💸 The Money Printer Is Warming Up

When Liquidity Moves, Markets Follow

If you get your news from the headlines, you probably think the economy is a story about inflation, the unemployment rate, and the price of eggs.

You think it’s a story about Jerome Powell standing at a podium deciding whether to tap the brakes or hit the gas.

But the truth is: the world isn’t run by policy, It’s run by plumbing.

I’m not talking about copper pipes and wrenches.

I’m talking about the invisible, subterranean machinery that moves trillions of dollars between banks overnight.

It is the boring, technical, acronym-filled layer of finance that 99% of people ignore because it sounds like homework.

But here is the dirty little secret of Wall Street: The plumbing is the only thing that actually matters.

Most of the time, the pipes hum along silently.

But every few years, the plumbing gets clogged and in the global financial system, a clog doesn’t just mean a messy bathroom.

It means the credit markets freeze, the stock market crashes, and the Federal Reserve has to panic.

Right now, if you put your ear to the ground, you can hear the pipes rattling.

The warning lights are flashing red.

The “smart money” in the bond market, the institutional giants who move markets while the rest of us argue about meme stocks is positioning for a massive shift.

They believe the Federal Reserve is about to pivot.

No, I don’t mean cutting interest rates by 0.25%. That’s child’s play.

I’m talking about the Fed turning the printing press back on.

We are talking about a program that will soon be announced that could pump anywhere from $20 billion to $60 billion of fresh cash into the system every single month.

But here is the catch: They are going to look you dead in the eye and tell you it isn’t “Quantitative Easing” (QE).

They are going to use a wall of jargon to convince you it’s just a “technical adjustment” to “reserve management.”

Today, we are going to rip up the floorboards.

We are going to ignore the headlines and look at the mechanics.

This is the deep dive guide to why the system is leaking, why the big banks are on strike, and why the money printer is likely warming up right now.

Part 1: The Pawn Shop of Wall Street

To understand why the system is fragile, you have to understand the Repo Market.

The Repo (Repurchase Agreement) market is essentially a massive, overnight pawn shop for banks and hedge funds.

Here is how it works: Let’s say a bank has a Treasury Bond (a safe asset) but they need Cash (to pay bills, settle trades, or lend to you).

They go to the Repo market.

They say, “Here, hold this Treasury Bond overnight, and lend me Cash. I promise to buy the bond back tomorrow morning for a slightly higher price.”

That transaction happens trillions of times a day.

It is the grease that keeps the gears turning. Without the Repo market, money stops moving. If money stops moving, the economy stops.

Normally, this market is boring. Banks charge each other tiny amounts of interest (the Repo Rate) to swap cash for bonds.

But what happens if everyone has Bonds, but nobody has Cash?

Part 2: The PTSD of September 2019

To understand the panic, we have to travel back to September 2019.

Back then, the Fed was doing exactly what they are doing today: Quantitative Tightening (QT).

Basically, the Fed was trying to slim down.

They were letting bonds expire off their balance sheet to suck cash out of the system.

They thought the banking system had plenty of cash left. They thought the plumbing was fine.

They were wrong.

On September 17, 2019, two routine events collided:

Corporate Tax Day: Companies withdrew cash from banks to pay Uncle Sam.

Treasury Auction: The government sold new debt, sucking more cash out of the system.

Suddenly, the banking system ran out of grease. Banks rushed to the Repo market to borrow cash, but the cupboards were bare.

The Repo Rate, the cost to borrow money overnight exploded. It went from a sleepy 2% to a panic-inducing over 7% in a matter of hours.

It was a cardiac arrest for the financial system. Trading desks froze. The Fed had lost control of the price of money.

To fix it, the Fed had to panic.

They rushed in with emergency hoses, printing billions of dollars overnight to flood the market with liquidity. It was embarrassing.

It proved that the “geniuses” at the Fed didn’t actually know how much cash the system needed to survive.

Why this matters today: The Fed is terrified of a sequel.

They see the same signals flashing now that they saw back then.

They know that if they keep draining cash, they are going to hit the wall again.

