Wall Street’s Spookiest Month: Could October Set the Stage for a Melt-Up or a Meltdown?

From dollar declines to hedge fund resets, the signals scream choppiness first, momentum after.

📬 In today’s issue, we dive deeper into:

PART I:

1. Charts Of The Week (Debt service burdens, dollar’s inflation effect, corporate profit slump)

2. October’s “spooky” history points to more volatility — but also the setup for a late-month rally.

3. Big Tech leads, but rotation into industrials, financials, and materials could spread gains.

4. Record call volume shows traders chasing speculation as retail momentum overtakes fear.

5. My Take and what it means for the markets

PART II:

5. The Rundown (Bezos warns of bubble, EA’s $55B buyout, OpenAI’s $500B)

6. On the Horizon (Shutdown delays key data, but earnings season begins)

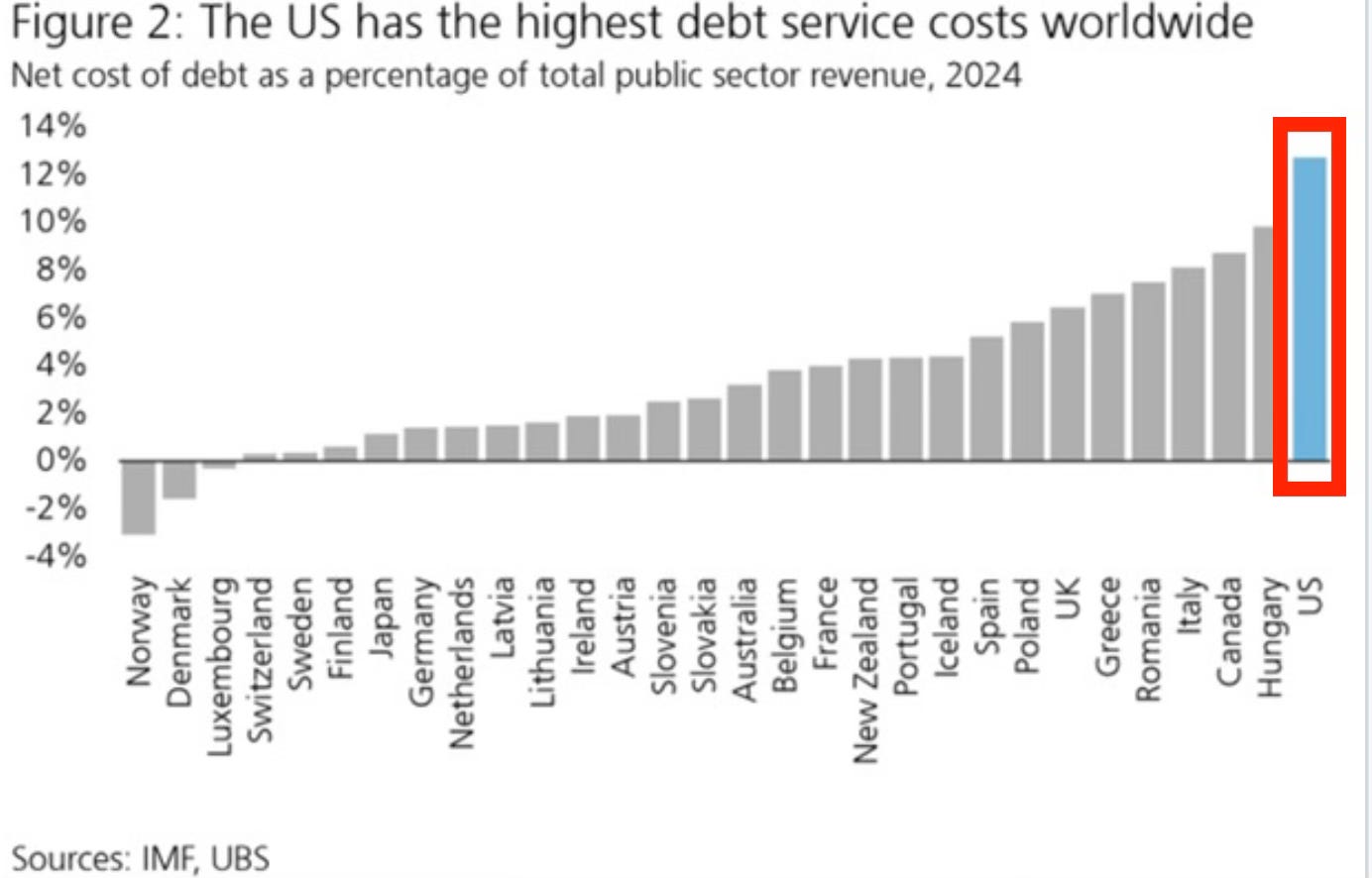

7. Reading Recommendations (Morningstar’s 10 long-term picks, global Stock Market breakdown, 2020s bull run, windowless planes)This chart tracks how much of each country’s government revenue is eaten up by interest payments in 2024. The U.S. leads by far, with debt service costs hitting 13% of revenue, the highest worldwide. That translates into a record $1.2 trillion in annual interest payments.

