The Unseen Flows That Could Rock Markets Today

How a $3.4 Trillion Options Expiration Is Setting the Stage for Big Market Moves

Understanding the Setup

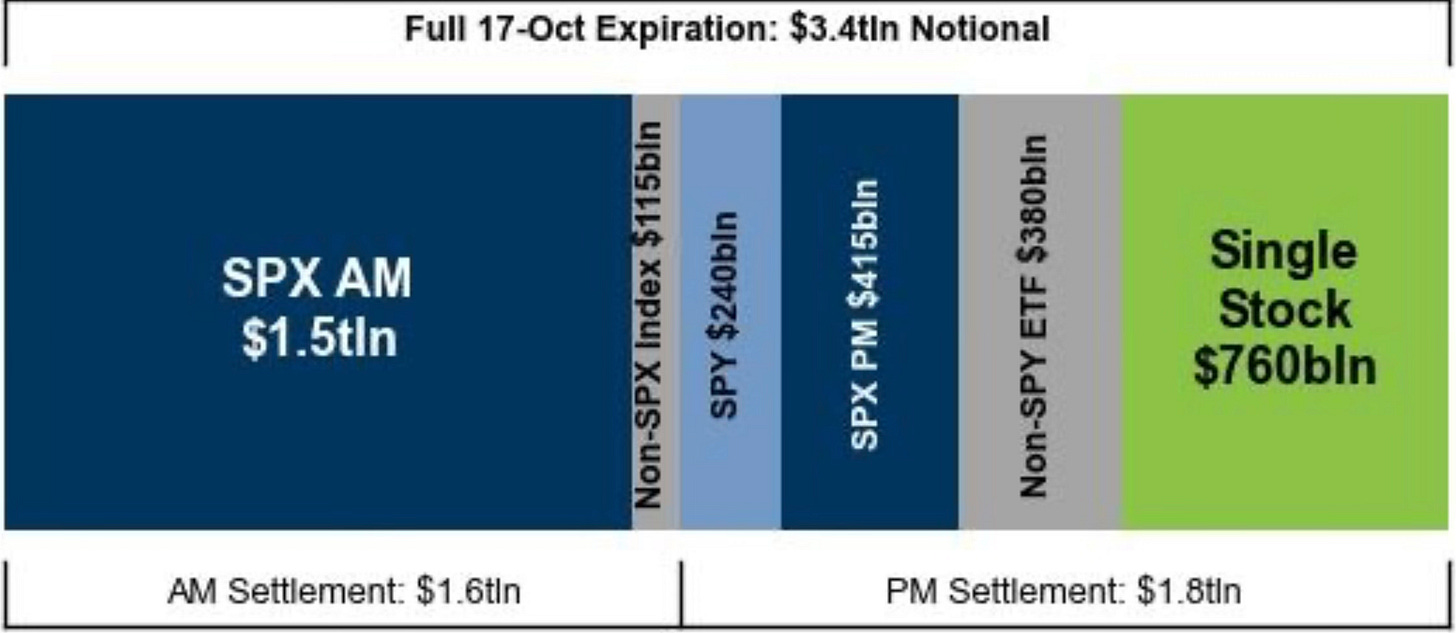

Today’s options expiration is shaping up to be one of the biggest market events of the year. Roughly $3.4 trillion worth of contracts are expiring, nearly double what you’d see in a normal month. Most people scrolling through their portfolios won’t realize it, but what’s happening under the surface has the power to move everything: prices, volatility, and short-term sentiment. This is a day where mechanical flows can steer the entire market.

To understand why, you first need to know what an option actually is. An option is like a contract that lets traders make a side bet on where a stock or an index might go either up or down, within a certain time frame. Some traders use options for protection (hedging), while others use them to speculate on direction. Behind every one of these bets, though, is a professional market maker, often called a dealer. Their job is to take the other side of those trades and then hedge their own exposure so they don’t lose money if prices move.

Here’s where it gets interesting: when all those contracts expire which happens every month, dealers have to rebalance everything. They adjust their positions to stay neutral, which can mean buying or selling huge amounts of stock or futures. When the amount of expiring contracts is small, the impact is minimal. But when the pile is this massive, $3.4 trillion worth even small adjustments can ripple across the market. This is why OPEX, short for options expiration, is such a big deal. It’s when the invisible gears of the market start grinding all at once.

And when those gears move, they move fast. This week’s expiration is one of the largest of 2025, and that scale alone can turn a quiet session into one of the most volatile trading days of the year.

The Mechanics at Play

All week, the S&P 500 has been caught in a tug-of-war between buyers and sellers. It’s not really about sentiment or headlines, it’s about positioning. The key concept here is something called gamma, which measures how much dealers need to adjust their hedges when prices change.

When gamma is positive, dealers act like shock absorbers for the market. If prices start to drop, they buy. If prices rise, they sell. That constant rebalancing keeps the market steady. Think of it like a car with good suspension, bumps in the road get absorbed, and the ride stays smooth. This week, those invisible “shock absorbers” have been holding the market near important levels around 6,650 and 6,750 on the S&P 500. The result is a market that feels restrained, pinned between invisible magnets.

But that stability doesn’t last forever. Once those contracts expire, the “positive gamma” disappears. The market loses that stabilizing force. Prices are suddenly free to move without those dealer hedges slowing them down. That’s when things can get chaotic, quick moves, fast reversals, and unexpected swings.

Now, if the setup flips into negative gamma, things start working in reverse. Dealers sell when the market falls and buy when it rises. That amplifies moves instead of dampening them. It’s like driving on ice, every turn becomes exaggerated. This is why volatility tends to spike around big expirations. It’s not that traders suddenly panic. It’s that the mechanical flow of hedging switches direction, turning normal price moves into sharp swings.

Meanwhile, another piece of the puzzle is implied volatility, or IV for short. IV represents how much movement the market expects. It’s not measuring what’s happening right now, it’s measuring fear about what might happen next. When traders start worrying about bigger moves, they rush to buy options as protection, and that drives IV higher. Right now, IV has been climbing all week as traders hedge for turbulence.

The funny part is what usually happens after these big expirations: volatility often drops. Once the wave of options rolls off, there’s less hedging, less protection being bought, and the market settles down. It’s almost like pressure being released from a valve, tension builds all week, it peaks on expiration day, and then the system resets.

I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade. I only charge about $99 a year, while competitors charge over $100 a month for emails like this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

How to Think About It and How to Position (You want to read the next part)

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.