December’s Fed Meeting Might Be the Most Chaotic Since the 1970s

A split committee, missing data, and rising dissents set the stage for the Fed’s most unpredictable call in decades.

The Federal Reserve is going through one of the biggest internal shifts it’s seen in decades.

It’s starting to showing up in the way officials talk, the way they vote and the way their decisions no longer line up perfectly.

For almost 30 years, the Fed operated like a single voice.

But for the first time in a long time, the Fed doesn’t sound like one unified voice, it sounds like individual people with their own views, their own priorities and their own thresholds for risk.

And honestly, that’s long overdue.

If you’re new to the Fed or haven’t thought much about how it’s structured, Here is a a must watch introductory video that helps everything click.

It walks through the Board of Governors, the 12 regional banks, and the FOMC in a way that’s simple, visual, and surprisingly good for beginners.

How the Fed Lost Its Voice and Why Consensus Became Religion.

Now that you watched that video and have a better understanding of the federal reserve, you need to back up a bit more to learn history.

Before 1987, the Fed was messy, dissent was normal. Different regional presidents argued based on what was happening in their districts.

That all changed after the 1970s, a decade of inflation, political pressure, and credibility crises.

Arthur Burns, the Fed Chair at the time, folded to the White House and held rates too low before the 1972 election.

Inflation spiraled, credibility collapsed and the committee was blamed for not acting as a unified force.

Then came Paul Volcker, who had the opposite problem, he had to act alone and force the economy through double digit interest rates to kill inflation once and for all.

He needed independence and that independence is what saved the U.S. economy.

After him came Greenspan, who took a completely different approach.

Instead of embracing disagreement, he engineered consensus.

He met with members privately, shaped expectations before the meeting even started and made sure dissent was almost nonexistent.

And because the 1990s looked like an economic miracle, the institution convinced itself that consensus = credibility.

From the late ’80s through the early 2000s, the Fed became what it still looks like today, a single voice.

