The Market That Forgot How to Feel: Why Record Earnings Don’t Move Stocks Anymore

The greatest show on Wall Street is still running but the audience has stopped clapping

Corporate America just pulled off one of the most spectacular earnings seasons in recent memory and Wall Street reacted like it had just watched paint dry.

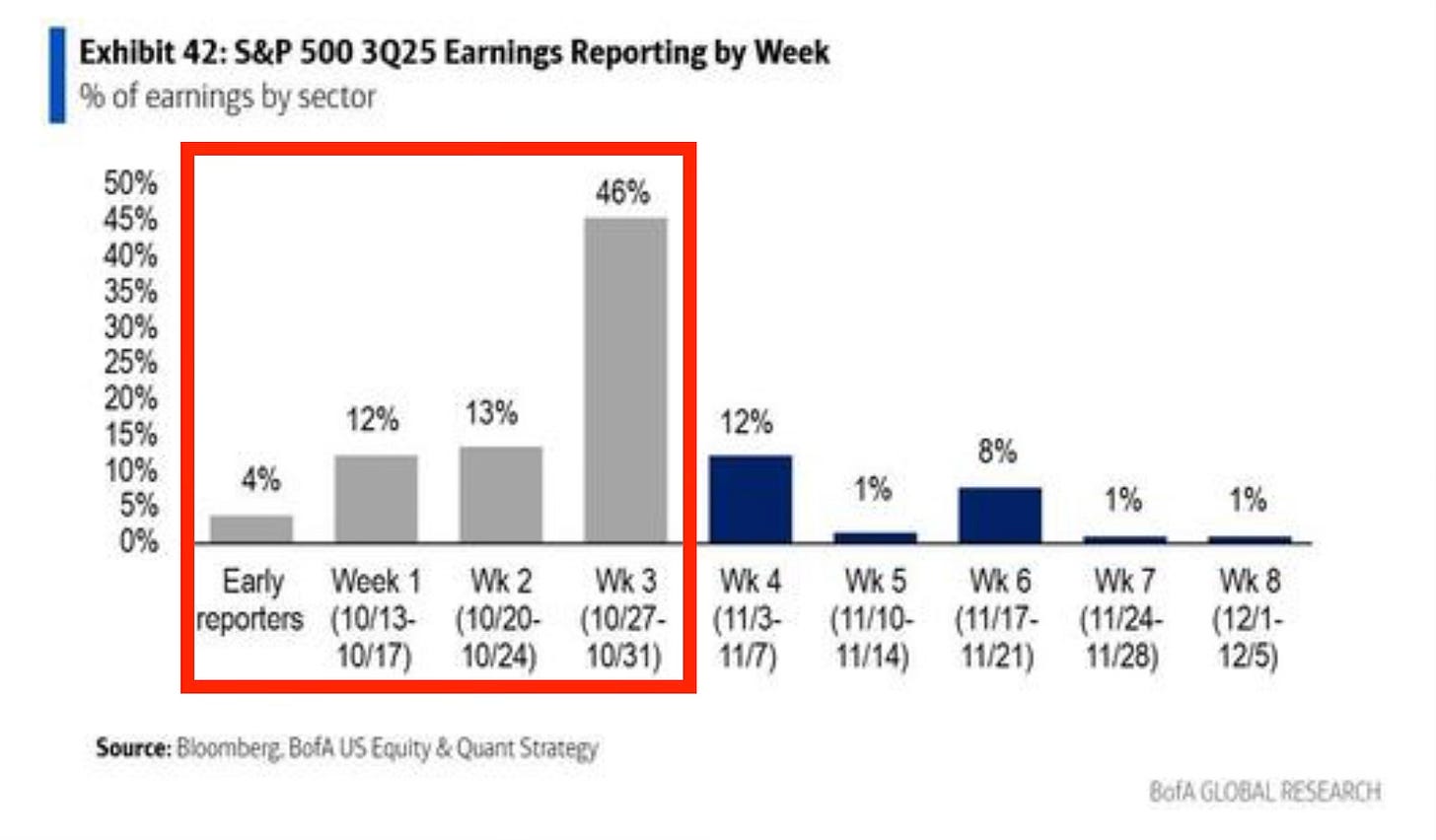

Nearly 70% of the S&P 500 has reported earnings.

Of those, 64% beat expectations by more than a full standard deviation meaning the earnings were so strong they shocked analysts, landing well outside the normal range of surprises.

That’s the kind of stat that used to make traders throw their coffee mugs in excitement.

Earnings Per Share growth came in at 8%, well above the 6% analysts expected when this season kicked off. Margins are expanding, revenues are rising, and balance sheets look healthy.

This is the kind of quarter that would normally send markets soaring. This time, though, the market responded with a polite yawn.

