The 30-Year Mortgage Trap: How Low Rates Froze the Housing Market?

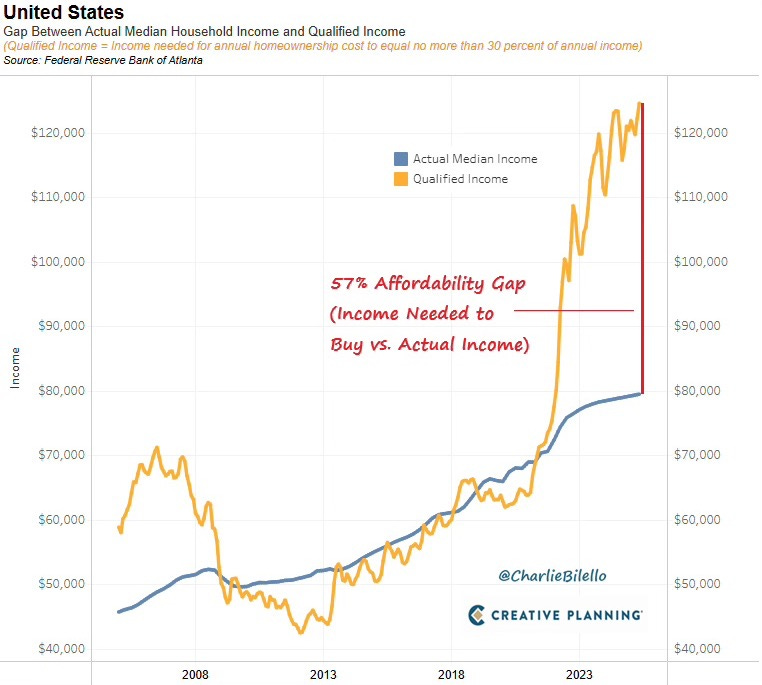

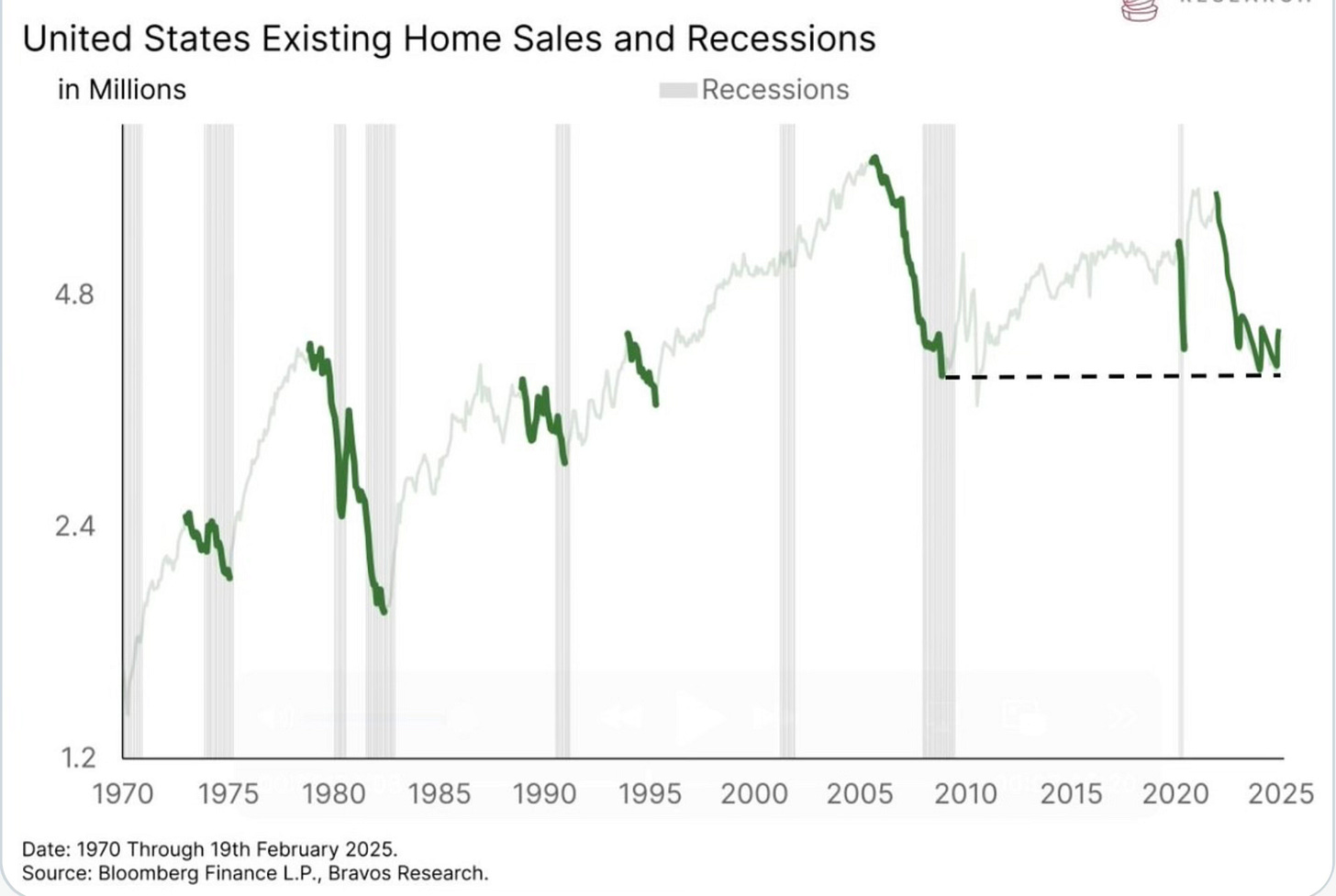

The U.S. housing market has a massive affordability problem, and it’s not just about high prices. The structure of the 30-year mortgage has turned what should be a question of “Can people afford to buy?” into a problem of “Will people even sell?” In other words, affordability has now become a supply crisis.

