Regional Banks Under Siege: Fraud, Private Credit, and the Emerging Credit Crisis

Fraud, leverage, and private credit risks are starting to collide and markets are finally paying attention.

Regional banks got crushed today after reports of fraud-related loan losses hit the market. What started as a few isolated issues quickly turned into a full-blown sell-off across the sector. Behind it all are years of loose lending, weak oversight, and a pile of hidden risks that have been quietly building inside the financial system.

Investors are finally realizing that these aren’t just one-off mistakes, they’re symptoms of a bigger problem. For years, smaller banks stretched their lending standards to chase returns and keep up with the bigger players. They handed out loans that looked fine when money was cheap, but now that rates are higher and liquidity is tight, those cracks are showing fast. What’s happening today feels less like an accident and more like the system catching up to itself.

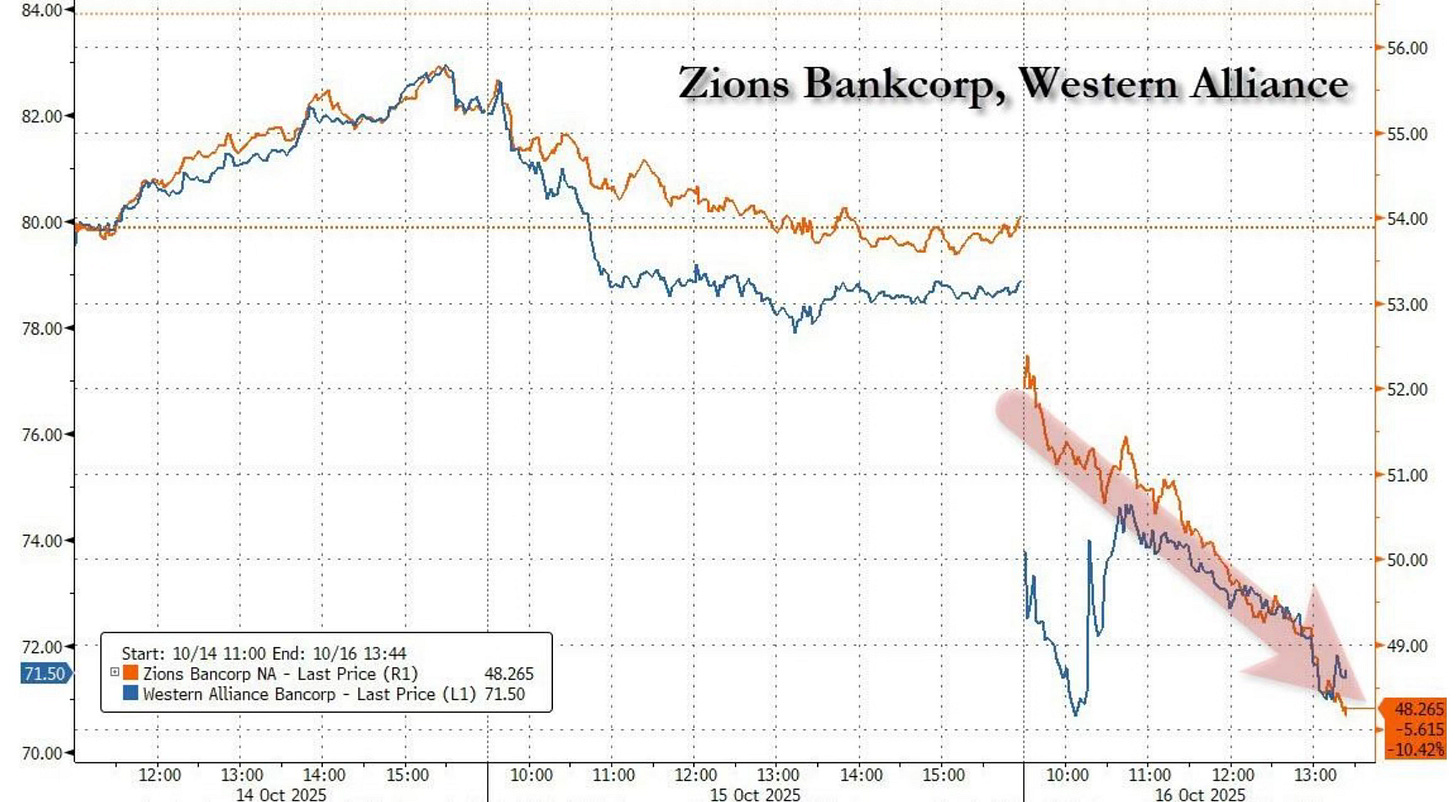

The Immediate Crisis: Zions and Western Alliance

Zions Bancorporation kicked off the sell-off after its stock plunged over 10% when the bank revealed a $50 million charge-off tied to two business loans worth around $60 million. The loans came from its California Bank & Trust division, and the bank said it found major “misrepresentations and contractual defaults.”

