The New Manhattan Project Is Here, Welcome to the AI Arms Race

The Hidden Economic Trap Forcing the U.S. to Double Down on AI Forever

In 1942, the U.S. government made a decision that changed everything.

President Roosevelt authorized the Manhattan Engineer District, a secret military project to build an atomic bomb before Nazi Germany did.

The government didn’t know if it would work.

The government just knew that if Germany got the bomb first, America lost the war so Roosevelt said, spend whatever it takes.

The government spent approximately $2 billion on the Manhattan Project between 1942 and 1945.

That’s about $30 billion in today’s money.

But here’s the critical part, the government didn’t stop spending in 1945 when the bombs were built.

The infrastructure, the uranium enrichment plants at Oak Ridge, the plutonium production complex at Hanford, the research facilities at Los Alamos and Argonne, didn’t disappear.

Instead, those facilities became the permanent national laboratory system and kept funding them indefinitely.

That’s the historical lesson.

The Economic Trap: Why Reversing AI Spending Now Means Recession

Fast forward to now, David Sacks, Trump’s White House AI and Crypto Czar, dropped a statement that laid bare the entire trap the U.S economy has just walked into.

Half the country’s GDP growth this year wasn’t consumers, housing, or manufacturing. It was AI.

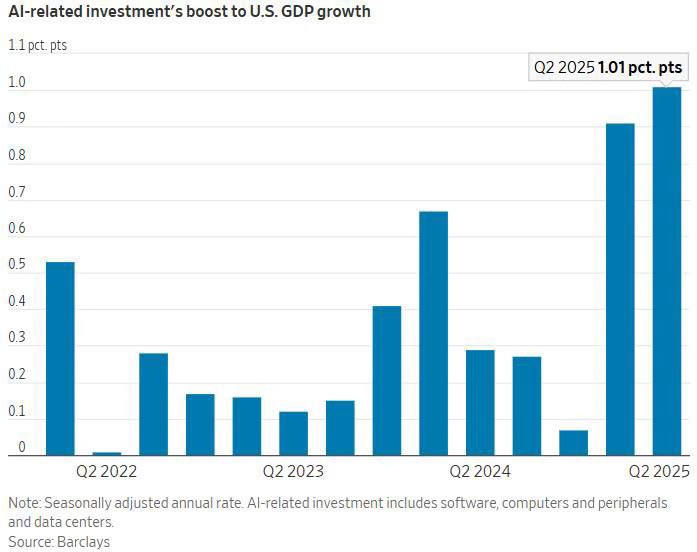

Barclays says AI spending drove over 50% of the U.S.’s 1.6% GDP growth.

Let that sink in.

Half Of All Economic Growth.

The only thing keeping the U.S. economy from sliding into recession is AI capex and the wealth effect from AI stock appreciation.

Sacks’ statement was blunt: “A reversal would risk recession. We can’t afford to go backwards.”

That’s the government saying, we cannot allow AI spending to slow down because the entire economic structure now depends on it.

If AI capex drops 10%, GDP growth goes negative. If AI drops 20%, you’re in a real recession.

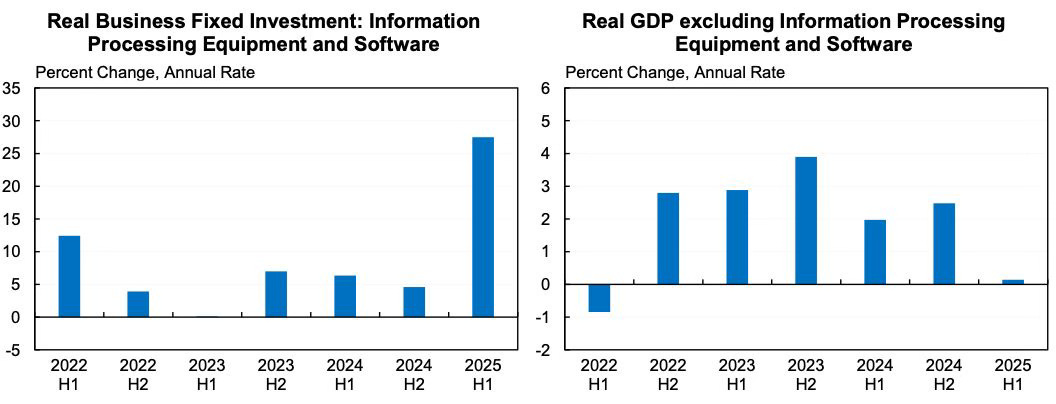

The New York Times reported it even more starkly, investments in AI hardware and software accounted for over 90% of all GDP growth in the first half of 2025.

Everything else, every other sector, every other industry is basically treading water.

Unemployment has ticked up, hiring has decelerated, manufacturing is shrinking.

Construction is soft, consumer confidence is declining as lower income families cut spending.

The economy is now a two track system, as economist Mark Muro from the Brookings Institution put it:

“This AI gold rush is generating all the excitement and papering over a drift in the rest of the economy.”

This is structurally similar to what happened with the Manhattan Project.

Once the government committed to uranium enrichment at Oak Ridge and plutonium production at Hanford, those facilities became so critical to national security that the government couldn’t close them.

Eighty years later, they’re still being funded. Oak Ridge and Hanford still gets government money.