The average company that beat earnings outperformed the S&P 500 by just 0.32% the next day. Historically, it’s triple that.

If this were a movie, we’d be watching the best performance of the decade with an audience that forgot to clap.

The Market’s Tired of Being Impressed

Wall Street is literally bored.

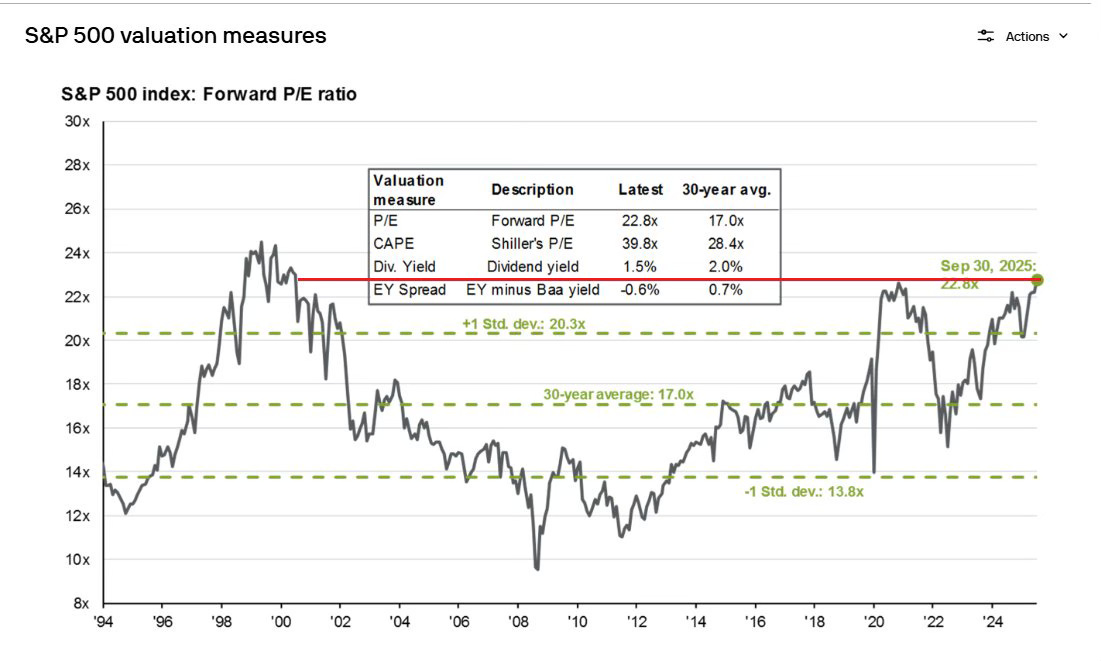

The S&P 500 trades at roughly 22.8x forward earnings meaning investors are paying about $22.80 for every $1 of profit that companies are expected to make over the next year. This is one of the richest valuations on record.

Historically, that 30 year average sits closer to $17 for every $1 of earnings.

When prices are stretched this far, good news stops moving stocks. It’s not that investors don’t appreciate the results, they just expect them.

The market doesn’t want improvement; it wants astonishment.

Companies that post solid numbers don’t get rewarded anymore because their success is already built into the price. Investors are grading on a curve so steep that even the best report cards look average.

The market’s appetite for surprise has disappeared. This earnings season now feels like watching a magician do the same trick for the hundredth time. The hand is still quicker than the eye, but the audience has figured out the secret.

When analysts and traders walk into a quarter already assuming growth, strong results stop being exciting. They become routine.

