The First Cut of 2025: A New Chapter for Markets

Hey everyone, Investinq here (aka StockMarket.News).

A lot of you follow me across social media, where I post content on macroeconomics and the economy. If you’ve been around for a while, you know how much effort I put into delivering real insights. Some of you may even remember my daily newsletter, I hit pause on that for a bit, but I’m excited to say I’m bringing it back in a new form.

This newsletter will cover the most important developments in the economy each week. This week, we’ll be covering the FOMC meeting extensively. I’ve never charged for my research before, but my goal now is to build a stronger community around this work. To make that possible, I’m offering a weekly newsletter for less than the cost of two coffees a month. I made this as cheap as possible for a reason, I want this to be accessible to everyone.

Why pay? Because I’m giving you access to research and insights that aren’t available to the general public, the same kind of information I personally spend $300–$400 a month to access. My mission is simple: bridge the gap between Main Street and Wall Street.

If you’ve found value in my content before, I’d love for you to join me as I take this next step.

📬 In today’s issue, we dive deeper into:

PART I:

1. Charts Of The Week (September scaries, housing flip, truck sales slump)

2. The Fed’s September Cut: A New Chapter in an Unusual Economy

3. The Projections: No Recession, Just Stagflation-Lite

4. Division, Politics, and Market Reaction

PART II:

