The Unprecedented Economic Divergence Reshaping America

Big Tech’s $500 billion AI spree is rewriting capitalism while consumers cut back on basics.

Here’s a fun fact that should absolutely terrify you: Kraft Heinz’s CEO just said the company is experiencing “one of the worst consumer sentiments we’ve seen in decades.”

Not in a quarter. Not in a business cycle but in Decades and he’s the guy running a company that sells ketchup and Lunchables to middle America. If people are cutting back on ketchup, we’re past the point of pretending everything is fine.

But that’s not even the wildest part of what just happened in earnings season.

The real story is about two completely different economies running in parallel, and they’re diverging so fast that pretty soon they’ll stop looking like the same country.

The Capex Fever Dream

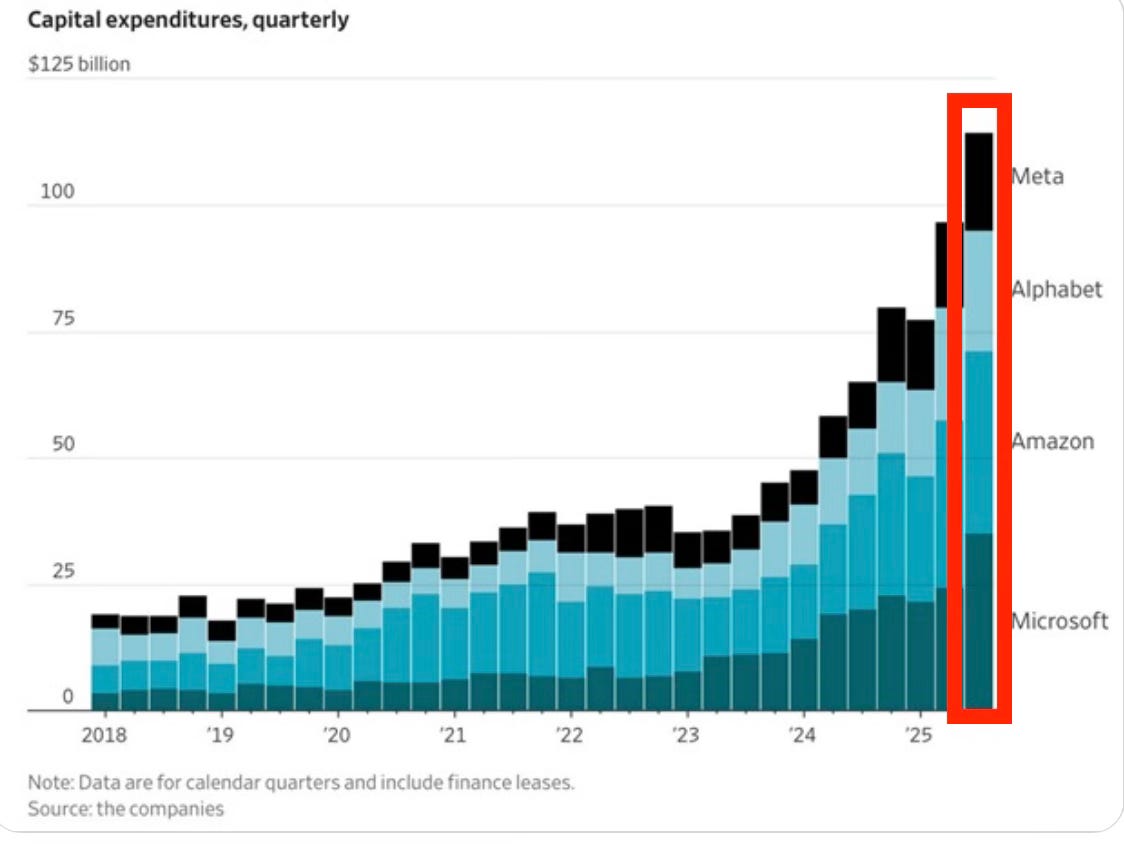

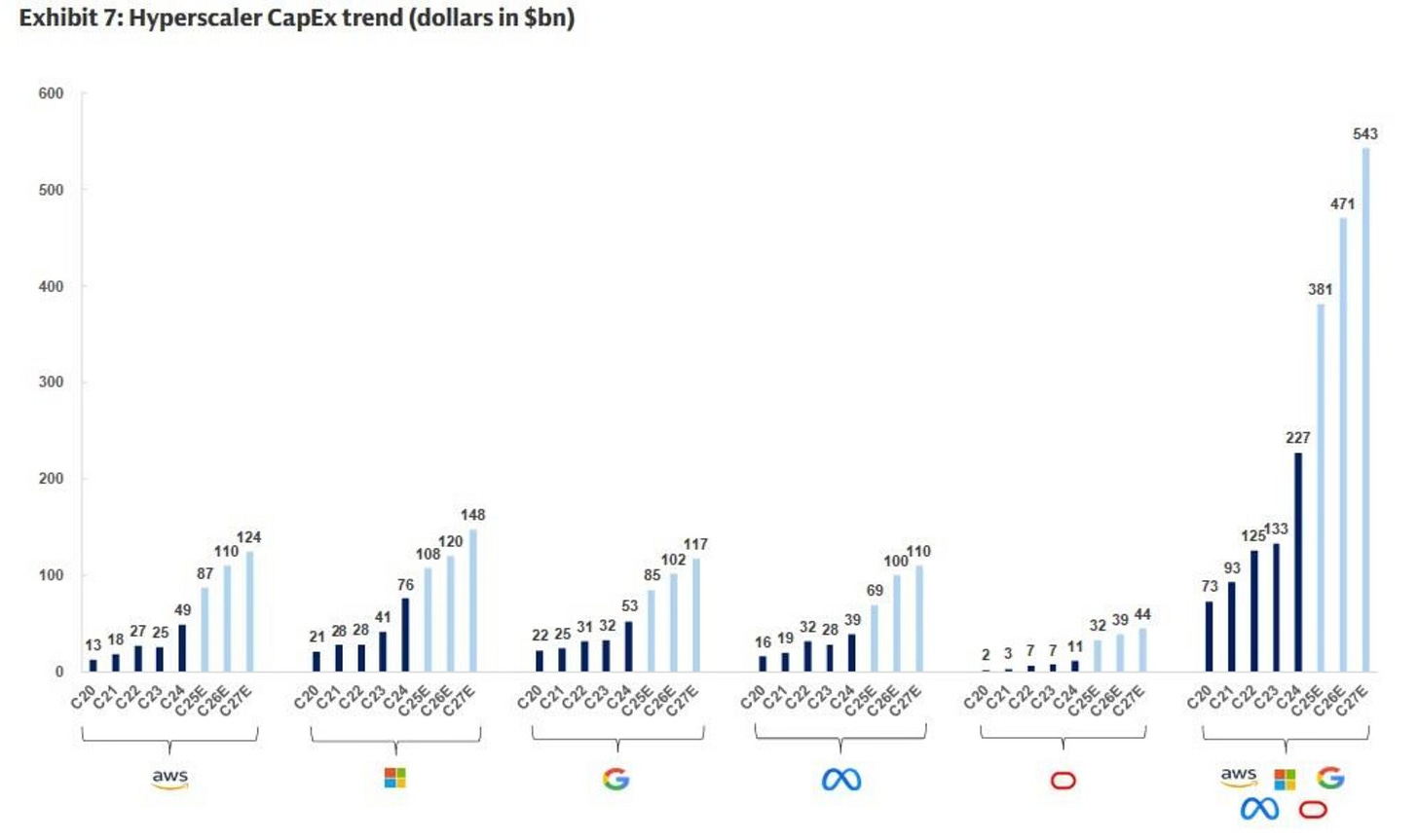

Let’s talk about what Wall Street is actually doing right now. In Q3 2025, the big four tech hyper-scalers, Microsoft, Google, Amazon, and Meta dropped a combined $112 billion on capital expenditures.