The Elephant in the Room: Michael Burry’s Contrarian Theatre

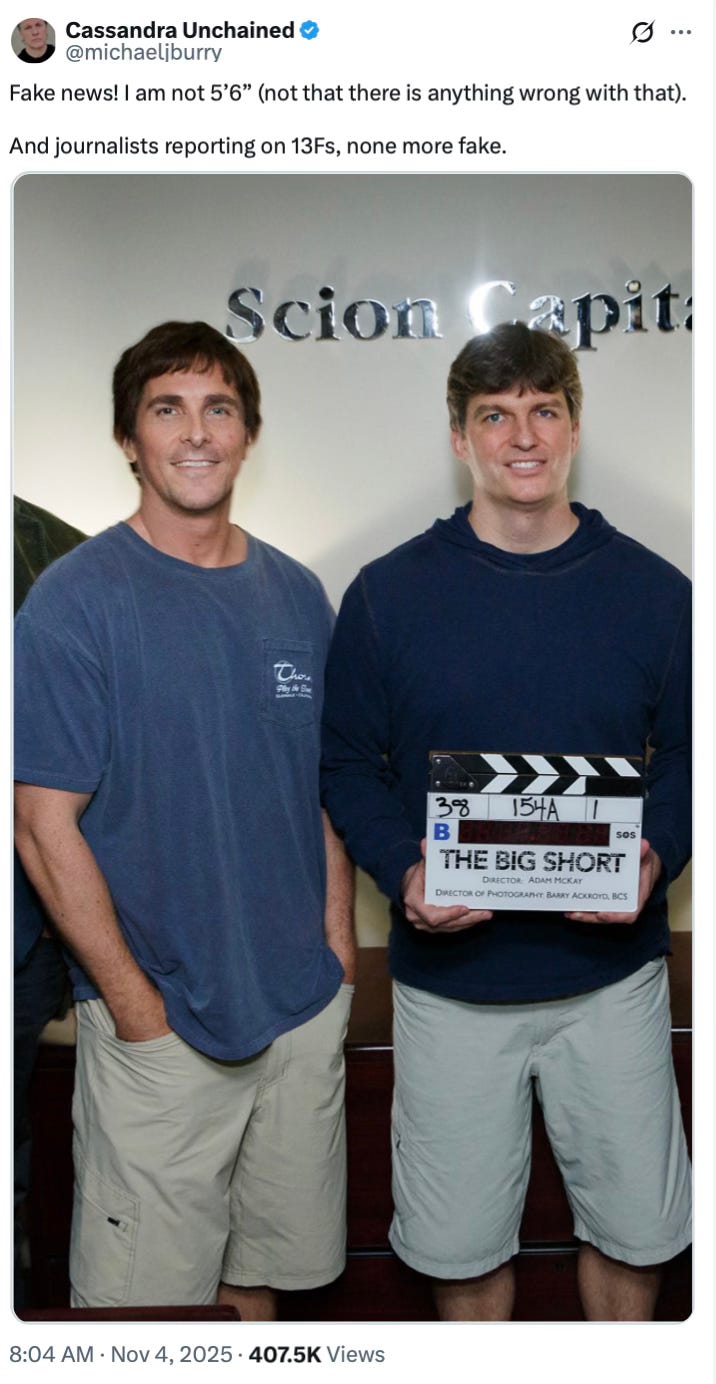

Before we get deeper into this earnings season déjà vu, let’s talk about the man who can “move” markets with a single cryptic post, Michael Burry. The Big Short legend, the myth, the meme, the guy who occasionally deletes his entire X account like he’s discovered monk mode, is back. And, of course, he brought chaos with him.

One day before Halloween because timing is everything Burry crawled out of his digital bunker and dropped a line that could double as a doomsday prophecy:

“Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

He paired it with a still from The Big Short and changed his name to “Cassandra Unchained,” a nod to the prophet cursed to see disaster coming but never be believed.

Then, as if to twist the knife, he followed it up a few days later with a not so subtle jab comparing the AI boom to the early-2000s dot-com fiber frenzy, all hype, all spending, minimal returns.

The digital equivalent of whispering, “Enjoy it while it lasts,” and walking offstage as the curtains burn behind him.

But here’s where things really start to cook.

Scion Asset Management, Burry’s hedge fund dropped its 13F filing two weeks early.

Translation: he wanted attention and he got it. Turns out Burry’s not just tweeting about bubbles once again, he’s putting his money on the line that one’s about to pop.

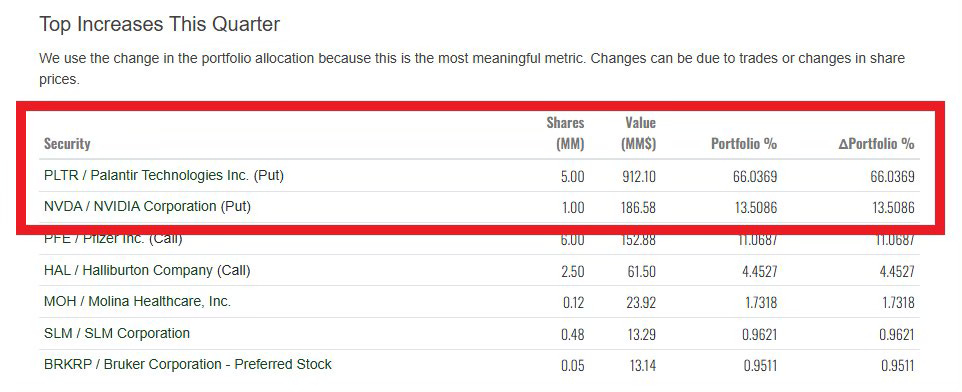

The first half of the filing was boring: a few residual holdings like Molina Healthcare, SLM, and a bruised Lululemon stake that’s been limping through 2025. But the second half? That’s where the fireworks are.