By comparison, Hungary (10%), Canada (9%), and Italy (8%) face smaller but still heavy burdens. Japan, despite being the most indebted major economy, spends only 1% thanks to ultra-low rates. Meanwhile, resource-rich nations like Norway and Denmark actually earn more from investments than they pay on debt.

The chart highlights how rising rates have turned the U.S. into the outlier: no major economy devotes more of its tax income to servicing debt, making rate cuts especially critical for Washington.

This chart shows the link between the U.S. dollar and inflation. A weaker dollar tends to push inflation higher, since imports and commodities become more expensive. Apollo notes that according to the Fed’s own model, every 10% drop in the dollar adds about 0.3% to CPI.

So far in 2025, the dollar index has fallen more than 10%, its sharpest annual decline since 1973. If the dollar stays at current levels through year-end, the model suggests upward pressure on inflation will persist into 2026. The takeaway: a sliding dollar risks complicating the Fed’s inflation fight.

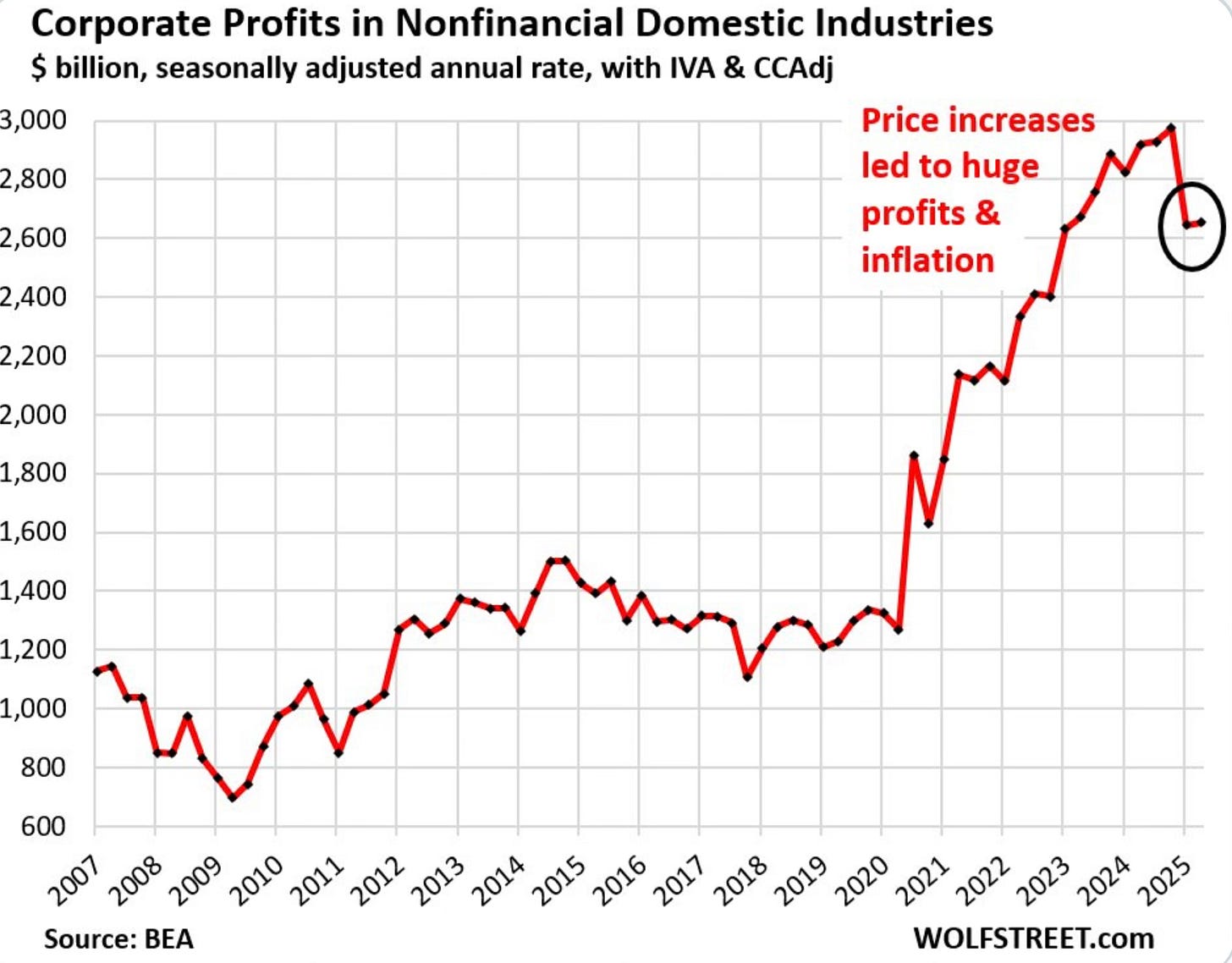

This chart shows a rare pullback in U.S. corporate profits. In Q1 2025, non-financial domestic industries saw profits plunge by $331 billion (-11%), marking the biggest quarterly drop since records began in 2001.