After looking deeper, Zions discovered the borrowers and their guarantors had provided false information and violated their agreements. The bank issued demands for repayment but got no response, forcing it to write off the full amount and begin legal action in California.

Then came Western Alliance Bancorp, whose shares sank about 11% after it disclosed exposure to what looks like the same fraud scheme. Western Alliance had lent money through a revolving credit facility with Cantor Group V, LLC and later sued the borrower, alleging fraud after it failed to provide proper collateral. The bank claimed it still had enough collateral to cover the loan, but the market didn’t believe it.

As investors rushed out, the SPDR S&P Regional Banking ETF (KRE) dropped more than 4%. Analysts said the situation raises real questions about how regional banks are underwriting loans and managing risk. The losses themselves aren’t massive, but they shine a light on how easily small cracks in confidence can spread.

The Backstory: First Brands and Tricolor Bankruptcies

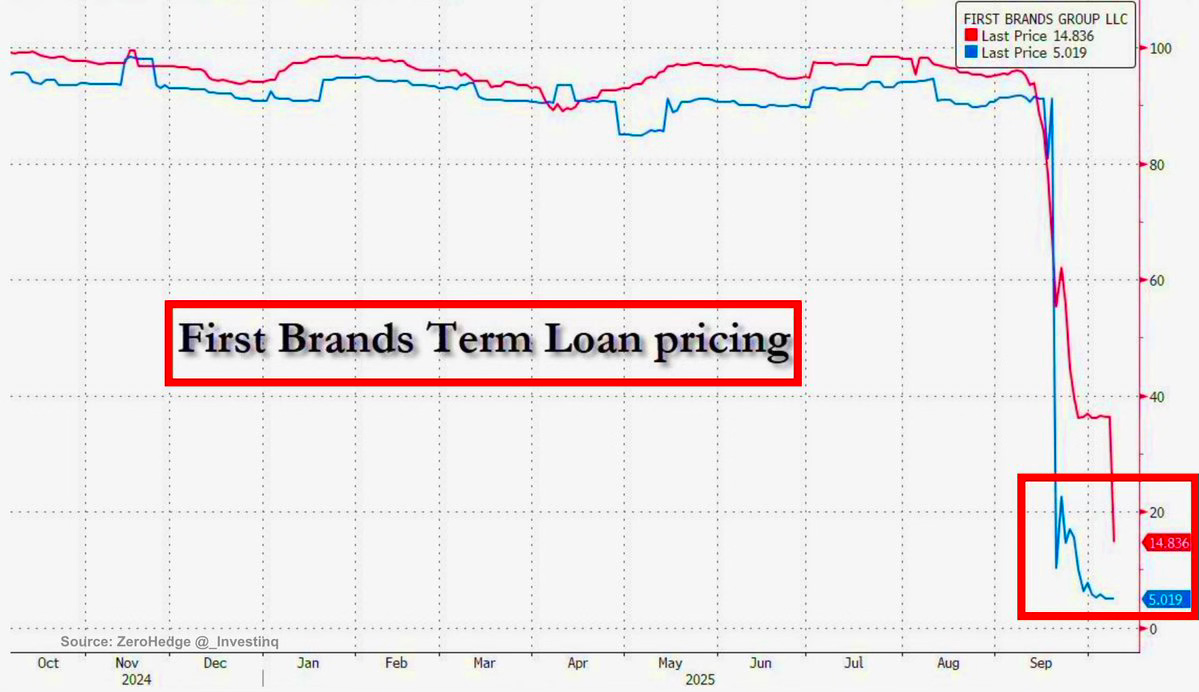

These banking losses come right after two massive corporate bankruptcies, First Brands and Tricolor Holdings both of which revealed how deep the problems in credit markets may go.