5. The Rundown (Nvidia ban, Meta glasses, TikTok deal, Tesla buy, Reddit talks)

6. On the Horizon (Fed speeches, housing data, PCE report)

7. Reading Recommendations (Ellison’s wealth, Congress trades, AI boom, Enron revival)Charts Of The Week

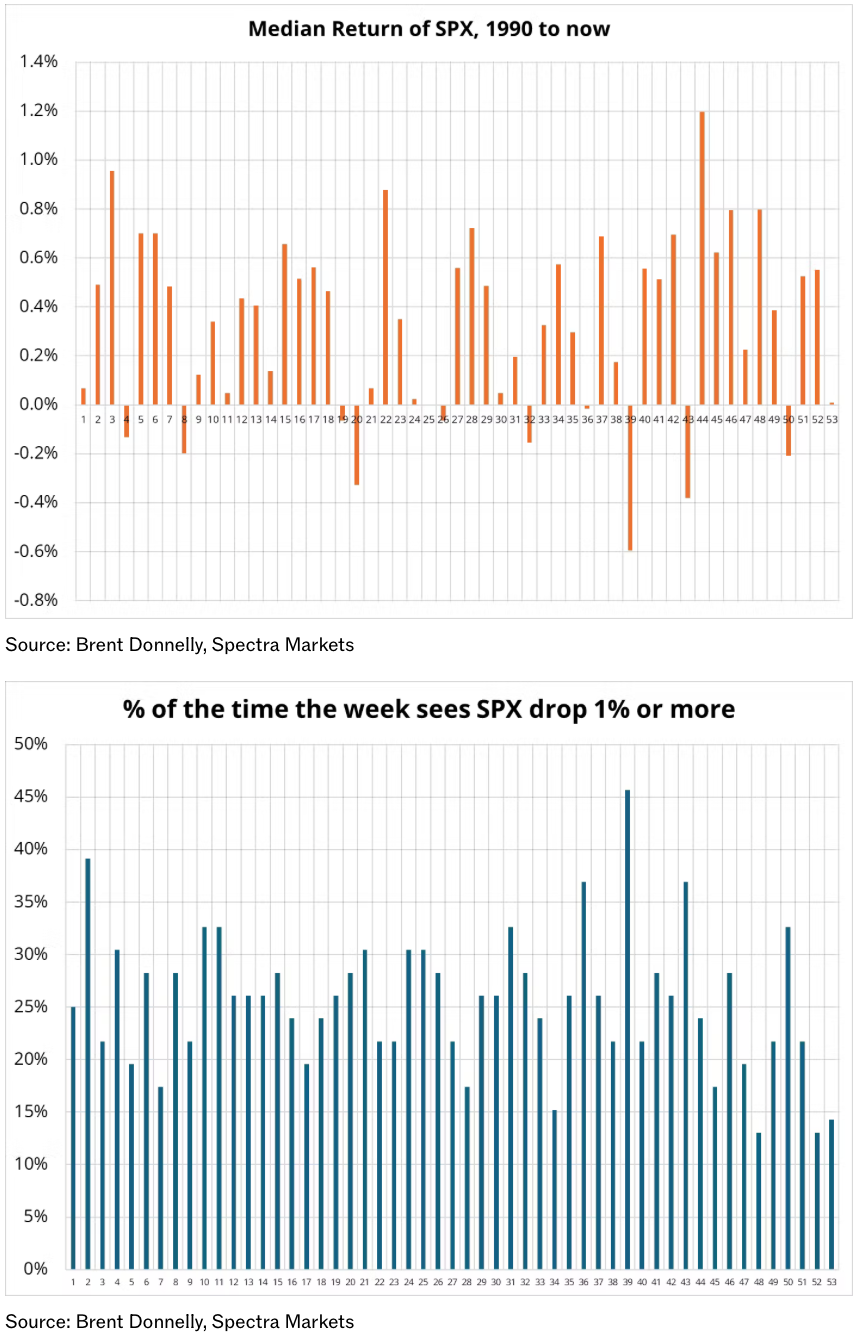

The 39th trading week is almost here, historically the worst week of the year for U.S. stocks. Since 1990, this stretch has produced more 1% declines in the S&P 500 than any other week, with median returns consistently negative. Brent Donnelly of Spectra Markets points out that the weakness often shows up right after September’s options expiry, though he notes that 2025 has been tough for seasonality-based strategies. With policy shocks and macro surprises overwhelming the usual calendar flows, this year’s September scaries may not follow the script, but the risk remains.

