I'm back: My 2026 AI prediction 🚀

Spoiler: It's nothing like 2025

Happy New Year to my Investinq Family!

I know I’ve been MIA (missed you guys) for the last few weeks, but trust me, I needed the reset.

I took some time to unplug, clear my head, and stare at the charts without the daily noise.

Now, I’m back, recharged, and arguably more locked in than ever.

I’m also making it official: my New Year’s resolution is to deliver two high-quality newsletters per week to your inbox.

I’ve written it down in permanent marker, so now you all have permission to hold me to it.

But enough about me.

I used that time away wisely to really look at where we’re heading, and my conclusion is that the landscape for 2026 looks nothing like the fever dream we just woke up from.

This edition is dedicated to my core thesis for the year ahead.

If you are still reading this, congratulations, you survived the “AI Mania” of the last three years.

You lived through the era where a CEO could simply whisper “AI” into a microphone and watch their stock price rocket.

You watched as the market threw money at anything with a microchip, ignoring fundamentals, logic, and occasionally, gravity.

It was a frat party in a penthouse, fueled by cheap money and expensive dreams.

But as we settle into 2026, the vibe has shifted.

The party is officially over.

The bartender is no longer handing out free drinks, he’s handing out the bill.

Wall Street strategists, who love inventing fancy terms for simple problems are calling this the “Great Bifurcation.”

It’s a polite way of saying the economy is snapping in half.

For the better part of the 2020s, a rising tide lifted all boats.

But now that era is dead.

In 2026, the tide is going out, and we are about to find out exactly who has been swimming naked.

This year isn’t just about growth at any cost. It is about discernment.

(the ability to tell the difference between a real business and a cool PowerPoint presentation).

It is about the ruthless separation of the winners, who are actually using technology to print cash from the losers who are just burning it to stay warm.

The Two Economies

To understand where to put your money this year, you first have to ignore the single biggest lie on television: The Economy.

Pundits love to talk about the US economy as if it’s a monolith, a single creature that is either happy or sad.

It isn’t.

We are currently living through a textbook K-Shaped reality where two completely different economic movies are playing at the same time.

On the top arm of the “K,” we have the Asset Class.

If you own a home, have a 401(k), and hold a good job, 2026 is shaping up to be a banner year.

This is largely to what is jokingly called the One Big Beautiful Bill Act (OBBBA).

While the name sounds like it was written by a marketing intern on a sugar high, the effects are real and they are actively reshaping the consumption habits of the upper middle class.

The standard deduction for married couples has jumped to $32,200, effectively shielding a massive chunk of income from the IRS.

The SALT cap (State and Local Tax deduction) has risen to $40,000, which is a massive bailout for the upper middle class in high-tax suburbs who have spent the last few years complaining about property taxes at dinner parties.

Seniors over 65 are getting an extra $6,000 deduction.