The spending never stops because the alternative, national security vulnerability is unacceptable.

The same dynamic is now true for AI.

The U.S. economy is now structurally dependent on AI investment. You can’t reverse it without causing a major blowback.

The Nvidia China Trap: Why Selling Older Chips Accelerates the Entire Boom

Here’s where this gets absolutely critical and this is a perfect example of how the government is trapped in its own AI spending cage.

The Trump administration is currently debating whether to let Nvidia sell its H200 chips to China.

On the surface, this seems like a straightforward trade policy question.

Should America allow Nvidia to sell advanced chips to a geopolitical rival?

The national security hawks say no. The commerce people say maybe.

Nvidia ‘s CEO Jensen Huang has been lobbying intensely for yes.

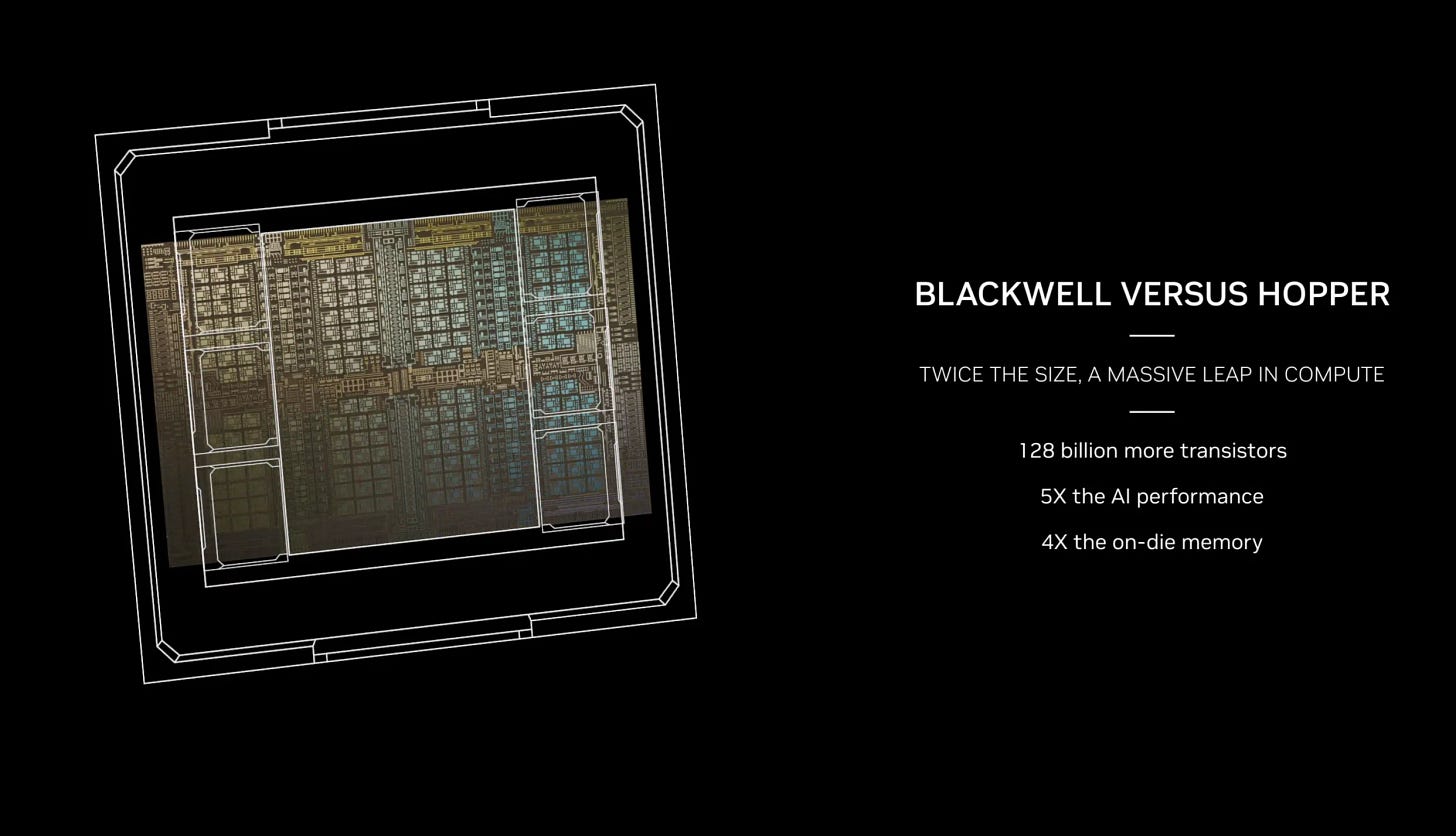

But here’s what most people are missing, the chips Nvidia wants to sell to China are not even the current-generation Blackwell architecture.

They’re Hopper-based chips, the previous generation. The H200 is Hopper, it’s been superseded by Blackwell.

When Nvidia sells H200s to China, it’s moving old inventory to free up manufacturing capacity for the newest Blackwell chips that go to American hyperscalers and the government.

Here’s the trap the government is in, if Nvidia gets H200 export approval, Nvidia ‘s revenue surges, Nvidia ‘s stock soars, the wealth effect accelerates, and GDP growth stays elevated.

The administration gets to claim it negotiated a win with China while keeping the economy booming.

But the government is literally trapped.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.