The Quiet Melt-Up: Why Stocks Keep Rising (And Why Smart Money Is Still Hedging)

Stocks are rising on liquidity, not growth, as structural inflows and the debasement narrative keep risk assets pinned higher.

The setup for U.S. equities right now is unlike anything I’ve ever seen before. Growth is slowing, inflation’s sticky, and geopolitical risks are rising, yet stocks keep grinding higher.

That’s not because the economy is booming. It’s because of flows, the unstoppable wave of money that keeps pouring into markets from households, retirement accounts, and passive funds. Add in strong positioning, the “debasement” narrative, and record levels of dealer support, and you get a strange reality: the market wants to go up, even if the fundamentals don’t fully agree.

Household Buying: The Real Engine Behind This Rally

The biggest buyer of U.S. stocks right now isn’t Wall Street, it’s Main Street.

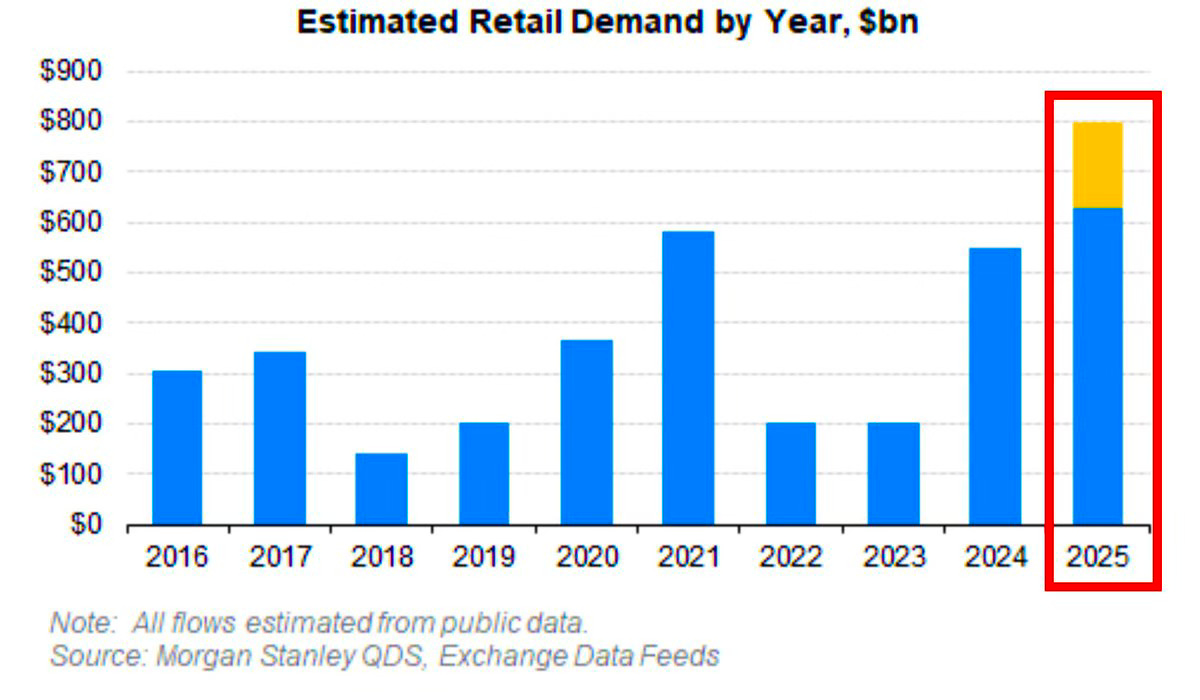

Retail investors have bought roughly $100 billion in stocks over the past month alone, the biggest single-month buying spree ever recorded. That brings total retail purchases this year to around $630 billion, already surpassing every prior year and now on pace to hit $800 billion by year-end.