The Golden Handcuffs of Low Rates

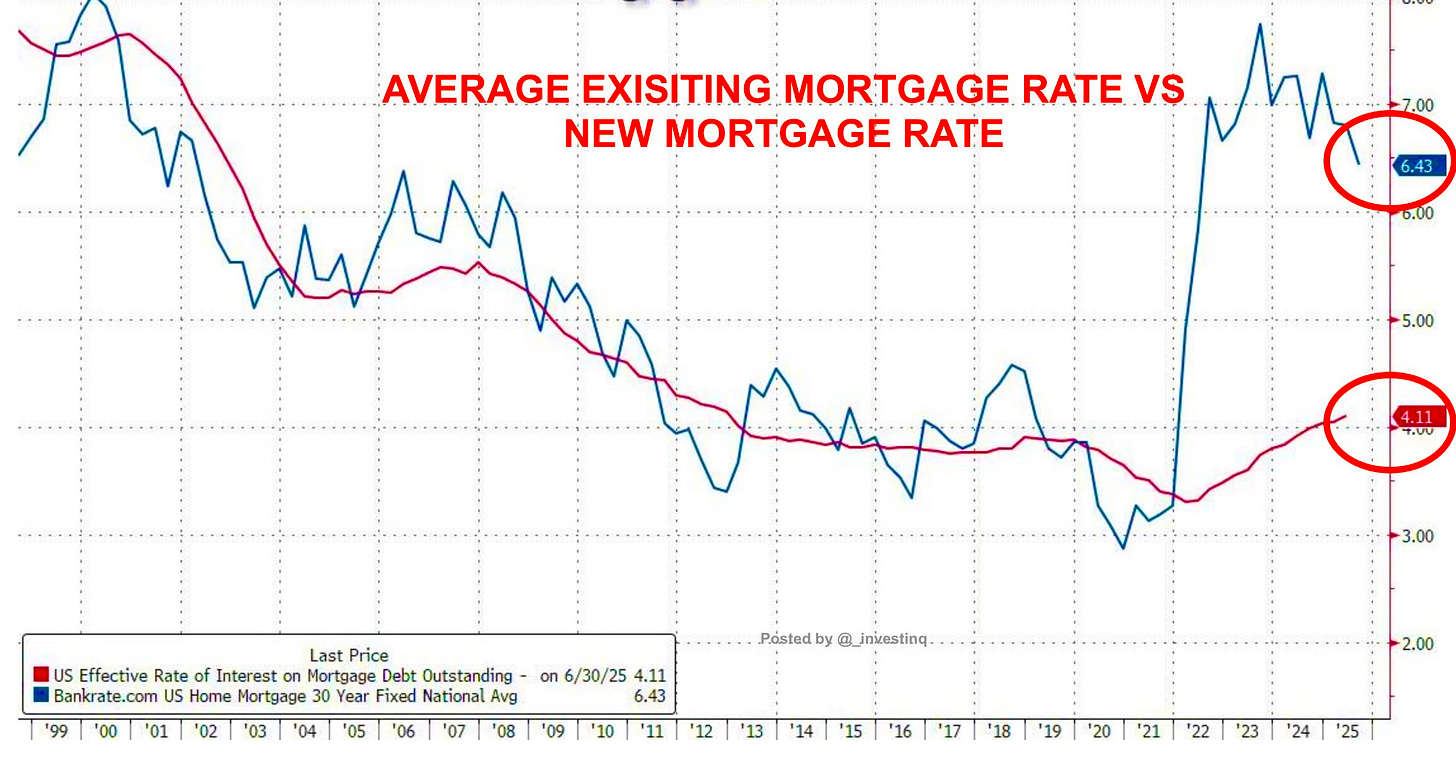

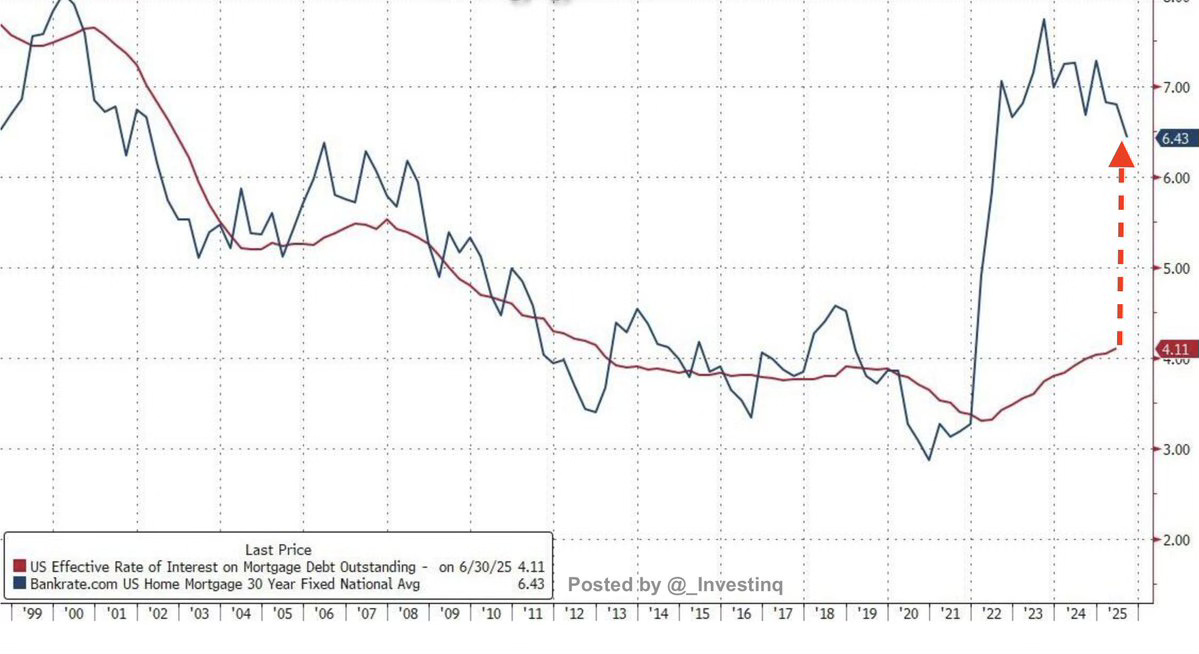

Right now, the average homeowner in America is paying about 4.1% on their mortgage. Compare that to the current market rate of 6.5% for a new loan. That difference, more than two full percentage points, might not sound huge in everyday conversation, but in the world of housing finance it’s enormous.

Over the past 40 years, the gap between “outstanding mortgages” (the rates people already had locked in) and “market rates” (the rates offered to new buyers) was almost always small. The gap was rarely more than one percentage point and never exceeded 1.35%. Today, the gap is over 2.0% and has stayed that wide for three straight years. That has never happened before.