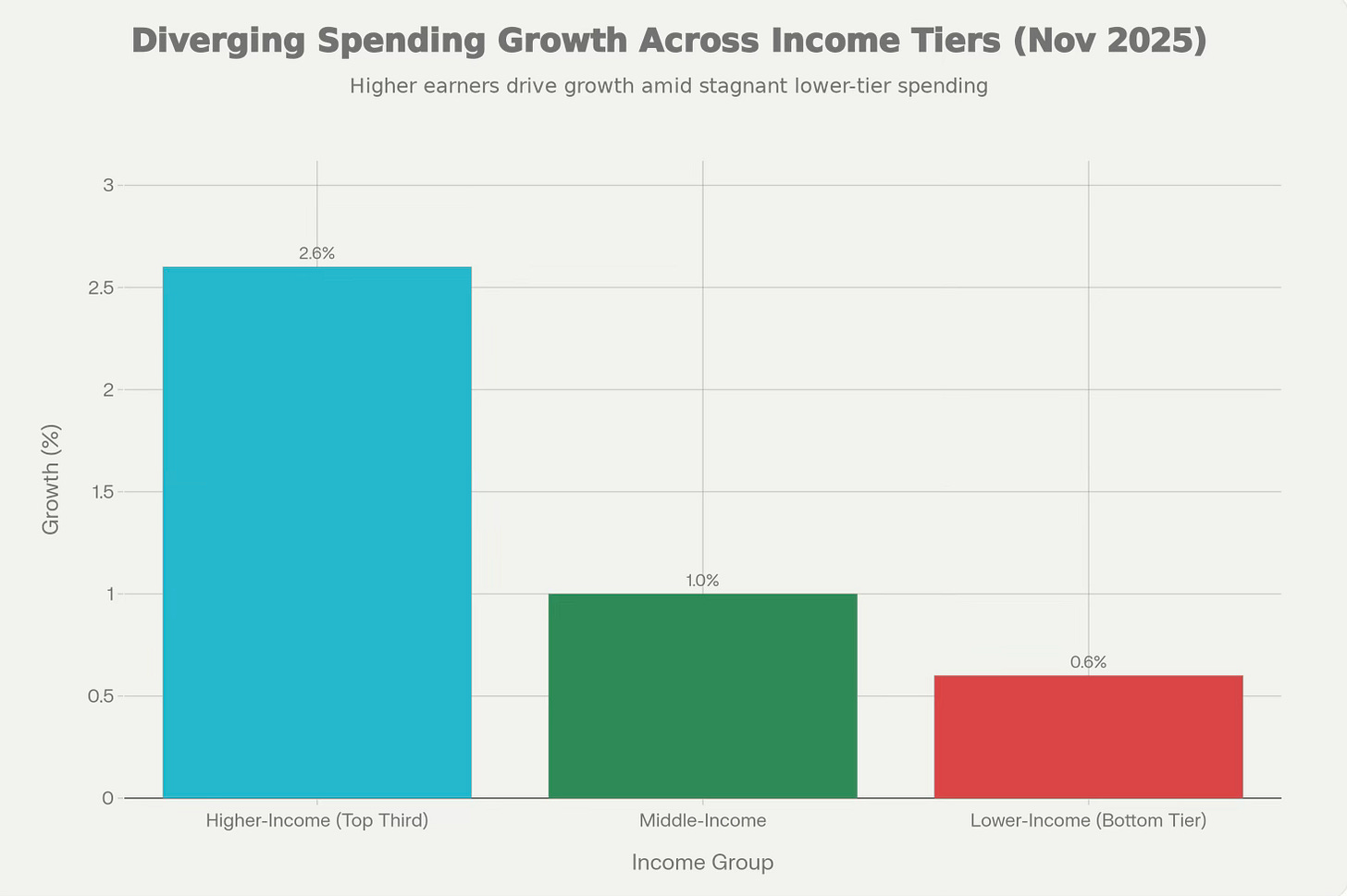

The data backs this up: the top third of American households grew their spending 2.6% year over year in November 2025.

They are flush with cash, tax incentives, and the warm glow of a rising stock portfolio.

But if you look at the bottom leg of the “K,” you see a solvency crisis that looks terrifyingly like 2008.

The low income consumer, the person who rents, lives paycheck to paycheck, and relies on credit is drowning.

The data reveals that the bottom third of households managed just 0.6% spending growth, a four-fold gap compared to the wealthy.