His Palantir wager covers a notional $912 million (about 5 million shares), and Nvidia’s sits at $187 million (roughly 1 million shares). On paper, that sounds insane like Burry just went all-in shorting AI.

But here’s what the traditional media won’t tell you: those headline numbers are basically optical illusions.

When you see “notional value,” it’s not the cash he actually spent, it’s the total value of the shares those options represent. Burry didn’t drop a billion dollars shorting Palantir; he bought put options, which are basically insurance contracts that pay out if the stock falls.

Think of it like this, he’s not buying the whole house; he’s just buying fire insurance on it.

That means he’s paying a small premium, maybe a few million bucks to control hundreds of millions in exposure.

If he’s right and Palantir or Nvidia tumble, he cashes in big. If they keep climbing, those puts expire worthless, and he’s basically spent a few million for the right to be wrong in style.

It’s a bold move and one he’s pulled before.

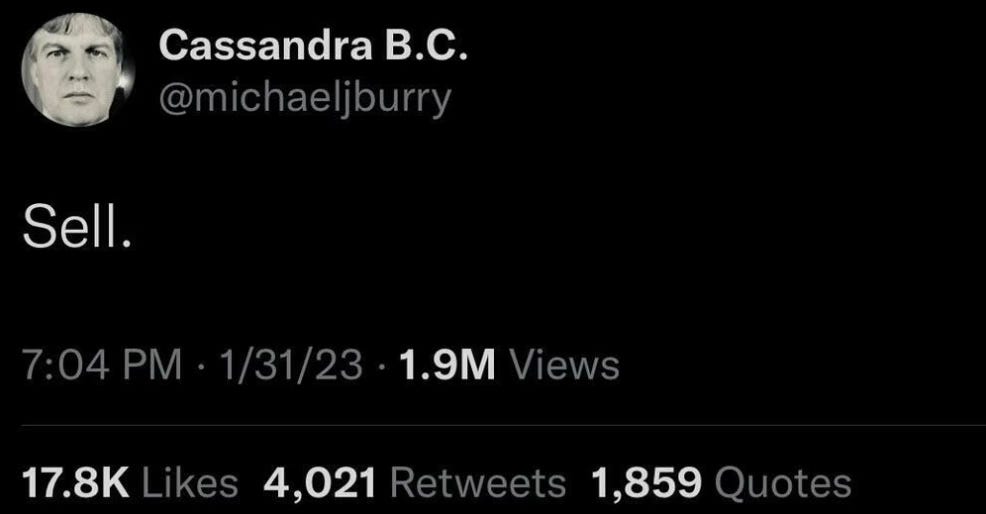

The last time Burry tried to top tick the market was early 2023 when he blasted the one-word “Sell.”

In August 2023, Burry bet $1.6 billion against the S&P 500 and Nasdaq with SPY and QQQ puts. and what do you know market is up over 69% since then.

His short bets got smoked, down an estimated 40% before he tapped out.

Before that, he called Tesla “ridiculous” right before it went up 700%. He said GameStop wouldn’t break $20. It hit $483. He went bearish on Chinese tech in early 2025, right before it spiked 68%.

The man who once nailed the biggest crash of our lifetime has spent the last few years getting dunked on by the bull market.

But the plot thickens.

Right after his 13F went viral and headlines like “Michael Burry Bets Against AI Boom” flooded every financial site.

Burry jumped back on X to post another Big Short meme this morning: “Journalists reporting on 13Fs, none more fake.”

Here’s what he meant and what most people miss.

A 13F is basically a time capsule. It’s a list of what hedge funds owned six weeks ago, not what they own today.

It doesn’t show when they bought it, if they already sold it, or whether it’s part of some hedge-on-a-hedge strategy. It’s old data dressed up like breaking news.

But that didn’t stop financial media from doing what they do best, turning a routine filing into a full-blown headline circus. I’ve already seen reports claiming that today’s baby sell-off (we’re talking less than 1%) was because of Burry’s 13F.

Yeah, no. That’s like blaming your mirror for a bad haircut.

The truth is, these filings don’t move markets, they just move clicks. They’re financial gossip columns with a balance sheet. And Burry, for all his complaining, knows it.

And let’s be real: this is also a man who’s been spectacularly wrong for years.

He’s called crashes that never came, shorted rallies that went vertical, and spent more time deleting tweets than being right.

Is he making a valid point that markets are inflated? Sure, you could argue that. But let’s not pretend his word is gospel especially when the choir stopped listening after 2023.

Two Different Stock Markets

Alright, enough about Burry’s theatre, let’s lift the hood on the actual market.

Consider Becoming a Paid subscriber to keep reading: These deep dives takes hours of work. Upgrade for just $99 a year (others charge $100+ monthly) to keep this newsletter going and get the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.