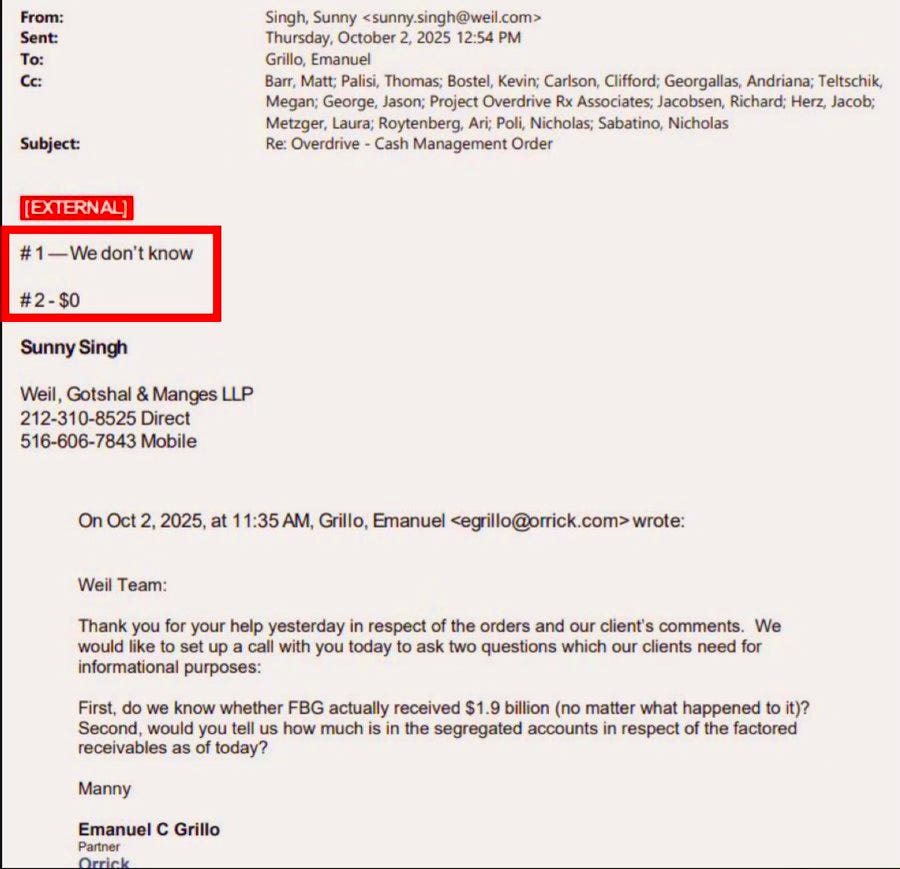

First Brands, the auto parts company behind brands like Fram and Autolite, filed for bankruptcy on September 28. The company had between $10 and $50 billion in debt but less than $10 billion in assets. The real shock came when investigators found that around $2.3 billion in assets had gone missing.

Court documents showed the company had been using complex off-balance-sheet financing including invoice factoring and supply chain finance to raise cash. In simple terms, it sold the same invoices to multiple lenders and pocketed the money. When creditors asked what happened, the company’s lawyers said “We don’t know”.

Jefferies Financial Group took the biggest hit, with its Point Bonita Capital fund holding around $715 million in First Brands receivables. UBS, BlackRock, Morgan Stanley, and Singapore’s GIC were also exposed. Jefferies’ stock is down over 23% this month, its worst stretch since 2020, and several investors are now trying to pull their money out of the fund.

Tricolor Holdings, a subprime auto lender, filed for liquidation in early September after investigators called it “a fraud of extraordinary proportion.” JPMorgan wrote off $170 million, and Fifth Third warned of losses between $170 and $200 million. Even Jamie Dimon admitted it wasn’t JPMorgan’s “finest moment” and said more credit losses could still surface.

Dimon’s “Cockroach” Warning and Private Credit Concerns

On JPMorgan’s earnings call, Dimon delivered a warning that rattled markets: “When you see one cockroach, there are probably more.”