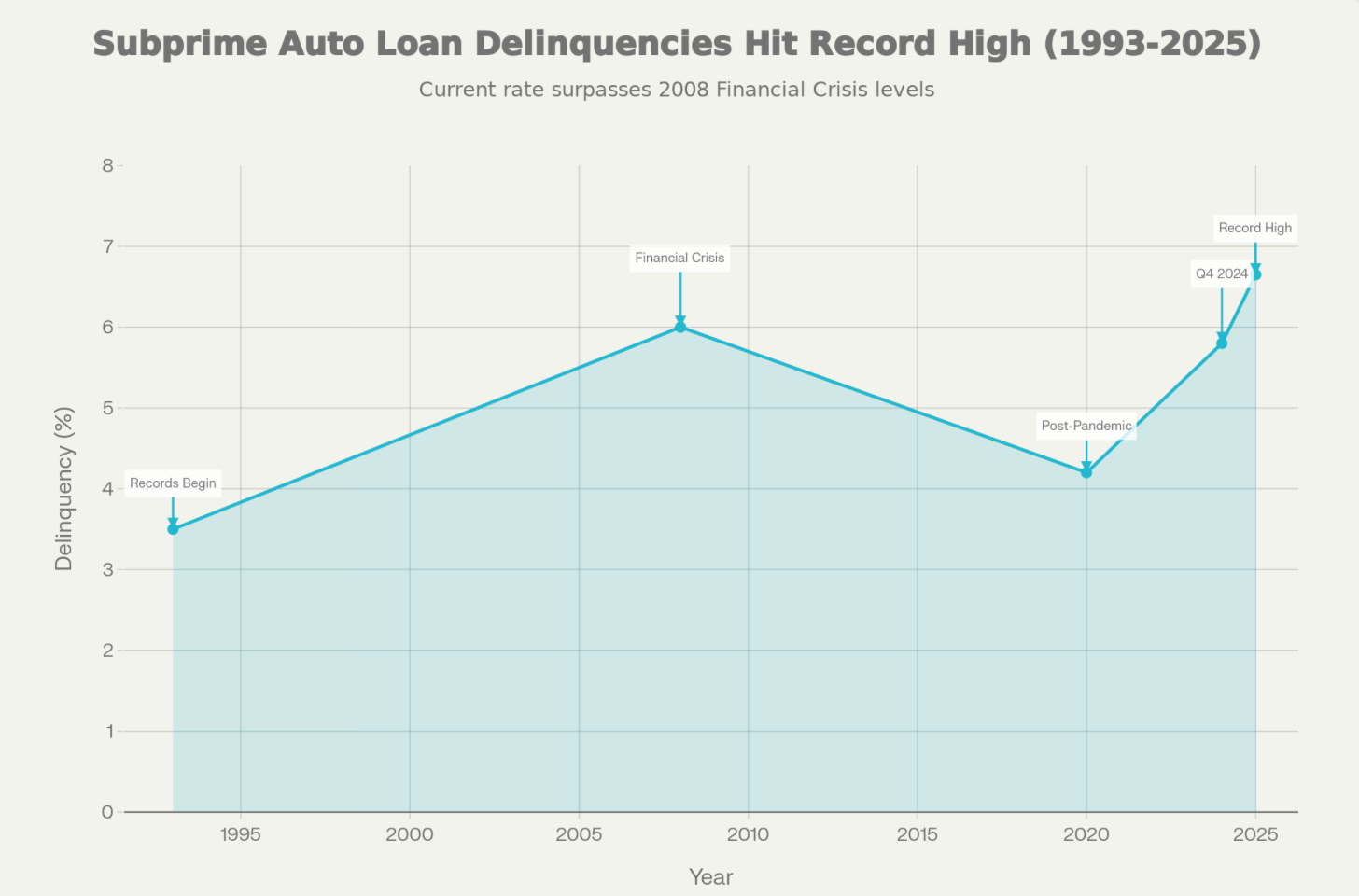

But the most alarming signal in the entire market is now the delinquency rate on subprime auto loans.

Right now, over 6.65% of subprime borrowers are more than 60 days late on their car payments.

That is higher than it was during the Great Financial Crisis.

Think about the desperation required to stop paying for your car.

In most of America, if you lose your car, you lose your job.

People don’t default on their car loans unless they have absolutely zero options left.

For a subprime borrower paying $600 a month in a world where average cars cost $50,000, a minor tax cut doesn’t move the needle.

They have exhausted their savings, maxed their cards, and are now capitulating.

This fracture creates a very specific roadmap for your portfolio.

You want to own the companies serving the top of the K and avoid the ones preying on the bottom.

This is why we are looking at Credit Acceptance Corp (CACC) and World Acceptance Corp (WRLD) not just as stocks to avoid, but as active shorts.

