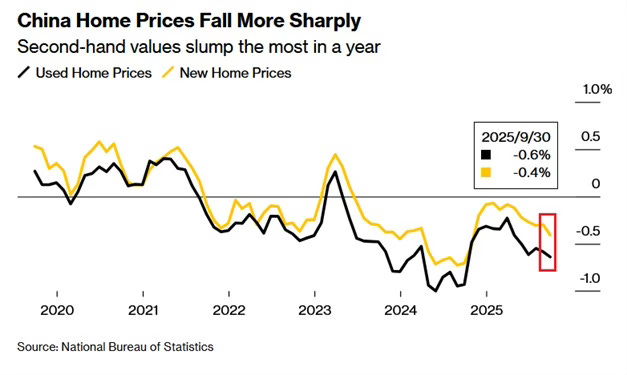

And right now, Chinese households are scared. The property market, the single biggest store of family wealth is in free fall.

New-home prices in China’s 70 major cities fell 0.41% in September, the sharpest monthly drop in nearly a year. It’s the 29th straight month of declines. Used-home prices dropped even more, 0.64%, the biggest fall in twelve months — and for the first time in a year, every single one of those 70 cities saw prices drop.

Meanwhile, property investment fell 13.9% year-over-year in the first three quarters — the weakest level since 2014. This isn’t just a market correction anymore. It’s a confidence crisis. For millions of families, their apartment isn’t just a home, it’s their life savings. When that starts losing value month after month, spending stops cold.

The housing market was China’s symbol of wealth for nearly two decades, a safety net, a status marker, a retirement plan. Now it’s the epicenter of fear. You can feel it in the data. You can feel it in the streets. The middle class has gone defensive.

Even with the government pumping trillions of yuan into the economy, much of it’s just sitting idle. Banks lend to local governments and state firms, but households are keeping their wallets closed. The liquidity is there, it’s just not moving where it needs to.

It’s like pouring water into a bucket that keeps leaking from the bottom. It looks full at first, but it never overflows.

China’s economy doesn’t have a money problem. It has a trust problem and until that changes, no amount of liquidity, no matter how massive can fix it.

So Why Does the World Care? Because when China floods its system with cash, the effects don’t stop at its borders. They ripple outward through trade, commodities, and credit markets.

China accounts for a quarter of the world’s total narrow money (M1). That means when it pumps liquidity, the whole global system feels it.

The Cockroach Hunt and the Surprise Hero

Meanwhile, across the Pacific, the U.S. credit market was starting to look shaky.

A few regional banks stumbled after a string of bankruptcies, First Brands, Tricolor, and PrimaLend and investors started whispering that there might be more “cockroaches” hiding in the dark.

You know how it goes, if you see one cockroach, there’s probably ten more behind the wall.

