Powell Cuts Rates, Ends QT, and Pretends the Economy Isn’t Cracking

Rate cuts in one hand, denial in the other: welcome to the Fed’s balancing act.

The Fed just cut rates again, another quarter point and tried to act like it’s business as usual.

Spoiler: it’s not.

Rates are now down to 3.75–4.00%, but the story isn’t the cut.

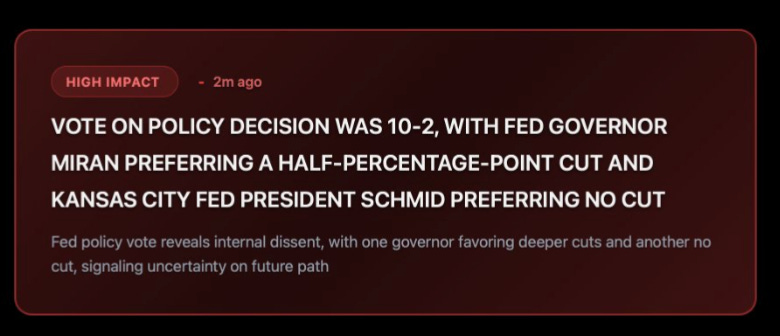

It’s the confusion behind it. The vote came in at 10–2, with one governor begging for a deeper 50bps slash and another saying “don’t cut at all.”

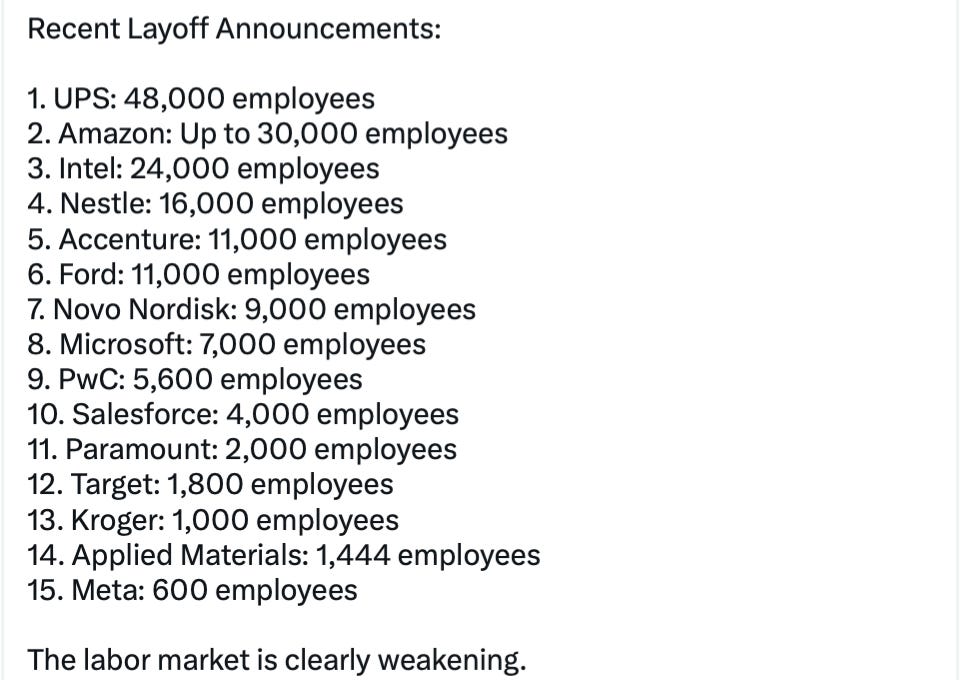

Powell stood up and said “the layoff numbers have not gone up”.

The Fed’s just trying to manage the optics, hoping that soft words can buy time before the hard numbers do the talking.

However, underneath that calm language, unemployment’s been rising all year especially this month. Job openings are drying up, hiring plans are getting shelved.

The End of QT: When the Fed Quietly Panics

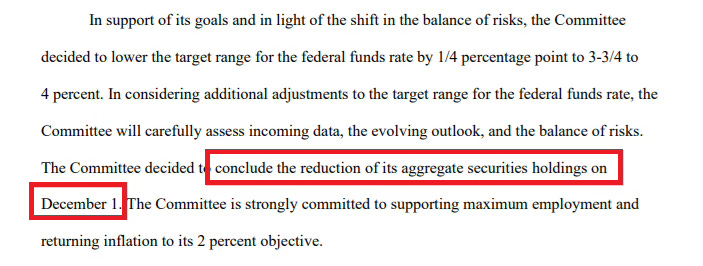

Forget the rate cut, this was the real headline. The Fed just killed quantitative tightening. On December 1, it’s officially over.