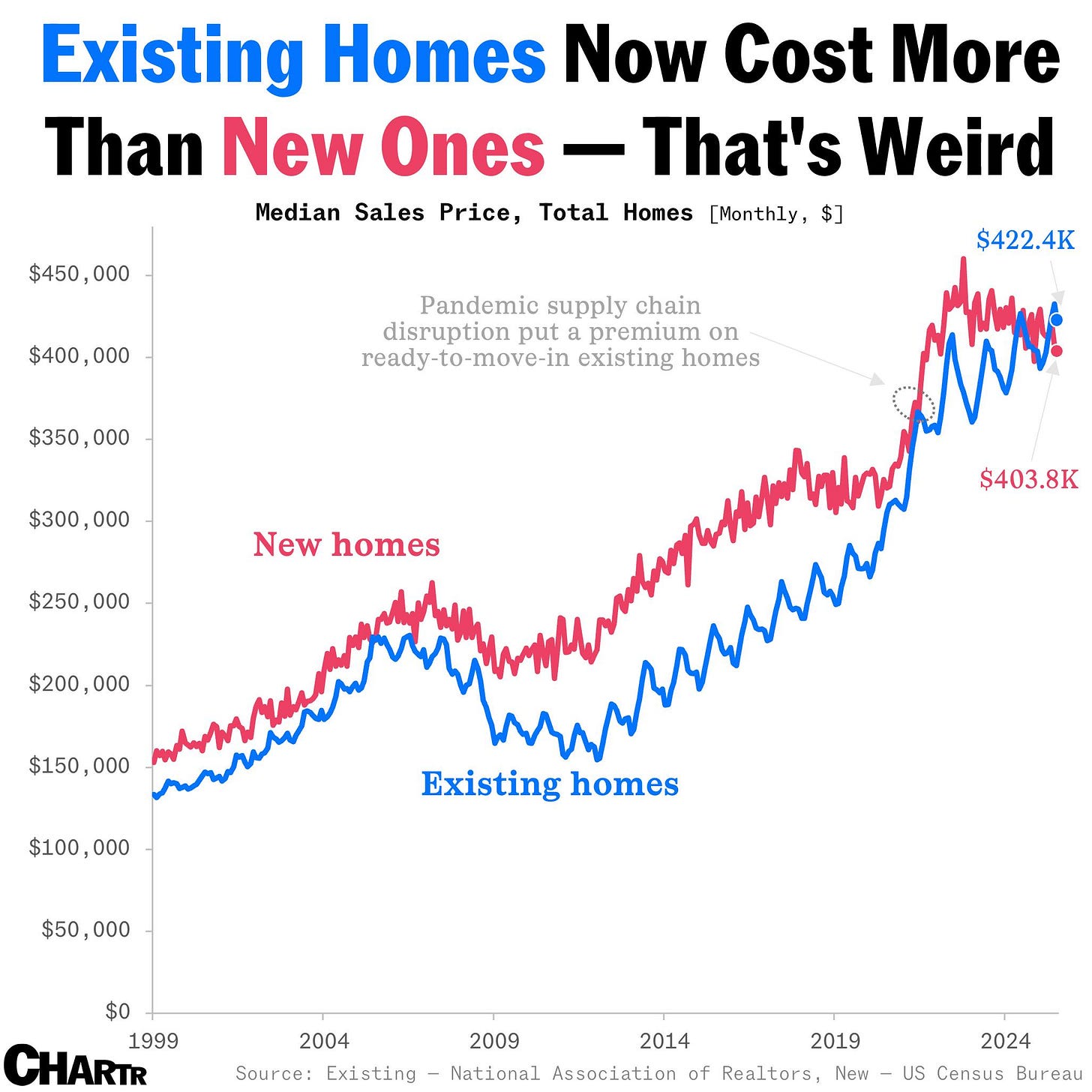

The housing market has flipped on its head: new homes are now cheaper than existing ones. In July, the median price of a new home fell to $403,800, below the $422,400 median for existing homes. Builders are drowning in inventory, with a nine-month supply on the market, and nearly 40% are cutting prices or offering mortgage buydowns to lure buyers. Meanwhile, existing homeowners are clinging to their low pandemic-era rates, creating the strongest “lock-in” effect in decades and freezing resale activity. To cope, builders are downsizing, with the average new home about 13% smaller than a decade ago.