He was talking about the $3 trillion private credit market, the fast-growing world of non-bank lenders like private equity and specialty credit funds that now handle much of the lending banks used to do. The sector exploded after 2008 as banks pulled back from risky loans, and again after the 2023 banking turmoil.

Private credit has filled the lending gap, but with little regulation and almost no transparency. These funds operate outside traditional banking rules, which means investors and regulators have little visibility into what’s really inside them.

The growth has created several red flags:

Borrowers are often highly leveraged and dependent on floating-rate debt.

Funds lend to weaker companies that couldn’t get loans from traditional banks.

Investors are promised periodic liquidity even though the assets can’t be easily sold.

Banks are lending more to these funds, tying the traditional system to the shadow one.

Banks have roughly $1.2 trillion in exposure to the shadow banking system, and lending to private credit has grown from $8 billion in 2013 to nearly $95 billion by late 2024.

The redemption requests now hitting Jefferies’ Point Bonita fund show how quickly confidence can evaporate. When one investor pulls out, others follow and liquidity vanishes almost overnight.

The Invoice Factoring and Supply Chain Finance Problem

The First Brands collapse has also exposed a major blind spot in corporate finance: invoice factoring and supply chain finance. These are tools companies use to sell their receivables for quick cash. In theory, they help smooth cash flow. In practice, they’ve become an easy way to hide debt or commit fraud.

First Brands had $2.3 billion in factoring facilities and another $682 million in supply chain finance before it went under. Investigators say the company used these programs to inflate assets and borrow multiple times on the same invoices, a textbook double-financing fraud.

This type of fraud isn’t new. We’ve seen it before with cases like BHS Electronics and TransCare, but the scale here is alarming. Accounting rules in the U.S. still let companies keep much of this activity off their balance sheets, which means lenders and investors often don’t see the full picture until it’s too late.

Is This Systemic or Just a Few Bad Actors?