This unprecedented gap has created what economists call the golden handcuffs. Imagine you bought a home in 2020 at a 3% mortgage rate. You’re paying hundreds less each month compared to someone buying today at 6.5%. Why would you ever sell your home, give up that 3% loan, and replace it with one that costs nearly twice as much? Most people won’t.

Why Fed Rate Cuts Haven’t Helped

If you follow the news, you’ve probably heard: the Fed is cutting rates. That should make mortgages cheaper, right? Not exactly.

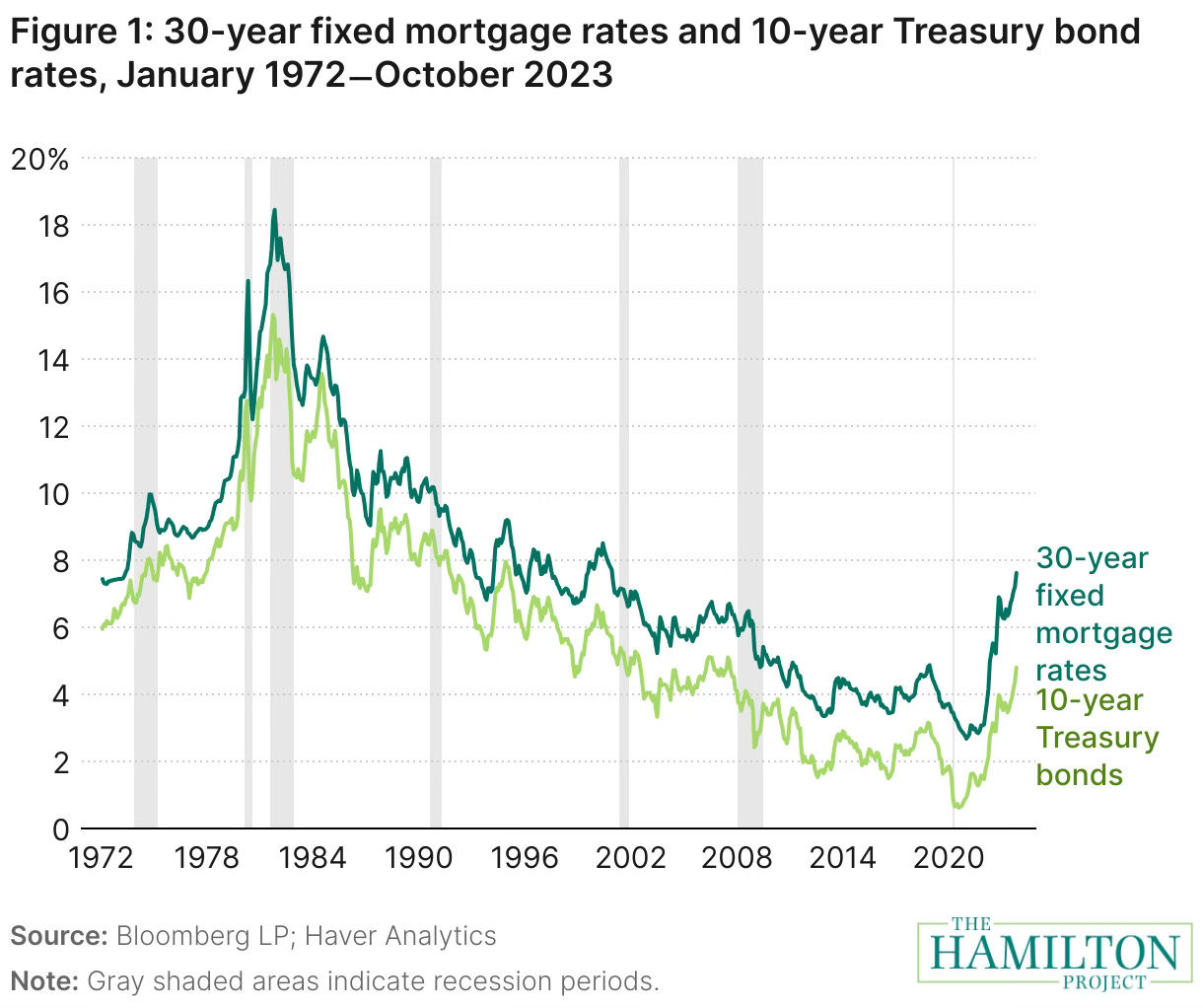

The Federal Reserve sets the Fed funds rate, which is the interest rate banks charge each other for overnight loans. It affects things like credit cards, auto loans, and business lending. But here’s the catch: mortgages don’t follow the Fed’s short-term rate.

