Dollar dying = investment opportunity 💵

Here’s how to get rich while it happens.

You know things are getting weird when a tiny bank in the Arctic Circle suddenly becomes the hottest stock on the planet.

Bank of Greenland is up 40% in a single week.

Did they discover a gold mine in their basement?

Did they invent a new way to finance igloos? No.

They rocketed higher because Wall Street is starting to bet on something that sounds like it belongs in a Tom Clancy novel:

The United States government might be looking to essentially “acquire” a new territory.

Buckle up, because we are going to walk through why the world is getting chaotic, why the dollar is in the crosshairs, and how you can actually make money from it.

The Dollar Dilemma: Printing Money While Fighting the World

Let’s start with the big picture, because this is the engine driving the whole car right now.

The current setup is a bit of a paradox.

Imagine you decide to quit your job to start a fight with your neighbors (Trade War/Tariffs), but at the same time, you decide to go on a massive shopping spree using your credit card (Government Spending/Printing Money).

That is effectively what the US policy looks like right now.

We have simultaneous “Quantitative Easing” (which is fancy banker speak for the Fed buying bonds to inject cash into the system) plus tariffs that make imported goods more expensive.

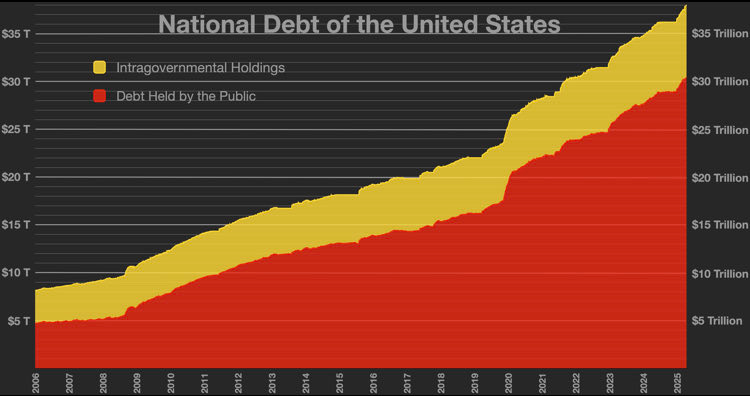

Here is the kicker: US gross national debt was $37 trillion in August and reached $38.4 trillion by December.

That is $2.23 trillion more than a year ago.

It is the fastest increase outside the COVID pandemic.

That is an unfathomable amount of money.

The only way the math works, the only way the government can afford to pay the interest on that debt is if they let the dollar get weaker.

When the dollar is weaker, the debt is easier to pay off (in real terms), and our exports look cheaper to the rest of the world.

So, what’s the trade? one of the trade is Bonds.

I know, I know. Buying bonds sounds about as exciting as watching paint dry.

And with interest rates where they are, it feels like a losing bet.

But here’s the secret: The government cannot afford for interest rates to go high.

If rates spike, the interest payments on that massive debt would bankrupt the budget.

So, they will do everything in their power, cut rates, buy bonds, manipulate yields to keep them down.

You aren’t betting on the economy; you’re betting that the government will do whatever it takes to survive.

That makes bonds a surprisingly smart contrarian play right now.

But wait what if I want more than just bonds, don’t worry:

I have the perfect playbook for you coming up.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.