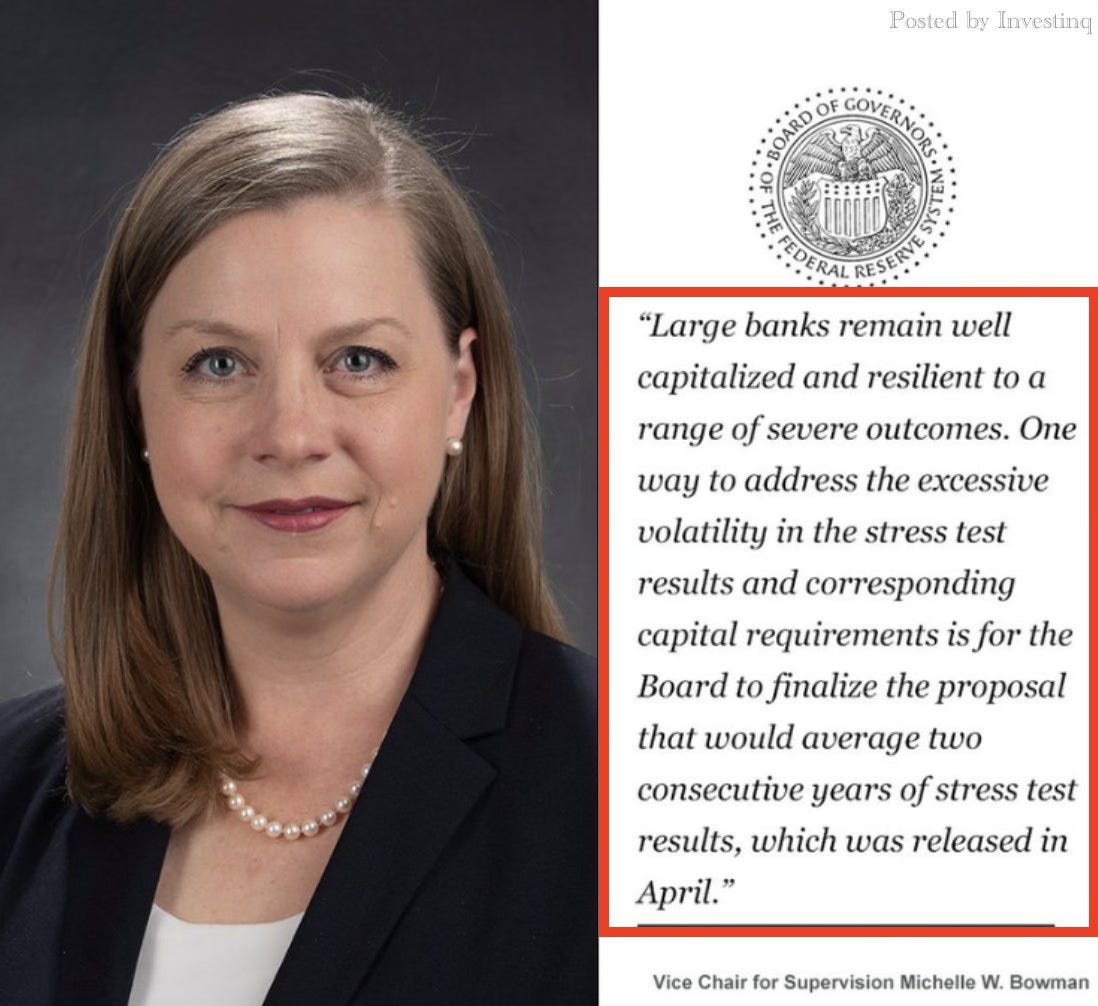

Wall Street is split. Some believe these are isolated cases of fraud and mismanagement. BlackRock and JPMorgan both said the bankruptcies look like “idiosyncratic pockets of stress” in deep subprime areas, not signs of a wider problem. The Fed’s 2025 stress tests also found banks well-capitalized even under severe scenarios.

But others are less optimistic. Dimon warned that the private credit market is now so interconnected with traditional finance that it could easily amplify shocks. Academic studies have backed this up, showing that private credit’s network of links between funds, banks, insurers, and pensions can spread stress quickly when conditions tighten.

Private credit ballooned from $2 trillion in 2020 to $3 trillion in early 2025. That growth happened in a stable, low-default environment. A downturn could reveal how fragile it really is.

Commercial Real Estate: The Next Shoe to Drop?

As if that weren’t enough, commercial real estate is now adding another layer of risk. Around $950 billion in property loans come due over the next 12 months. Many were written when rates were near zero. Refinancing those loans today costs far more, and values especially for offices have fallen.

Nonperforming office loans hit 5.8% earlier this year, and distressed loans now make up roughly 60% of the office portfolio. CMBS office loan delinquencies recently topped 11%, higher than they were after the 2008 crisis. Regional banks are particularly exposed, and some analysts think we’re nearing the point where “extend and pretend” renewing loans to delay losses stops working.

Market Impact and Contagion

The sell-off on October 16 was brutal:

Zions Bancorp (ZION): down about 10–12% intraday

Western Alliance (WAL): down 9–11%

Jefferies (JEF): down over 8% today, and about 25% for the month

SPDR Regional Bank ETF (KRE): down 4.6%

Analysts warned that if more disclosures surface in the coming weeks, weaker regional banks could be revalued sharply lower. Western Alliance, which barely survived the 2023 deposit panic, is now under pressure again, this time from credit losses instead of deposit flight.

What Comes Next

Several key questions will shape how serious this gets:

Are there more “cockroaches” just like ones we saw today?

Will private credit funds face more redemptions? The rush at Jefferies’ fund could spread if confidence continues to fade.

Can regulators close the transparency gap? The Fed and global regulators are already drafting new rules for shadow banking exposure.

What happens if the economy weakens? A downturn could reveal just how weak underwriting standards have become.

Will commercial real estate trigger another wave of losses as $950 billion in loans mature?

Everything still looks fine on the surface, but the cracks are starting to show where it matters most, in smaller banks, private credit funds, and companies already under pressure. Jamie Dimon’s “cockroach” comment feels more real now than ever. When problems like these start appearing, they usually don’t stop at one.

The big question is whether this is just a few bad players getting caught, or the start of something much larger slowly making its way through the financial system.

We just started a free options trading discord. Join here before it is invite-only.

Having come from Canada, whose banking system is widely regarded as one of the soundest in the world, I have never understood why the US allows these problems. Get with the program! My fortune cookie says several other banks are scrambling 😂 for how could it not be so?

FIAT money on a FIAT banking system on a FIAT lender of last resort

Next stop: Private equity, the new WMD