These companies’ entire business model is lending money to people who are currently broke.

Their asset backed securitizations depend on borrowers maintaining payments, but with delinquency rates at three-decade highs, the math has inverted.

Recovery rates are compressing, and loss severity is widening.

When the repo man is busier than the loan officer, your stock is headed for a violent repricing.

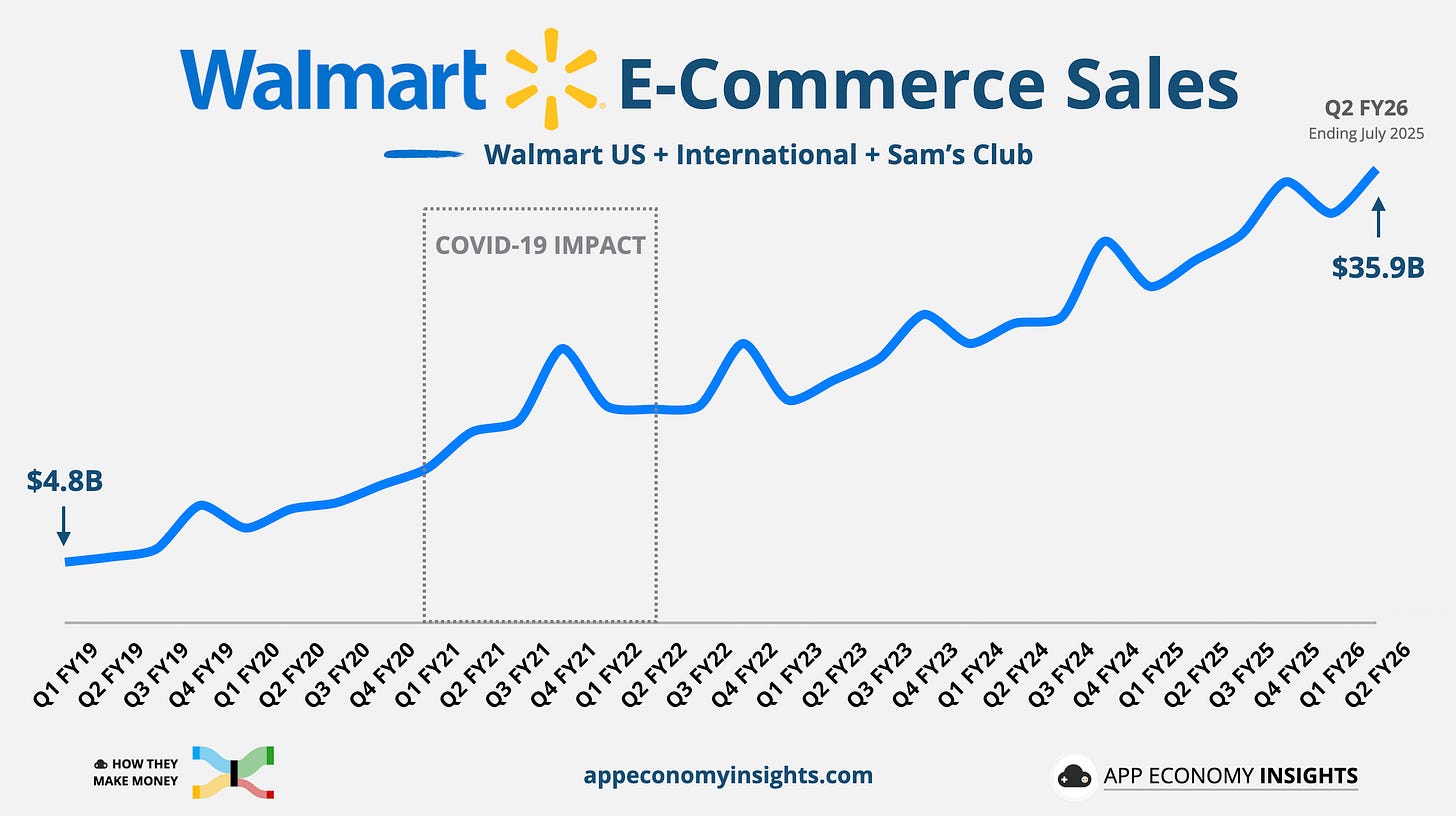

Conversely, this is why Dollar General (DG) and Walmart (WMT) are poised to win.