In one quarter. Most of it going toward AI infrastructure: data centers, GPUs, the whole digital religion.

But here’s where it gets insane. This spending has literally doubled since Q1 2024 and tripled since Q2 2023. We’re not talking about a gradual ramp. We’re talking about exponential acceleration.

And they’re not slowing down. Amazon just raised its 2025 CapEx forecast to $125 billion and is already signaling that spending will rise even further in 2026. Alphabet expects full-year CapEx to hit between $91 billion and $93 billion. Meta is guiding between $70 billion and $72 billion but expects spending to “grow notably larger in 2026”. Microsoft posted a 45% increase last year and sees acceleration continuing in fiscal 2026, suggesting spending could hit at least $94 billion.

Add those up. That’s over $380 billion in CapEx from just these four companies in 2025 alone. And we’re talking about a trajectory that could easily push the collective spending to nearly $500 billion annually by the end of 2026, which is what analysts are projecting.

That’s not a budget. That’s a war chest.

To put this in perspective: $500 billion annually is more than the entire federal transportation budget. It’s more than what most countries spend on everything combined. It’s roughly equivalent to the GDP of Argentina. And it’s all flowing into semiconductor fabs, AI clusters, and server farms that make our current infrastructure look like a flip phone from 2005.

The implicit bet here is staggering: all that capital is supposed to generate returns by unlocking some massive productivity multiplier. AI is going to be so transformative, so revolutionary, that burning half a trillion dollars a year on the infrastructure to run it actually makes financial “sense”.

But zoom out for a second. That $500 billion? That’s capital that’s supposed to generate returns by making human labor more efficient. Which is a polite way of saying: automating jobs away.

The K-Shaped Knife Fight

Meanwhile, something genuinely weird is happening in the actual economy where actual people buy things.

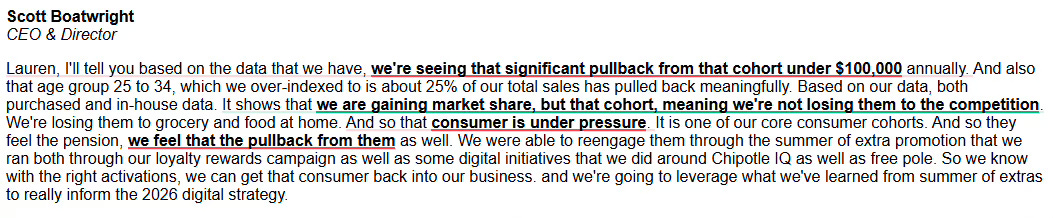

Chipotle just issued its third downward guidance revision in less than a year. The company’s core customer, people making under $100,000, ages 25 to 34 has basically stopped showing up. Comparable sales guidance went from expected positive growth to negative low-single digits.

SFM (Simply Good Foods) cratered 26% in a single day. CAVA got crushed 11%. Sprouts down 9.6%. O’Reilly Automotive is reporting that DIY customers are deferring maintenance because they can’t afford to fix their cars. Hershey is discounting before Halloween.

The Winners Just Keep Winning

While all that destruction is happening, something else is occurring simultaneously in a different universe.

Visa is posting broad based strength across all consumer spend bands, with the highest spend band growing fastest. Starbucks says every demographic is crushing it, transactions flipped positive, college campuses are thriving, every generational cohort is responding well. Chili’s claims it’s growing across all income levels, and get this: their fastest-growing customer base is households making under $60,000.

This is where your brain should break a little bit.

How can Chili’s be growing in low-income households while Chipotle is getting destroyed in low-income households? How can Starbucks be crushing it across all demographics while SFM crashes 26%? How can Visa see strength across all spend bands while half the retail sector is getting obliterated?

The answer is simple and terrifying:

Consider Becoming a Paid subscriber to keep reading: These deep dives takes hours of work. Upgrade for just $99 a year (others charge $100+ monthly) to keep this newsletter going and get the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.