For three years, Powell’s been draining liquidity like a slow leak in a tire, rolling off $60B in Treasuries and $35B in mortgage bonds every month. That’s quantitative tightening (QT), the Fed’s fancy way of saying, “we’re putting the money printer in reverse.”

Back in 2020, the Fed was running full-blown, quantitative easing (QE). They were buying everything in sight, Treasuries, mortgages, you name it to flood the system with cash. QT is the hangover that follows the binge. The Fed stops buying, lets old bonds expire, and money quietly leaves the financial system. It’s supposed to make things “cool off.”

Now that their balance sheet has dropped from nearly $9 trillion to $6.6 trillion, Powell’s trying to pull the classic mission accomplished moment. But here’s the thing:

You don’t stop QT because you feel good. You stop because the system’s wheezing.

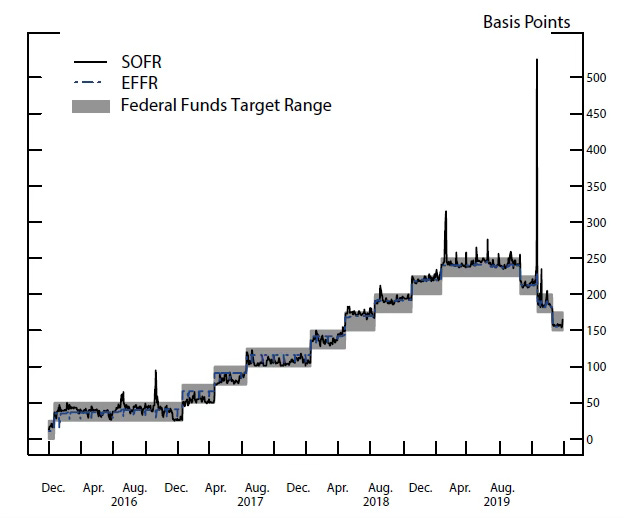

Behind the curtain, the financial plumbing is creaking. The repo market, the overnight lending machine that keeps banks and funds alive is flashing warning signs. That’s where institutions borrow cash overnight using Treasuries as collateral.

Normally, it’s dull. Predictable. The monetary version of a heartbeat.

But when repo rates start spiking, it’s like watching a patient’s vitals go haywire. It means there’s not enough cash flowing through the system. And right now, those rates are jumping. The SOFR rate, the key benchmark for these short-term loans has climbed above the Fed’s own policy rate. That’s not supposed to happen.

Think of it this way: the Fed sets the “official” price for money, but the market’s now saying, “Nope, cash costs more.”

That’s a liquidity problem, plain and simple.

And Powell knows it. The Fed’s reverse repo facility, once a $2.3 trillion parking lot for extra cash is now basically empty. The excess reserves that kept the banking system stable are gone, and Powell’s watching the fuel gauge hit empty.

This is the same movie from 2019, when repo rates suddenly exploded from 2% to 10% overnight because reserves got too low. The Fed had to rush in with emergency cash injections just to keep the system from locking up. Powell swore it wouldn’t happen again and now here we are, déjà vu with better branding.

So what’s the Fed doing? Quietly changing the rules mid-game. As I mentioned previously, starting December 1, the Fed will reinvest every maturing Treasury instead of letting it disappear.

Normally under QT, when a bond matures, the Fed takes the cash and walks away money quietly leaves the system. Now, they’re doing the opposite. When that bond comes due, they’ll use the cash to buy a new one, keeping liquidity right where it is.

For mortgage bonds, they’ll still let some roll off, but instead of letting all that cash vanish, they’ll funnel it into short-term Treasury bills basically cash-like assets that mature in weeks or months.

It’s not technically quantitative easing (QE), where the Fed fires up the money printer and buys assets outright. But let’s be honest, it’s close enough to smell like it. Call it QE-lite, diet QE, the sugar-free version of stimulus.

Powell won’t admit it, of course. He’ll say reserves are still ample and liquidity is normal. But you don’t throw out a three-year tightening plan for fun. You do it because something’s breaking behind the scenes and the last thing you want is to tell the markets the engine’s smoking while you’re still in flight.

This is the softest pivot imaginable. The kind where you keep a straight face while doing the opposite of everything you said you’d do.

And that’s the tell. The Fed’s not confident, it’s cornered.

They’re not easing because they want to. They’re easing because they have to.

Powell’s Hawkish Act: The December Head-Fake

Markets were ready to pop champagne after the rate cut until Powell stepped up to the mic and killed the mood.

Please read this to continue: These deep dives takes hours of work. Upgrade for just $99 a year (others charge $100+ monthly) to keep this newsletter going and get the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.