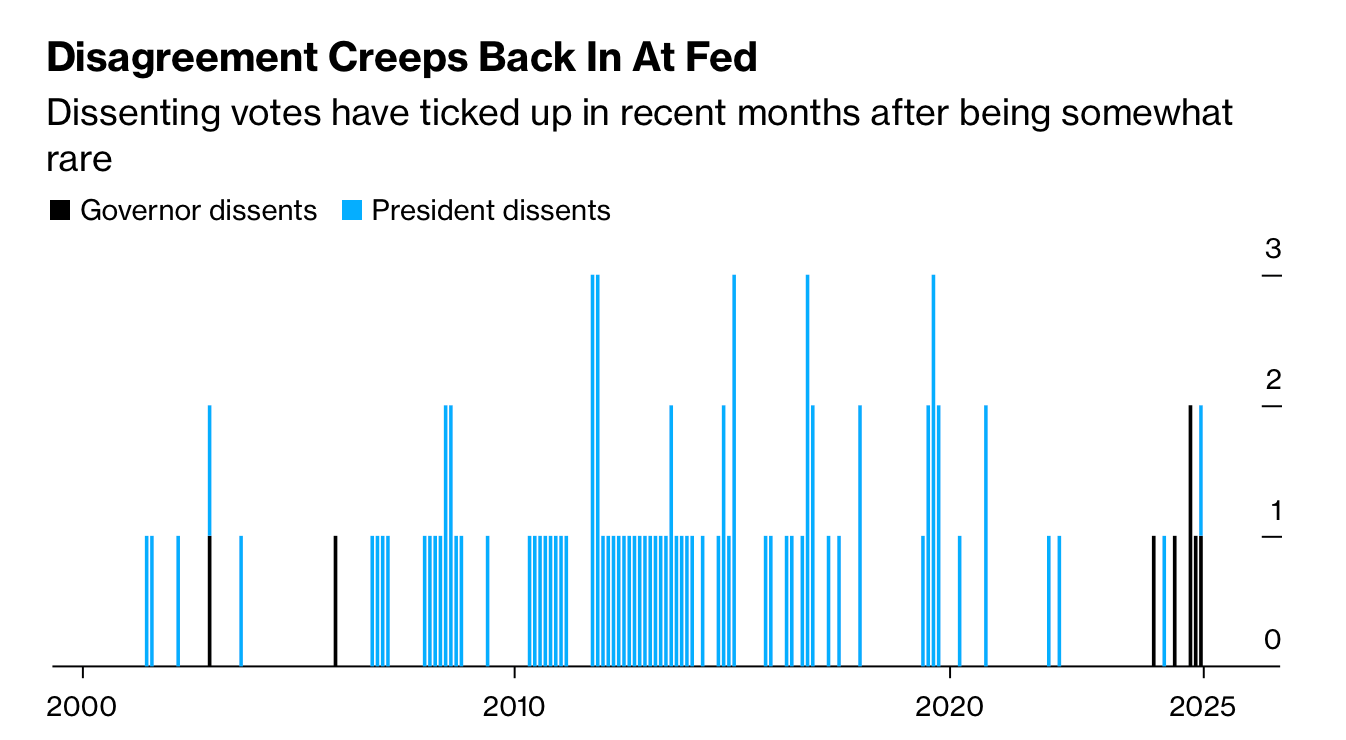

Dissents were rare. Public disagreement became taboo and the Chair gained enormous power but that unity came at a cost.

When transcripts from the Greenspan era were released years later, they showed that people did disagree.

They worried about bubbles, leverage, and overheated markets but none of that reached the public because nobody wanted to break the illusion of unity.

It took the 2008 financial crisis to break that spell.

The Post-Crisis Shift: Cracks in the Machine

When Bernanke took over, the world fell apart.

The Fed slashed rates to zero, launched QE, and revived lending markets.

For the first time in years, multiple FOMC members publicly dissented.

Regional presidents pushed back on QE. Others accused the Fed of being too cautious.

Under Yellen, the Fed opened up even further.

She encouraged open discussion. She valued different viewpoints and she allowed dissent without treating it as rebellion.

Then Powell arrived and the culture shifted again, this time even more dramatically.

Powell basically removed the unwritten rule that the Chair decides.

He told members to vote based on what they believe, not on what the Chair signals.

At the same time, Dodd-Frank made individual votes more visible.

Slowly, but consistently, the Fed began drifting away from its consensus era.

2025: The First Real Break From the Old Fed

This year is the first time in a long time we’re seeing the shift happen in public.

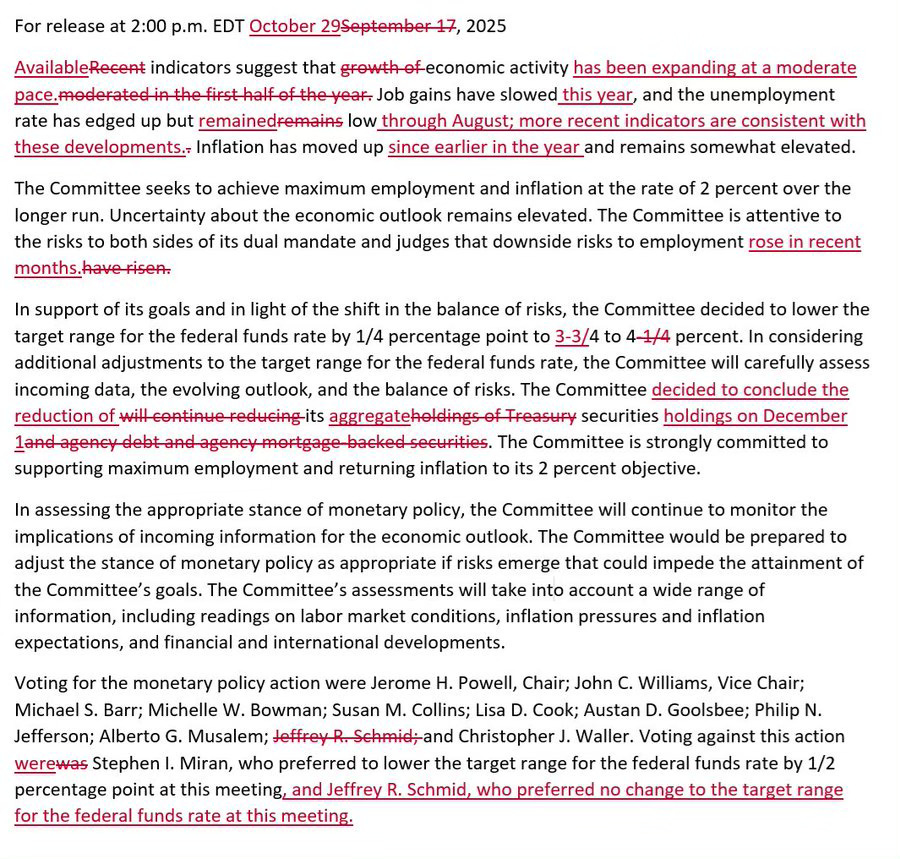

The October vote was 10–2 for a 25 bps cut but it was anything but unified:

Stephen Miran argued for a 50 bps cut

Jeff Schmid argued for no cut at all

Others split between 25 and 50

And the minutes noted strongly differing views, rare language for the Fed

And heading into December, Fed members aren’t hiding where they stand.