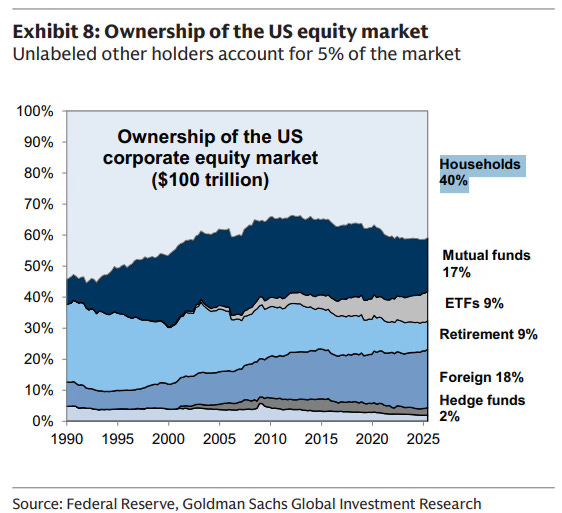

Over 40% of the stock market is owned directly by households, and almost 90% of that sits in the hands of the wealthiest 10%. That means when markets wobble, it’s the same top group buying the dip. They’re not panic-selling; they’re allocating consistently through automated retirement accounts and passive index funds.

And those habits matter. Every paycheck in America funnels money into 401(k)s, which are retirement plans that automatically invest in index funds, regardless of whether the market is up or down. Those consistent inflows (roughly $500 billion a year) act like a conveyor belt pushing stocks higher week after week.

It’s not retail euphoria, it’s structural. Even when sentiment cools off, money keeps flowing in.

Positioning and Flows: When the Market Becomes Self-Reinforcing

After a mild pullback in the summer, more than $70 billion in new inflows came back into U.S. stocks within just a few weeks. Retail investors added another $20 billion over three months. That’s what happens when every dip feels like an opportunity.

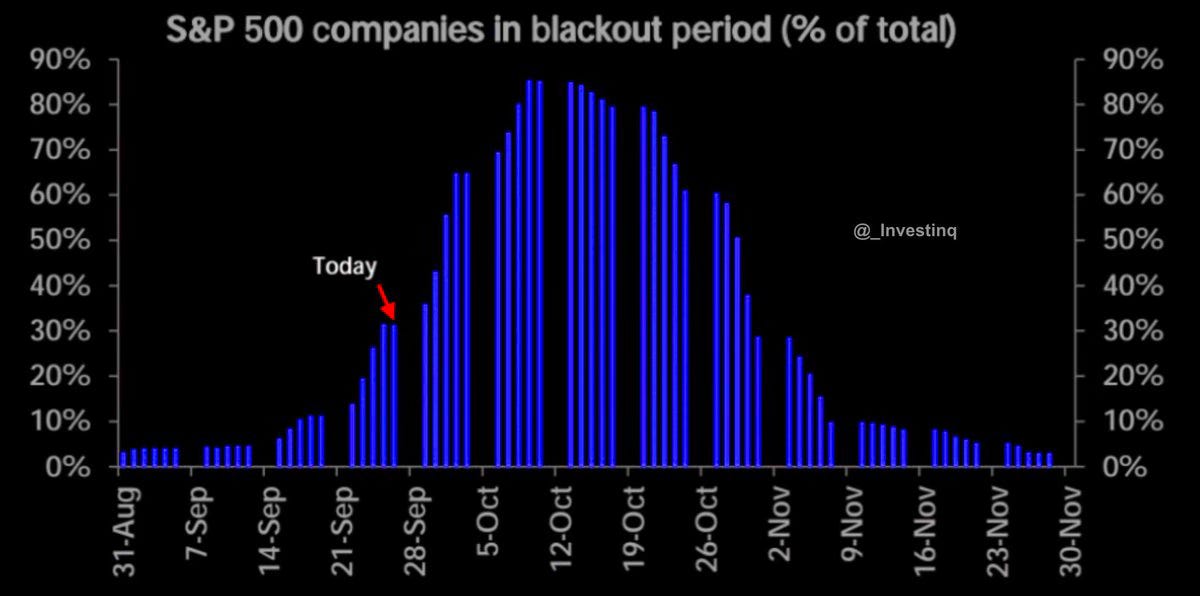

At the same time, corporate buybacks (when companies purchase their own shares) are on temporary pause during the blackout period, a few weeks before earnings when companies aren’t allowed to buy stock. But once that blackout ends, the corporate bid returns.

Then there’s the CTA bid, short for Commodity Trading Advisors. These are systematic funds that trade based on trend-following algorithms. Right now, CTAs are max long across all major indices (S&P 500, Nasdaq, and Russell 2000), meaning their models are still flashing “buy.”

Even more important is dealer gamma. Dealers are the market makers who sell options to investors. To stay hedged, they have to buy when prices fall and sell when prices rise. When gamma is positive, like it is now, it keeps volatility low because those hedges smooth out price swings.

