The Setup No One’s Seeing: Why November Could Shock Everyone

Flows are building, and the market’s starting to hum with that late-October energy that usually means one thing.

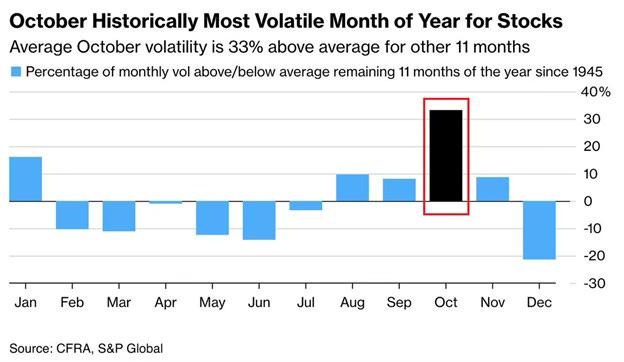

Every October feels the same, fake breakdowns, violent reversals, and more whiplash than a theme-park ride.

But behind all that noise, late October usually hides one simple truth.

You can feel it, that shift in the air. The tension, the positioning, the way bad news stops dragging things down and the market just… pauses. Like it’s waiting for something.

In this article, I’ll be breaking down one of the most important weeks in October, the point where the noise fades, the setup builds, and the market decides what comes next.

And spoiler: it’s not just the institutions.