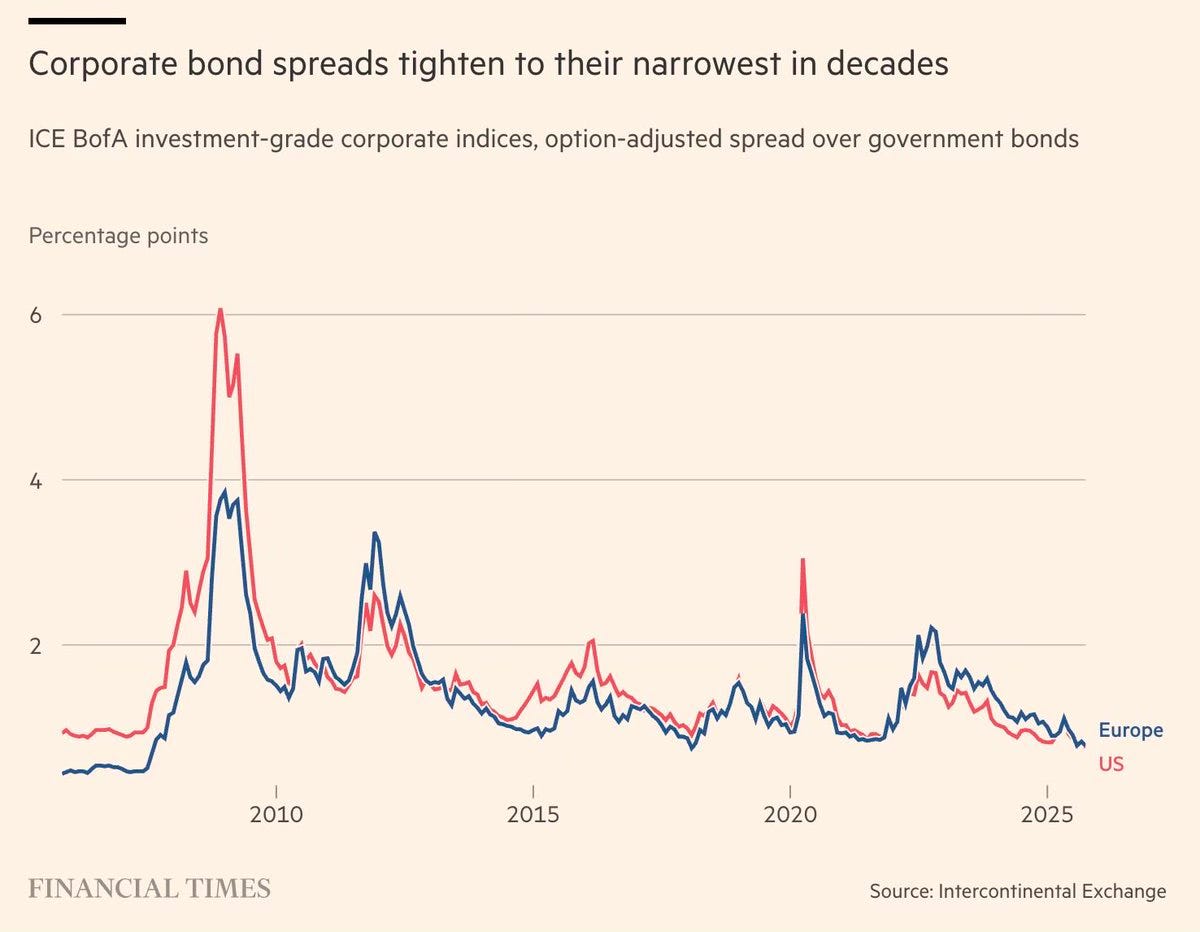

But then something unexpected happened. Instead of spiraling into chaos, U.S. credit markets stabilized. Corporate bond spreads narrowed. So what happened?

Where did all that pressure go?

The answer, once again, is liquidity and a lot of it came from China.

When China injects money into its economy, that liquidity doesn’t just stay put. It leaks into global markets through trade, currency channels, and investment flows. It gives breathing room to credit markets around the world, especially the U.S. That’s what I am seeing right now, a global credit system getting an unintentional bailout from China’s monetary flood.

Why Liquidity Rules Everything

Here’s something most people underestimate: liquidity is like gravity for markets. It pulls everything.

When liquidity is rising, risk assets breathe easier. Companies that might’ve been on the edge suddenly find financing again. Bond spreads tighten. Investors take more risk.

When liquidity dries up, everything seizes, markets panic, banks pull back, and “cockroaches” start crawling out.

Right now, liquidity is the hero of this story. It’s what’s keeping credit markets calm even as global growth looks fragile.

You can think of it like oxygen: it doesn’t solve your problems, but without it, nothing else works.

And for now, China’s providing the oxygen everyone else needs.

The Dark Corners Still Exist

Of course, there’s still plenty lurking under the surface.

The private credit market, a roughly 2.5 trillion beast in the U.S. is still a giant black box.

It’s full of loans that don’t trade publicly and aren’t easy to value. Many of those loans have floating interest rates, which means borrowers are paying more every month as rates rise.

The danger is that we don’t see the cracks until they’re already spreading.

If liquidity ever dries up again, the problems hiding in that shadow lending world could resurface fast.

But for now, liquidity is keeping those lights dim enough that nobody has to look too closely. The cockroaches are still there, they’re just staying out of sight.

The Balancing Act Between Beijing and the Fed

This moment is weirdly balanced.

In the West, the Fed is draining liquidity and trying to cool inflation. In the East, China’s flooding the system and trying to revive growth.

Two opposite forces, one tightening, one loosening somehow keeping the global system from breaking apart.

It’s like one country’s exhaling just as the other inhales. The timing’s almost uncanny.

That’s the real reason global markets haven’t collapsed under the weight of high rates, China’s liquidity is cushioning the impact.

So, Can China Keep Saving the World?

That’s the million-dollar question.

China’s liquidity flood has given the global economy breathing room, but it’s not a permanent fix. Liquidity can delay pain, it can’t erase it.

If Beijing pulls back too soon, or if confidence doesn’t return at home, the ripple effect could reverse fast. Credit spreads could widen. The “cockroaches” might crawl back into the light.

And if both China and the West tighten at the same time, that’s when the real cracks would show.

The Bottom Line

China’s liquidity boom is one of the quiet engine holding the world together right now. It’s the reason global credit feels calm, the reason trade is stabilizing, and the reason the financial system hasn’t cracked under higher rates.

But liquidity is temporary power, not permanent progress. It buys time. It hides stress. It papers over problems that haven’t been solved yet.

China’s problem is still the same: households don’t trust the system enough to spend. Until that changes, all this liquidity will keep cycling through factories and financial institutions but not through the people who matter most.

For now, though, it’s working. The money is flowing. The cracks are quiet. The cockroaches are hiding.

And the rest of the world? It’s living off the flood.

Because when China turns on the tap, the world starts breathing again.

Magnificent write-up! Thank you🙏

You mentioned how 'the west is trying to drain liquidity and reduce inflation'. For the US's role in this, would you help me understand how the US massive tariff-raising (inflationary), pressure to reduce interest rates (inflationary) & efforts to debase the USD (including through gold purchases + pushes into CBDC/USDT/BTC) plays out as ' liquidity draining and inflation cooling'. I really want to understand this because it is quite complex.