This is why the market feels calm: every small dip gets bought automatically. But when gamma flips negative usually after a sharp drop or big event, those same mechanics can amplify volatility.

So we’ve got a setup where volatility is artificially dampened, positioning is heavy on the long side, and the inflow machine is still running. That’s how markets can melt up even when the economy’s just “okay.”

Macro Conditions: Weak Growth, Sticky Inflation, Rising Tariffs

Now let’s talk macro, what’s actually happening in the economy.

U.S. GDP growth is expected to slow to just 0.9% annualized in Q4 2025. That’s not a recession, but it’s sluggish. Unemployment is inching up in certain areas like tech and manufacturing, but overall it’s still low.

The big story is inflation. The Fed’s preferred measure, core PCE (Personal Consumption Expenditures), is expected to peak around 3% by the end of 2025, then drift back toward the Fed’s 2–2.2% target range by 2026.

But the new wildcard is tariffs. Analysts sees the effective U.S. tariff rate rising to around 15–15.5% in 2026 as trade tensions heat up again.

The good news? The pass-through (how much of that cost actually hits consumers) is only about 55–70%, far lower than previous cycles. That’s because companies are adjusting supply chains, currencies are moving to offset costs, and margins are absorbing some of the hit. In short: tariffs sting, but they’re not breaking the system yet.

The Debasement Narrative: Why Gold Won’t Go Away

There’s another undercurrent driving markets right now, “debasement”. It’s the idea that fiat money (like the U.S. dollar) is losing real value because of excessive government debt and money printing.

When people believe their cash is losing value, they start looking for alternatives assets that feel “real.” That’s where gold and private assets come in.

The 2026 price outlook for gold now sits near $4,900 per ounce, supported by persistent central bank buying, steady ETF inflows, and ongoing geopolitical tension. Gold is already up almost over 50% year-to-date, and this move isn’t driven by short-term traders, it’s coming from large institutions quietly increasing allocations as a long-term hedge.

Unlike the 1970s, inflation expectations are more controlled today, so gold’s move isn’t explosive, it’s steady. And there’s a new player supporting the bid: life insurers and annuity managers. They’re increasingly investing in private credit and private equity, using the stable cash flow from insurance products to fund long-term, high-yield assets. That creates a self-feeding flywheel for alternative asset growth.

So, the “hard asset” trade gold, private credit, even Bitcoin, isn’t just about fear. It’s about preserving purchasing power in an era where policy feels permanently loose.

The Bigger Picture: Exceptionalism and Hidden Fragility

For now, the U.S. still looks unbeatable. Global capital keeps flowing into American assets, fueled by AI-driven growth, tech leadership, and a relatively stable political backdrop. That’s the “U.S. exceptionalism” story.

But the cracks are there. A new rare earths battle with China could threaten EV and semiconductor supply chains. Tariff escalation could reheat inflation. And AI infrastructure spending while bullish for semis also adds strain to power grids and credit markets.

The system works… until it doesn’t. The more investors crowd into the same “safe” trades, the more fragile the structure becomes.

How to Position: Ride the Wave, But Stay Hedged

Right now, directional conviction is low, nobody’s sure whether to go all-in bullish or defensive. But the weight of structural flows means investors can’t afford to sit out.

So what’s the play? Stay invested, but manage risk differently. Use path-dependent hedges like lookbacks or corridor options, tools that protect against timing shocks without killing upside potential. These are becoming popular because they protect when something happens, not just if it does.

And don’t ignore alternatives. Gold, private credit, and other real assets still serve as ballast against the debasement story.

The bottom line: This market isn’t complacent, it’s trapped. Flows, liquidity, and passive demand keep it pinned up, while tail risks keep smart investors quietly hedged.

The melt-up may continue, but when liquidity shifts or volatility returns, there won’t be time to react. That’s why the best move now isn’t to fight the rally, it’s to ride it, but hedge it before the calm breaks.

It seems to me, and I may be wrong, that the top 10% hold the keys to the kingdom, the kingdom itself being funded by the masses. Every paycheck that flows into a 401(k) ends up buying the same few stocks through index funds. It’s a brilliant, self-reinforcing loop, yet a fragile one. It should be in everyone’s interest, you’d think, to keep that wheel of fortune turning. Nice and steady as she goes. Everyone wins.