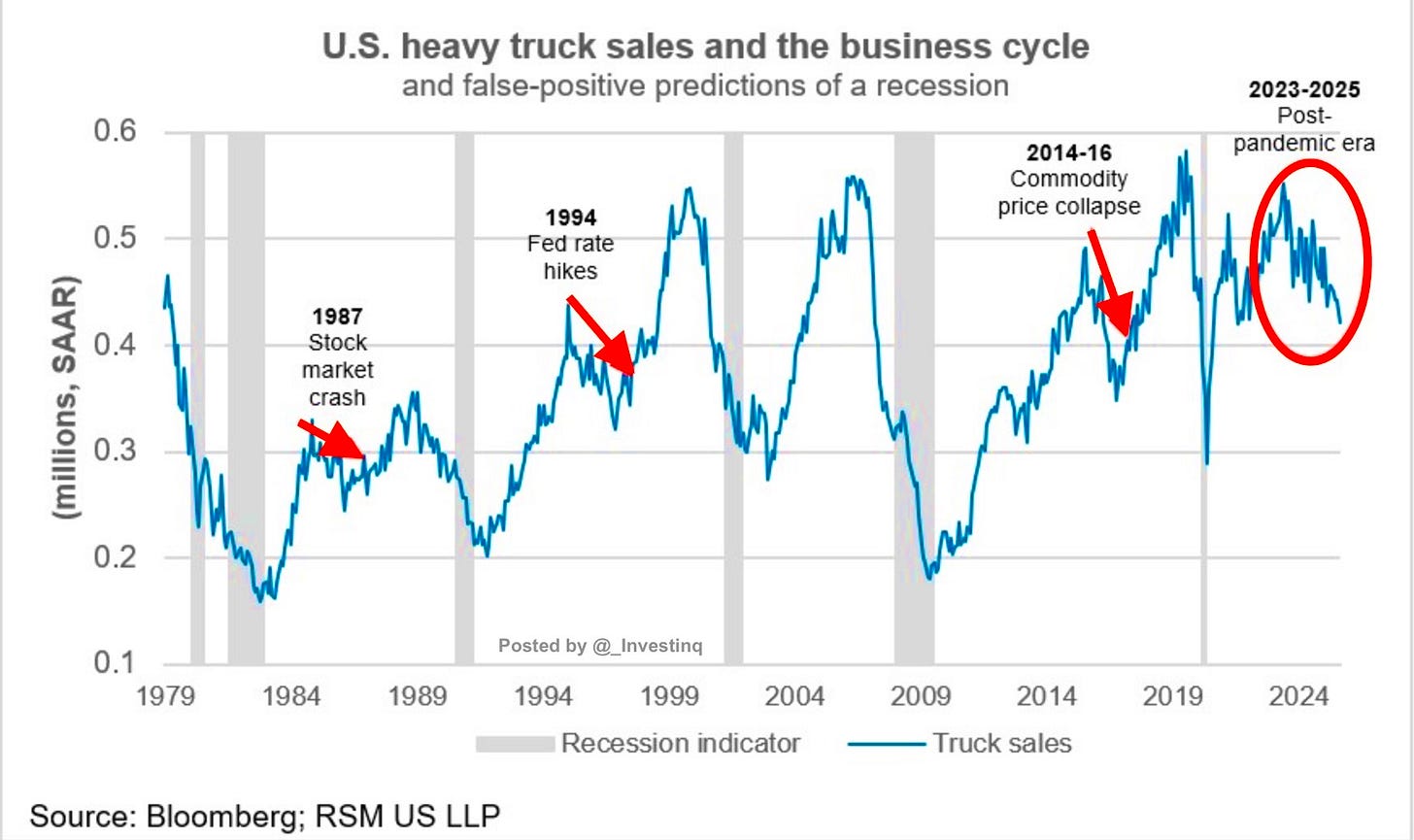

The chart shows U.S. heavy truck sales from 1979 to today, highlighting how downturns in this market often align with recessions shaded in gray. Sharp declines can be seen before major economic events like the early 1980s recession, the dot-com bust, and the 2008 financial crisis. There are also periods where sales slumped without an immediate recession, such as after the 1987 stock market crash, the 1994 Fed rate hikes, and the 2014–2016 commodity price collapse. The most recent drop, beginning in 2023, marks another steep decline during the post-pandemic era. Overall, the chart reinforces heavy truck sales as a strong (though imperfect) leading indicator of economic slowdowns.

The Fed’s September Cut: A New Chapter in an Unusual Economy

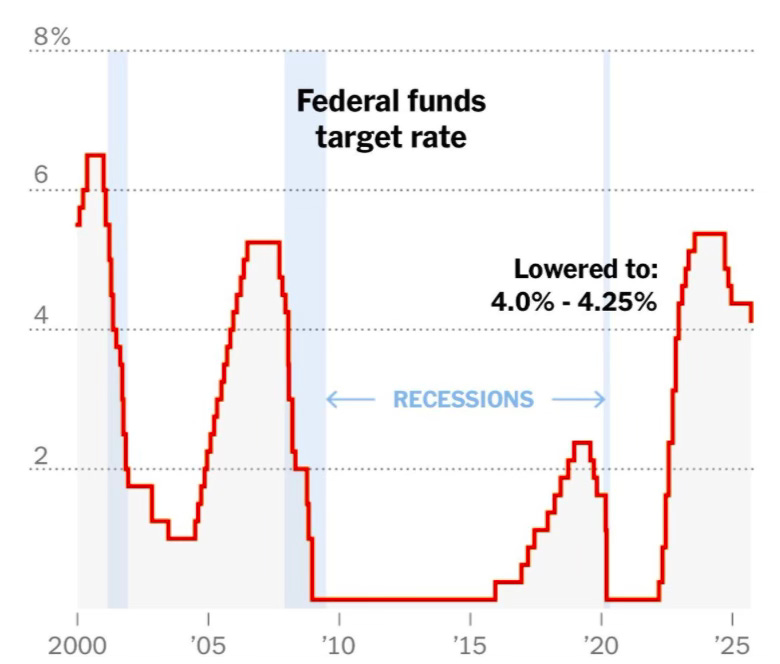

As you know, this was one of the most anticipated weeks of the year. Markets had been waiting months to see if the Federal Reserve would finally step off the sidelines. On Wednesday, they did, cutting interest rates for the first time in 2025. The federal funds rate, the short-term rate banks charge each other was lowered by 25 basis points (0.25%), bringing it to a range of 4–4.25%. It was a small move, but the context made it monumental.