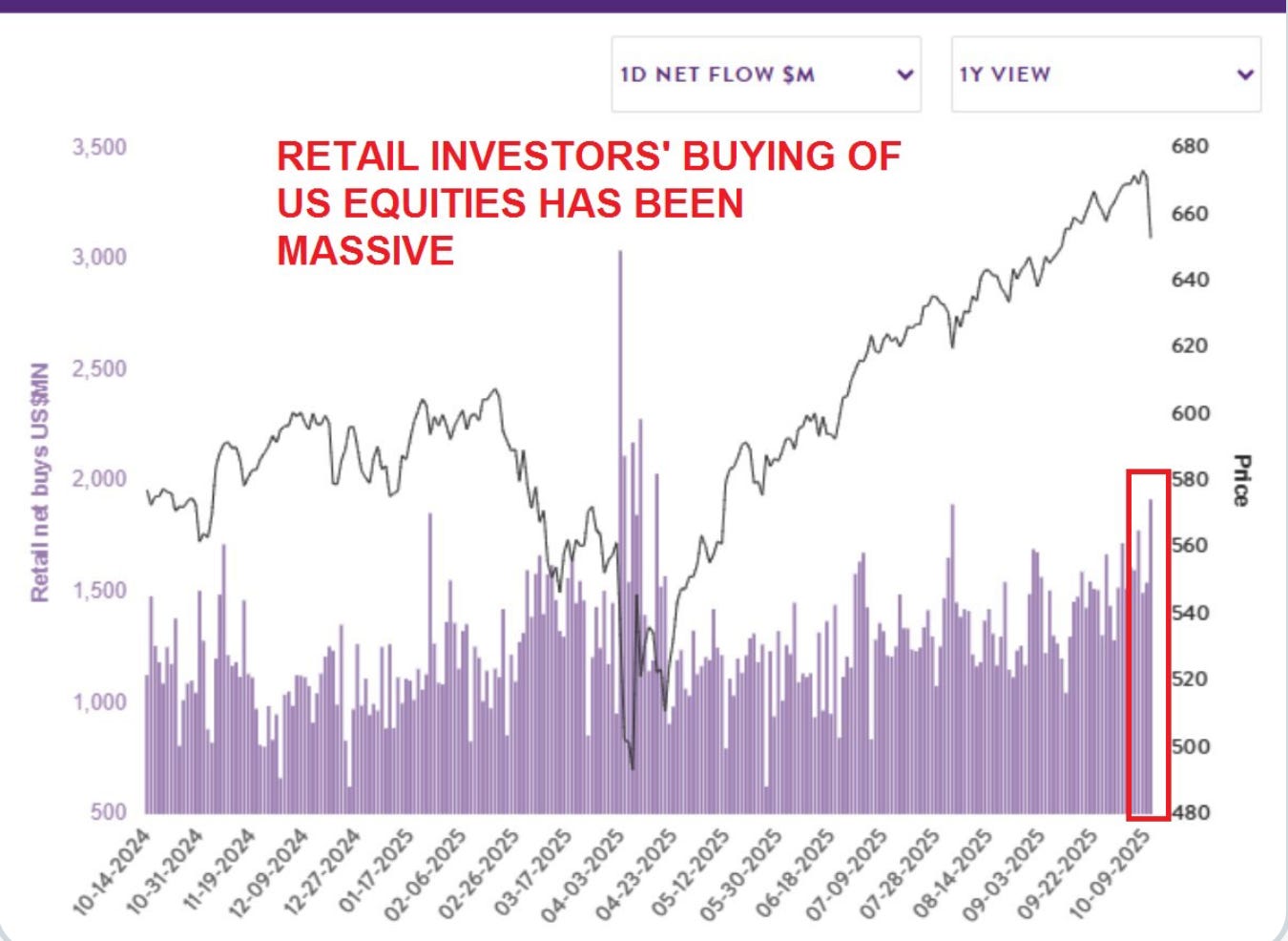

Retail’s Not Following the Tape Anymore, They Are the Tape

Let’s start with retail because that’s where the story begins.

Here’s the thing, retail traders aren’t just along for the ride anymore. They’re driving it.

Week after week, the data keeps showing the same thing: relentless inflows. Retail has been net buyers in 23 of the last 27 weeks. ETF inflows? Green for 220 out of 222 sessions.

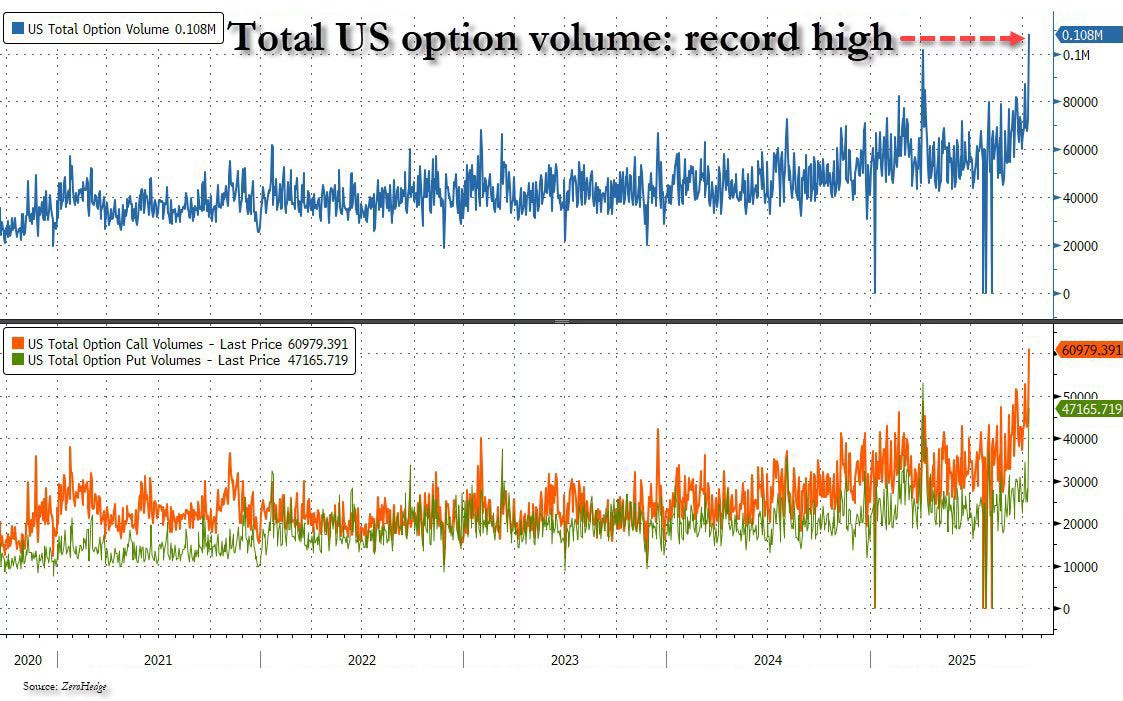

Call options? Twenty-five straight weeks of buying, a record.