Instead, mortgage rates are tied to the 10-year Treasury yields. These are the rates the U.S. government pays to borrow money for longer periods. Investors use those Treasury yields as a benchmark when pricing mortgages. If Treasuries are high, mortgages are high. If Treasuries drop, mortgages can drop too.

Over the past year, the Fed cut its rate by a full percentage point. Yet mortgage rates actually went up by 0.25%. Why? Because Treasuries stayed high, and mortgages followed Treasuries, not the Fed.

Even the recent decline in the 10-year Treasury yield doesn’t change the long-term picture. The bond market is forward-looking. Investors expect short-term rates to rise again down the road, so the pricing already reflects that. In fact, the 10-year yield is about 0.50% higher than the 5-year, which signals that investors expect the 5-year yield to climb by about 1.0% in the future. Mortgage rates are set based on those expectations, not just today’s numbers.

The Role of the Spread

There’s another layer too: the spread. Mortgage rates aren’t just Treasury yields, they’re Treasury yields plus a markup. That markup, or spread, reflects a few things:

Guarantee fees: These are charges from Fannie Mae and Freddie Mac, the government-sponsored companies that buy and back many mortgages.

Risk premiums: Investors buying mortgage-backed securities want extra compensation for the risks they take, like prepayment risk (homeowners refinancing early) or credit risk (defaults).

Market conditions: If investors are nervous, they demand a higher return, which makes spreads bigger.

Unless the structure of Fannie and Freddie changes, something policymakers have debated for years, those risk premiums won’t shrink. And if they don’t shrink, mortgage rates won’t fall much even if Treasuries decline. That’s why Morgan Stanley argues that Fed cuts alone won’t fix affordability.

What It Would Take to Restore Affordability

So how low would mortgage rates need to go to unlock the housing market? One way to measure affordability is by looking at how much of your income goes to your mortgage payment. Economists often use a rule of thumb: housing is affordable if it takes no more than 30% of income.

Morgan Stanley estimates that a 1% drop in mortgage rates improves affordability by about 10%. That’s a significant improvement, but here’s the kicker: this level of improvement has only happened nine times in the last 45 years. It’s rare.

Their analysis suggests the “magic number” is 5.5%. At that level, affordability improves enough to encourage more buyers to step in and more sellers to finally list their homes. But until then, most homeowners with 4% mortgages will stay locked in.

Why Recovery Takes Time

Even if mortgage rates fall, the recovery in housing isn’t immediate. History shows that when affordability first improves, activity doesn’t surge overnight. In fact, it can dip at first, especially if the economy is in recession. For example, lower rates might arrive during an economic downturn, which discourages homebuying despite the affordability boost.

This time, though, Morgan Stanley doesn’t expect a recession. That means the path looks different: instead of a decline, we could see a gradual increase in activity. Their forecast calls for existing home sales to rise about 5% in 2026, with faster growth in 2027 as affordability improves further. Think of it as a slow thaw rather than a sudden breakout.