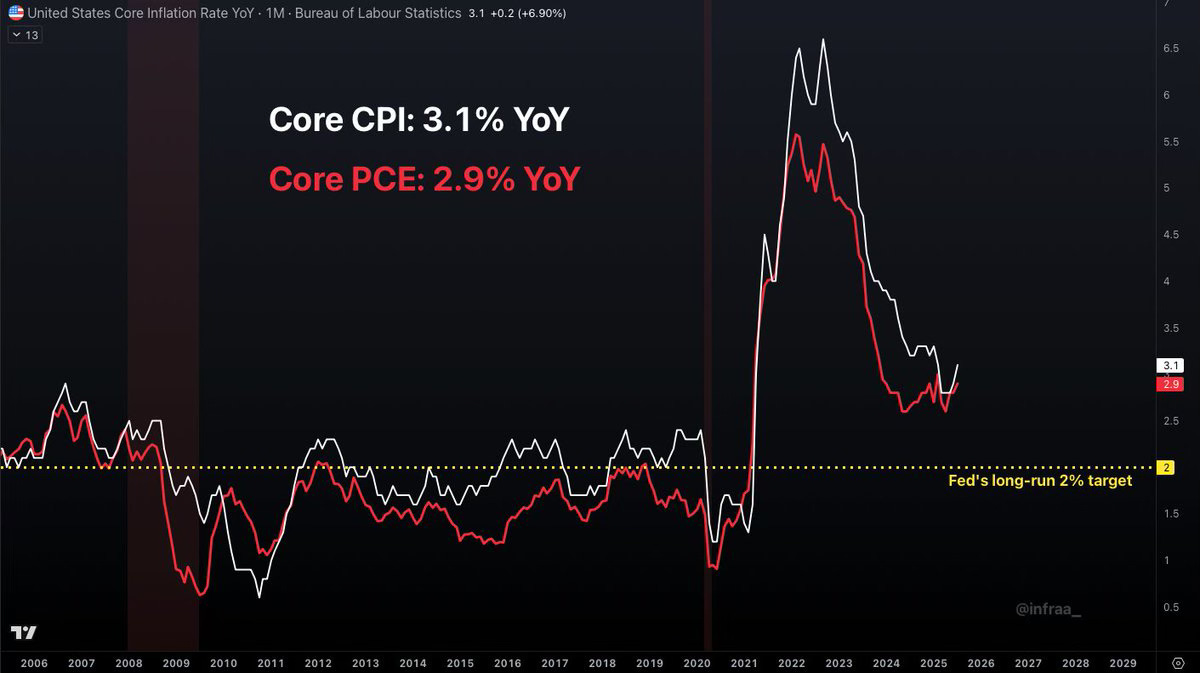

Chair Jerome Powell didn’t describe it as a reaction to crisis. Instead, he called it a “risk-management cut.” In plain English, that means the Fed sees warning signs in the labor market and wants to ease early, before weakness turns into widespread layoffs. The remarkable part is that they made this decision while inflation remains elevated. Core PCE, the Fed’s preferred inflation gauge that strips out volatile food and energy costs, is still running near 2.9%. It has been more than three decades since the Fed last cut rates with inflation this high.