While Q2 brought a small rebound of just $9 billion, profits remain well below their 2024 highs. After years of margin expansion fueled by price hikes, companies are now feeling the squeeze, raising questions about whether corporate pricing power, and its inflationary punch, is finally fading.

Welcome to October: Wall Street’s Spookiest Month

I don’t know about you, but this year feels like it’s flying. A new month means a fresh set of market moves to keep up with earnings are just around the corner, the Fed is still keeping us on edge, and you already know Wall Street won’t make it boring.

So let’s dive in. I’ll break down October and what it means for the markets and your money, because this month isn’t just any month, October has a way of being special for Wall Street.

October’s Reputation

October officially marks the start of the fourth quarter, and if there’s one thing history reminds us, it’s that this month has a flair for drama. Think 1929. Think 1987. This is the month that gave us some of the nastiest crashes in market history. No wonder traders call it spooky season. And not just because of Halloween, portfolios can get haunted too.

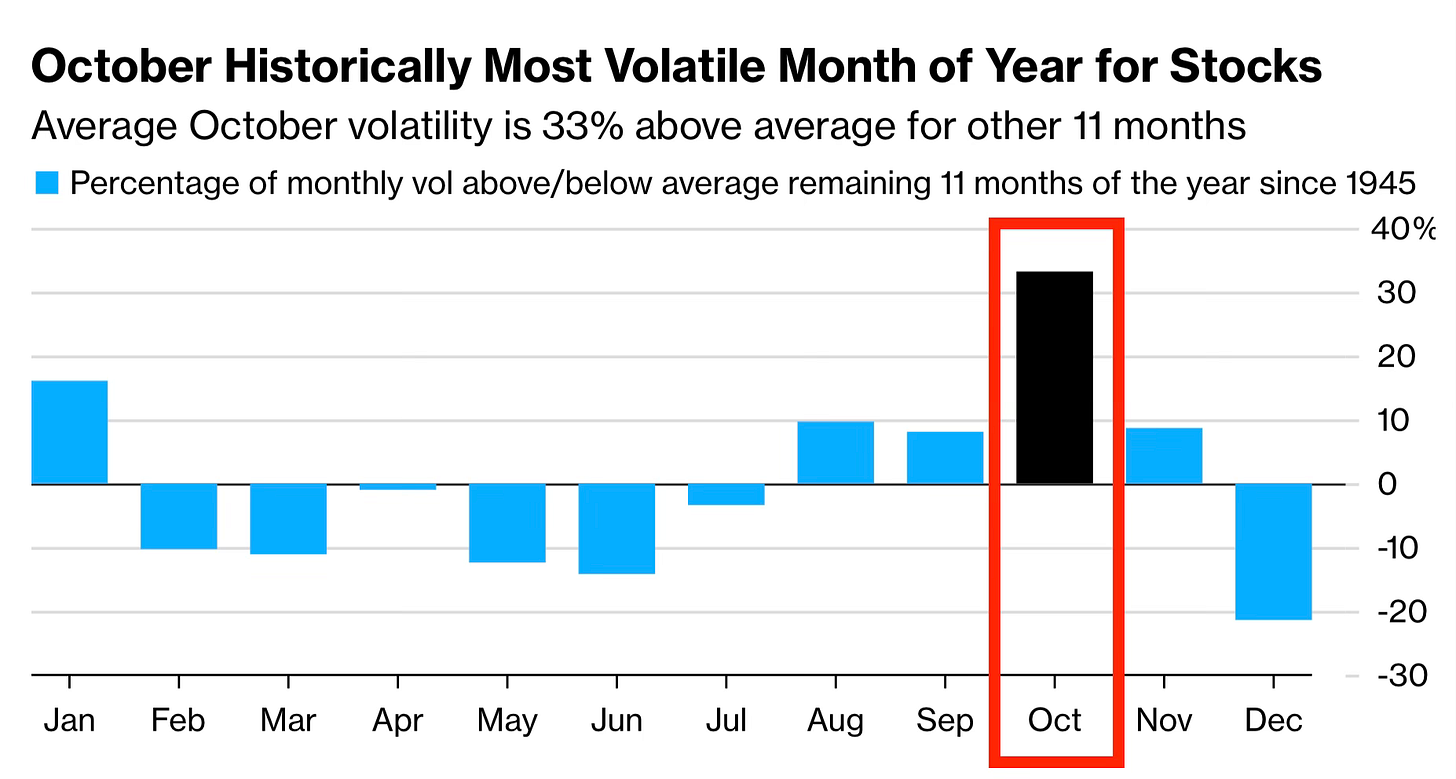

Here’s the stat that makes people squirm: on average, October volatility runs about 33% higher than the rest of the year. No other month even comes close. So while everyone else is carving pumpkins and watching horror movies, Wall Street is bracing for the kind of jump scares that come in the form of a red screen.