Part 3: The Bathtub Theory

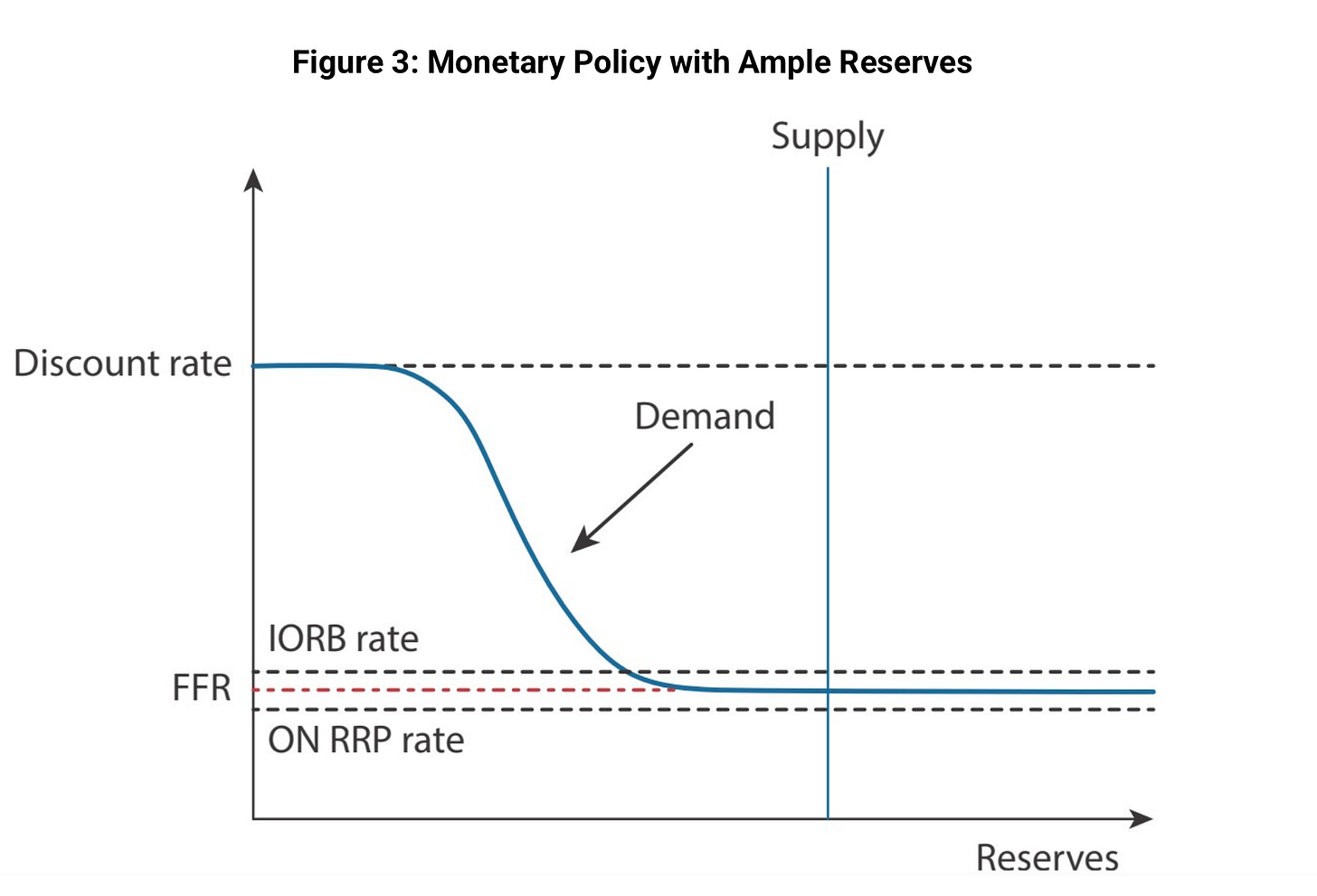

The Fed operates on a framework called “Ample Reserves.”

Think of the US banking system as a giant bathtub.

The Water: Bank Reserves (Cash held at the Fed).

The Drain: Quantitative Tightening (QT).

For the last two years, the Fed has been pulling the plug on the drain to fight inflation.

They are intentionally lowering the water level.

The Fed’s goal is to keep the water level “Ample”, low enough so there isn’t excess splashing (inflation), but high enough that the drain isn’t sucking air (a crisis).

The Problem: The Fed is driving blind. They don’t actually know where the bottom of the tub is.

In 2019, they thought the bottom was at $1.2 trillion. They hit it at $1.4 trillion and crashed the car.

Today, estimates suggest the “danger zone” is somewhere around $3 trillion.

The “Repo Gurus” on Wall Street are screaming that the water is getting too shallow.

If the Fed doesn’t turn the faucet back on, the plumbing is going to seize up again.

Part 4: The “Backpack” Rule (Why Banks Are on Strike)

You might be asking a logical question: “The US Government is issuing trillions in debt. Banks are profitable. Why don’t the banks just buy the debt and lend the cash? Why does the Fed have to get involved?”

This is the most critical part of the story. The banks are effectively on strike.

They aren’t on strike because they want to be. They are on strike because the government broke their legs with regulations.

There is a rule called the Supplementary Leverage Ratio (SLR).

Let’s call it the “Backpack Rule.”

After the 2008 financial crisis, regulators told banks: “To make sure you don’t go bust, you have to limit how much stuff you own relative to your capital.”

Think of it like this: Every bank has to wear a backpack.

The regulators say the backpack can only weigh 50 pounds.

Here is the insanity of the rule: Everything counts as weight.

A risky loan to a bankrupt startup? That goes in the backpack.

A safe, risk-free US Treasury Bond? That also goes in the backpack.

Pure Cash? That goes in the backpack too.

Right now, the big banks (JPMorgan, Citi, BofA) have full backpacks.

Their balance sheets are saturated.

They literally cannot buy more Treasury bonds or hold more cash without raising expensive capital or firing clients.

So, we have a standoff:

The Treasury: “We need to sell trillions in debt to fund the deficit.”

The Banks: “Sorry, backpack is full. We are regulatory constrained.”

The Market: “If nobody buys this debt, rates are going to spike and break things.”

This leaves only one buyer left in the room: The Federal Reserve.

Read the rest to understand the impacts of this in your portfolio.

Part 5: The Stealth Pivot (The “Not QE” Solution)

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.