The Projections: No Recession, Just Stagflation-Lite

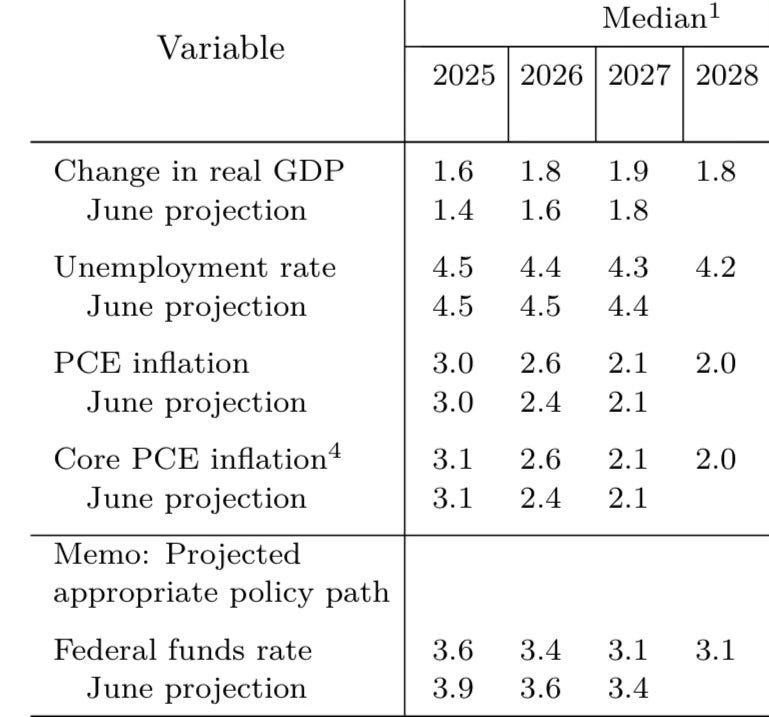

Beneath the headlines, the Fed’s projections told a story of their own. Officials raised their growth outlook, now expecting GDP, to expand about 1.6% this year. That is sluggish by historical standards but still positive. They forecast unemployment ticking up to 4.5%, which signals some cooling but not a collapse. And inflation, while easing, is projected to take years to fully normalize. According to the Fed’s own numbers, price growth does not return to the 2% target until 2028.

Taken together, this outlook signals something important. The Fed does not see a recession unfolding. Instead, they are admitting we are stuck in an uncomfortable middle ground, growth that limps along, a labor market that weakens at the edges, and inflation that refuses to go away quickly. It’s not the runaway stagflation of the 1970s, but a softer version often called “stagflation-lite.” Think of an economy that isn’t collapsing, yet still feels weighed down: growth is sluggish, unemployment drifts a tad bit higher, and inflation lingers above target. It’s not the oil-shock chaos of the past, but it’s uncomfortable enough to strain households, limit prosperity, and leave the Fed trapped with few good options.

Division, Politics, and Market Reaction

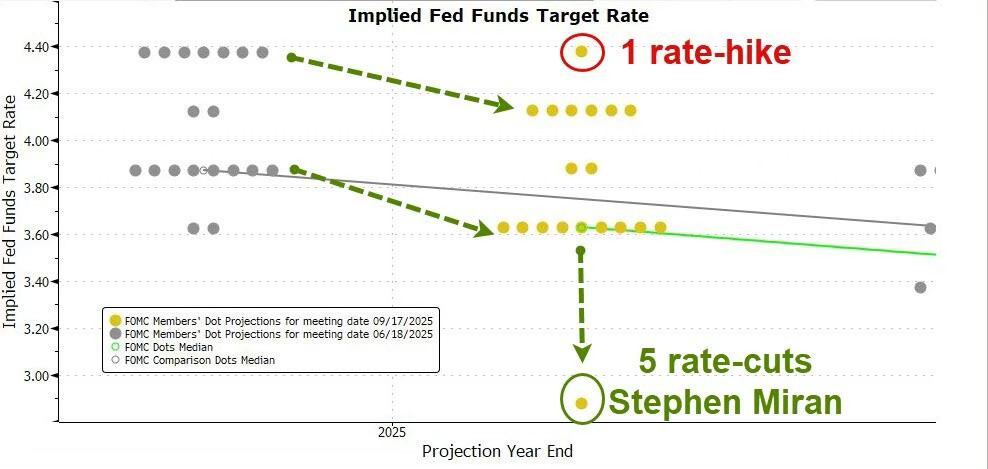

Inside the Fed, the split was striking. Of the 19 policymakers, nine expect two more rate cuts this year, two see just one cut, six think no further cuts are needed, one even penciled in a hike and, drumroll… one projected five cuts. That last view came from Stephen Miran, a new appointee aligned with the Trump administration, who argued for a sharper half-point cut right away. His dissent underscored both the divisions inside the Fed and the political crosswinds surrounding it.

There is also the unusual pairing of policies. While the Fed is cutting rates, it has not changed its balance sheet strategy. Quantitative tightening, the process of shrinking its holdings of Treasuries and mortgage-backed securities remains in place. That program pulls liquidity out of the financial system even as rate cuts try to push money back in.

Markets had already priced in this cut well in advance. Futures trading showed more than a 96% chance before the announcement. Investors are betting on more action than the Fed’s own projections suggest, expecting up to four cuts by late 2026. On the day of the decision, stocks actually dipped and finished in the red but that doesn’t tell the full story. Historically, when the Fed cuts at market peaks, short-term volatility often hits first. only to be followed by sustained gains. The S&P 500 hovering near record highs today fits that pattern: choppy at the start, but with room to run afterward.

So where do we stand after this landmark decision?

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.