This isn’t the 2021 meme stock crowd throwing darts. This is a new wave of retail traders showing up consistently, adding real liquidity, and shaping how the tape moves. They’re loading up on S&P ETFs, large-caps, and names that can handle size.

And that shift changes everything. When retail goes heavy on short-dated calls, dealers hedge by buying stock. That hedge creates real demand, mechanical buying pressure that supports prices even when headlines look grim.

It’s not “hope” holding the market up, it’s pure math. The same math that’s turned every dip into a buying opportunity and every breakdown into a head fake.

Every selloff has been shorter. Every pullback, shallower. The market keeps trying to trip people up but retail keeps filling in the gaps.

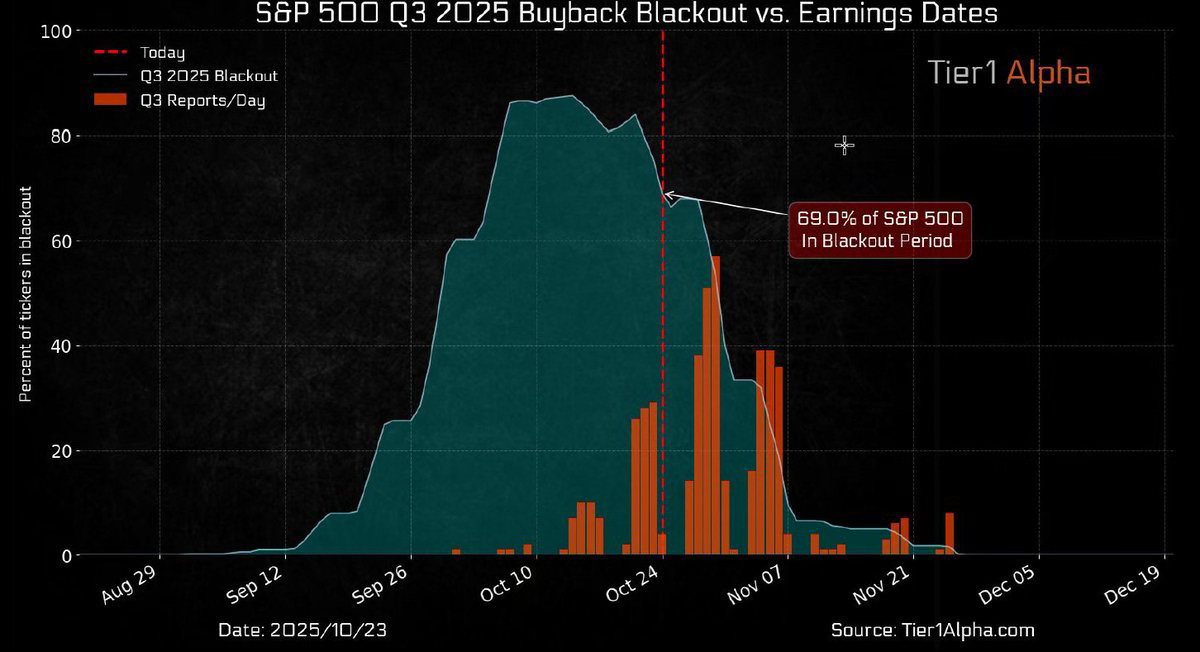

The Buyback Engine Is About to Kick Back In

Now add the next catalyst, buybacks.

Corporations have been in blackout mode during earnings season, but that ends this week.

On deck? Over $1.3 trillion in approved authorizations waiting to hit the tape. That’s roughly $5 billion a day in mechanical buying that doesn’t care about headlines or the Feds, it just executes.

Buybacks are consistent, and ruthless. They’re not emotional. They’re systematic. They create real demand and reduce supply, plain and simple. And when they come back online right as retail keeps buying dips, it’s like lighting an engine that’s already idling warm.

Institutions Are Still Bearish, Which Is Perfect

Here’s what makes this even more interesting: the so-called “smart money” still doesn’t believe it.

Before you keep reading, I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade. I only charge about $99 a year, while competitors charge over $100 a month for emails like this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.