We are witnessing the great trade down, a mass migration where families earning six figures swallow their pride and swap Whole Foods and the “Erewhons” of the world for the discount aisle to make ends meet.

As the middle class feels the pinch of inflation, they trade down to value.

For example, Walmart’s online sales surged 28% in the second half of 2025, driven largely by households earning over $100,000 trading down to save money.

Dollar General is seeing a similar trend, expanding its gross margins to nearly 30% as it becomes the primary retailer for 80% of communities with fewer than 20,000 residents.

They are some of the beneficiaries of the great trade-down.

Revenge of the Boring

While the economy fractures, a similar split is happening in the corporate world.

For the last three years, the only game in town was the “Pick and Shovel” trade.

You bought Nvidia because they made the chips.

You bought stocks like Arista because they made the cables but the infrastructure phase is maturing.

The easy money there has been made.

The smart money in 2026 is rotating into what we call the productivity super-cycle.

We are moving from the companies building the AI to the companies using it.

And ironically, the biggest winners are the boring, unsexy, old economy giants that you haven’t thought about since 2010.

These companies are using AI not to write poems or generate weird images of cats in spacesuits, but to decouple revenue growth from headcount growth, the holy grail of business.

Consider Bank of America (BAC). It’s a dinosaur, right? Wrong.

Under the hood, BofA has become a technology fortress.