Prices Will Stay Stubborn

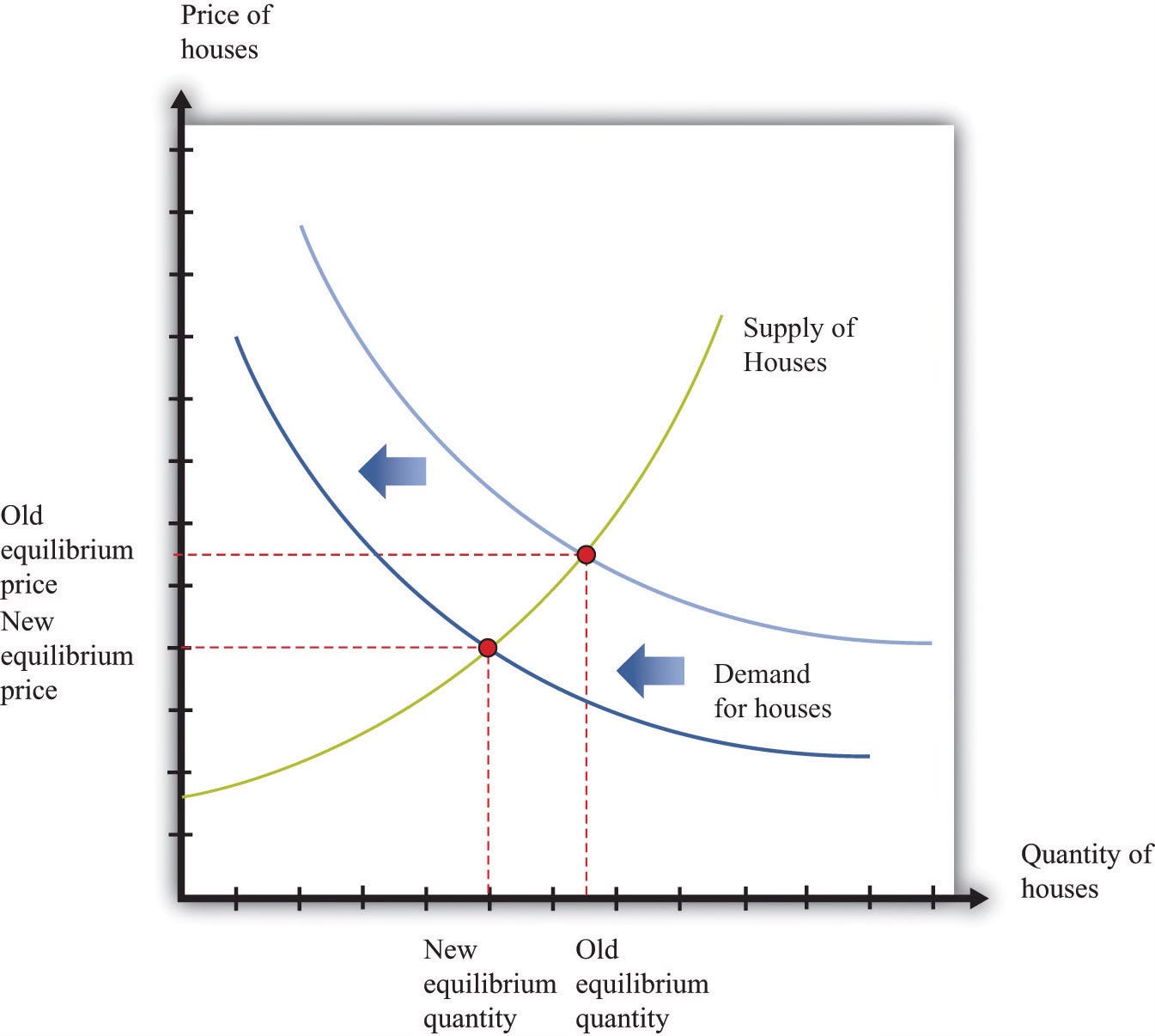

Some might hope that higher activity means prices will finally fall. But that’s unlikely. Here’s why: when both supply and demand rise together, they offset one another. More sellers listing homes increases supply, but more buyers stepping in increases demand. The result is that prices remain flat, or “range-bound,” rather than crashing.

Morgan Stanley expects exactly that outcome: a more active housing market, but one where home prices don’t plunge. Housing will be less frozen, but it won’t suddenly become cheap.

The Bigger Picture

The big lesson here is simple: the Fed doesn’t control mortgage rates the way people think it does. Lowering the Fed’s short-term rate doesn’t automatically make mortgages cheaper. Mortgages depend on long-term Treasuries, investor expectations, and spreads tied to Fannie Mae, Freddie Mac, and the risks of mortgage investing.

Until those deeper forces shift, the golden handcuffs will keep homeowners locked in, new buyers will continue to face steep barriers, and affordability will remain out of reach.

Gosh, I just noticed we can restack (repost), plus we can edit our responses. What a treat!

It's great to be able to see the entire article, vs as a thread. It really rolls out nicely!