Here’s what some of them are saying:

Christopher Waller

“The labor market is still weak and near stall speed. I am not worried about inflation accelerating or inflation expectations rising significantly. My focus is on the labor market, and after months of weakening, it is unlikely that any data in the next few weeks would change my view that another cut is in order.”

“I worry that restrictive monetary policy is weighing on the economy, especially about how it is affecting lower- and middle-income consumers. A December cut will provide additional insurance against an acceleration in the weakening of the labor market.”

Jeff Schmid

“By my assessment, the labor market is largely in balance, the economy shows continued momentum, and inflation remains too high. I view the stance of policy as only modestly restrictive...My preference was to hold the policy rate steady.”

“Inflation has been running above the Fed’s 2 percent objective for more than four years...Talking to contacts in the Kansas City Fed’s district, I hear widespread concern over continued cost increases and inflation.”

Susan Collins

“I believe that a mildly restrictive policy is very appropriate at this moment, which makes me cautious as I consider what the next policy actions should be.”

“I think inflation is likely to remain elevated through the remainder of this year into early next...Once the level has adjusted, you won’t experience additional impacts, but that can occur over time.”

They’re all having different views and going on record about cuts, inflation, labor markets, and policy trajectories something you almost never saw in the old Fed.

Why December Could Be the Defining Moment

The December vote is unusually high stakes, not just because it will set the tone for 2026 but because the Fed is going in without fresh data.

October CPI was canceled

November CPI comes after the vote

Labor data is incomplete

The Fed will be making one of its most consequential decisions using stale numbers.

Members have to lean on their judgment and not the latest readings. And when that happens, their actual views come out. That alone makes this meeting different.

You can already see how much that missing data has shaken the committee.

Powell hasn’t spoken publicly since Oct. 29, and his silence has basically opened up the floor for everyone else.

Officials are now openly stating their preferences, something you almost never saw during the consensus era.

Traders who used to listen for Powell’s every adjective are now counting individual votes like it’s a Supreme Court decision.

And the votes look split. Right now, the camps look like this:

Hawks (likely no-cuts): Barr, Musalem, Schmid, Goolsbee, Collins

Doves (likely cuts): Waller, Bowman, Miran, Williams, Cook

Uncertain: Powell, Jefferson

A 7–5 or 6–6 vote is on the table. That would be the most divided Fed we’ve seen in years.

It would also be the clearest confirmation that the institution has truly shifted away from its consensus era.

The Old Fed Is Gone

The Fed is operating differently now. Members aren’t treating the Chair’s stance as the default answer.

They’re not softening their views just to make the vote look clean.

They’re laying out their reasoning publicly and sticking to it. That’s a real and a good change.

December is unpredictable for the simple reason that the normal anchors aren’t there.

Without new inflation data, every member is leaning on their own interpretation of the economy.

For some, inflation is still too high. For others, the cooling labor market and slower growth are flashing warning signs.

For the first time in years since Powell took over, you can actually tell who is hawkish, who is dovish, and who is trying to land somewhere in between.

What you’re seeing now is more transparent and more aligned with how the Fed was originally supposed to function.

If you made it to the end, hit like, restack it, and share it with someone who’d get value from it. Seriously, it helps more than you realize.

Disclaimer: Nothing in this newsletter is financial advice. All opinions, analyses, and commentary shared here are my own personal views, based on publicly available information and independent research. You should not rely on any of this content as a recommendation to buy, sell, or hold any security or investment. Always do your own due diligence and consult a licensed financial advisor before making investment decisions.

For those interested, in my latest post titled “The Fed’s AI Gambit”, I explore:

The trap the Fed finds itself in: boxed between fiscal dominance it can't tighten away and inflation it can't ease into

Why the economy looks strong on the surface while entire sectors feel like recession

Why everyone asking "is AI a bubble?" is asking the wrong question

What it means if productivity is the only door left

https://alphawavess.substack.com/p/the-feds-ai-gambit?r=2gkbpg

Paul Volcker was, in my view, the most efficient Fed chair, especially considering the economic environment of the time. He wrote a highly engaging autobiography called “Keeping at It” which I recommend.