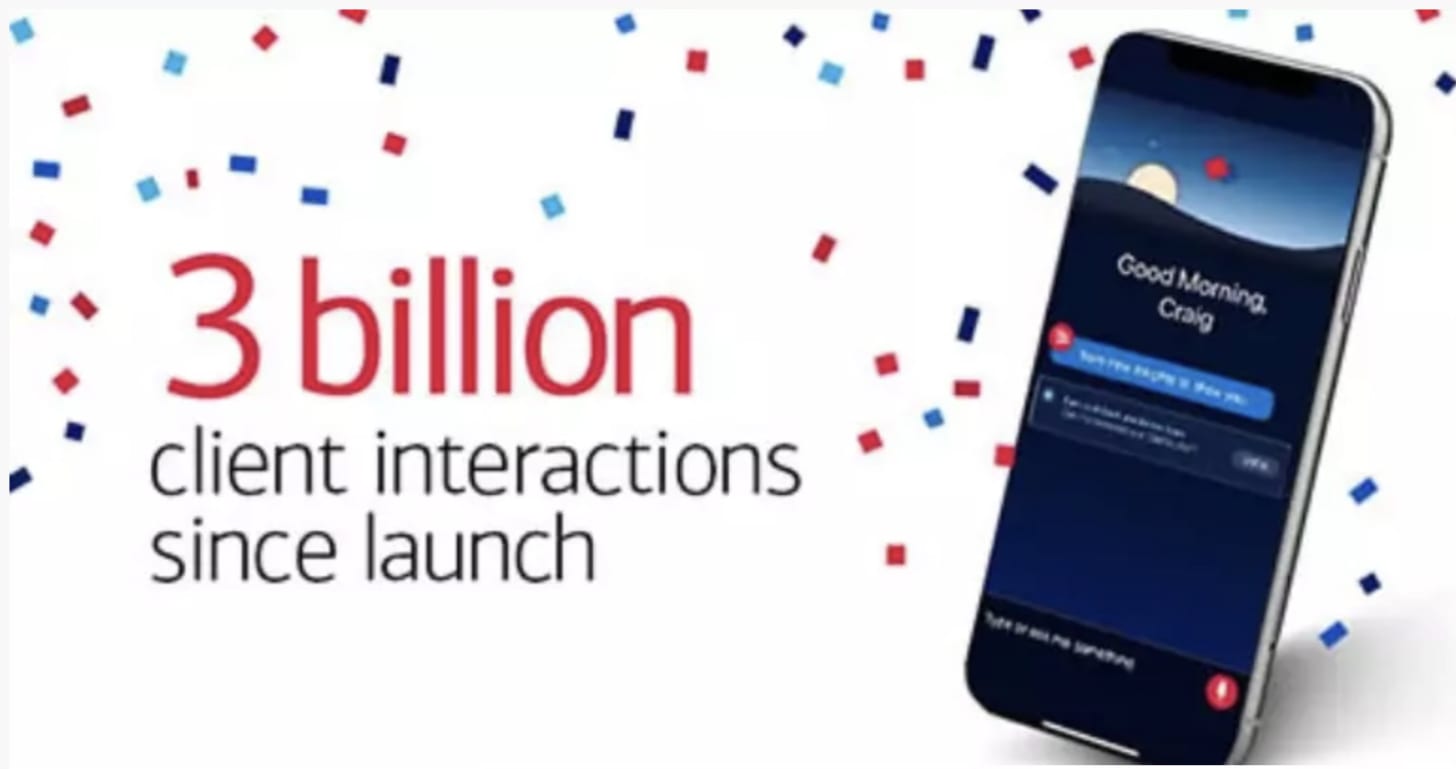

The bank’s “Erica” virtual assistant has handled over 3 billion customer interactions.

Now, I know what you’re thinking.

Most AI assistants are just frustrating gatekeepers that make you scream “REPRESENTATIVE” at your phone screen.

I get it, they can be annoying.

But put your personal feelings aside and look at the math.

That volume is the equivalent of 11,000 full-time employees working around the clock, never sleeping, never getting sick, and never demanding a raise.

This technology generated a 19% revenue lift through strategic cross-selling, surfacing refinancing and investment opportunities to customers automatically.

But looking only at the chatbot misses the bigger picture.

Deep inside the bank’s plumbing, BofA is deploying a private army of AI agents that normal customers never see.

For their corporate clients, they launched CashPro, a crystal ball that uses AI to predict future cash flows so CFOs don’t have to build spreadsheets.

For their wealth managers, they built “Ask Merrill,” a tool that turns every junior advisor into a walking encyclopedia by instantly pulling data from massive reports.

They are even getting weird with it, using AI-powered VR headsets to train employees, complete with a Metaverse room where staff can ride virtual unicorns to de-stress (I promise I am not making that up).

Add in a developer workforce of 18,000 engineers using AI to boost coding speed by 20%, the bank is guiding for 6-7% earnings growth in a tough environment.

While other banks squeeze margins, BofA is using technology to widen them.

Or let’s look at XPO Logistics.

Trucking is a brutal, low margin business where success usually means saving pennies on diesel.

But XPO has deployed AI to solve the industry’s biggest problem: empty miles.

When a truck drops off a load and drives 100 miles empty to the next pickup, that is just burning cash, a $30 billion annual waste for the industry.

XPO’s new algorithms have reduced those empty miles by 12% and cut unnecessary rerouting by a staggering 80%.

They are effectively creating “free” capacity out of thin air.

In Q2 2025, their purchased transportation costs fell 53% year-over-year because their AI allowed them to insource 93% of their linehaul operations.

This is a company turning efficiency into margin expansion while competitors burn cash fighting for market share.

We are also watching the mortgage sector, specifically UWM Holdings (United Wholesale Mortgage).

In an industry that usually relies on an army of loan officers making awkward phone calls, UWM deployed “Mia,” an AI-powered agent that works 24/7.

In just a few months, Mia made 400,000 outbound calls to past clients, reminding them about refinancing opportunities.

The result? 14,000 closed loans that would have otherwise been missed opportunities.

UWM saw its best quarter for loan originations since 2021, proving that AI can drive volume even when interest rates aren’t at rock bottom.

The Reckoning

Finally, we have to address the elephants in the room, the pure-play AI stocks.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.