Seasonals Flip the Script

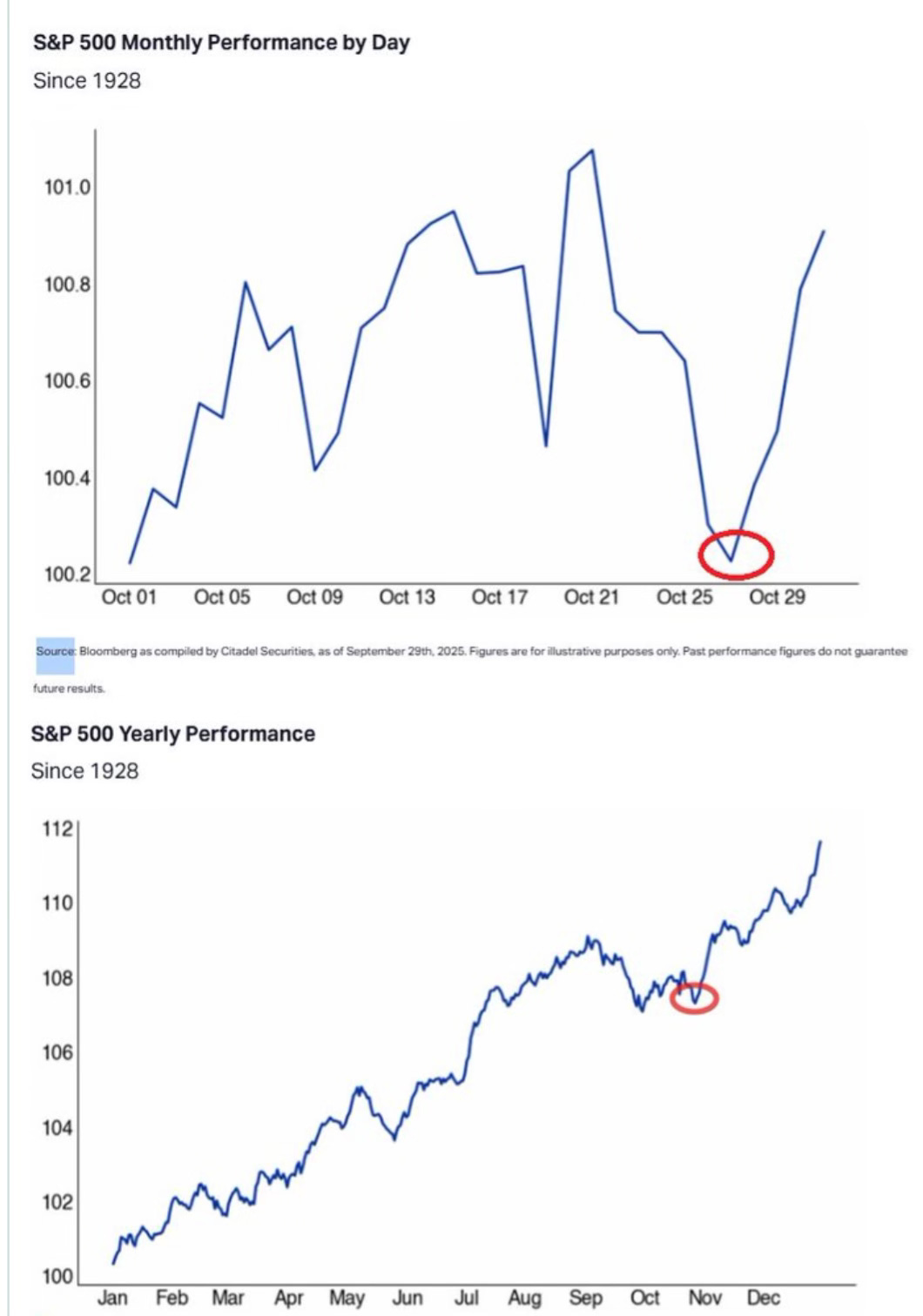

But here’s where October gets interesting, the very same month that scares investors often sets up the year’s best rally. Citadel’s Scott Rubner pulled 100 years of data and found that October 26th is typically the low point for the S&P 500 in Q4, while October 27th marks the low for the Nasdaq 100. Translation: late-October dips are usually the setup for the strongest trading stretch of the year.

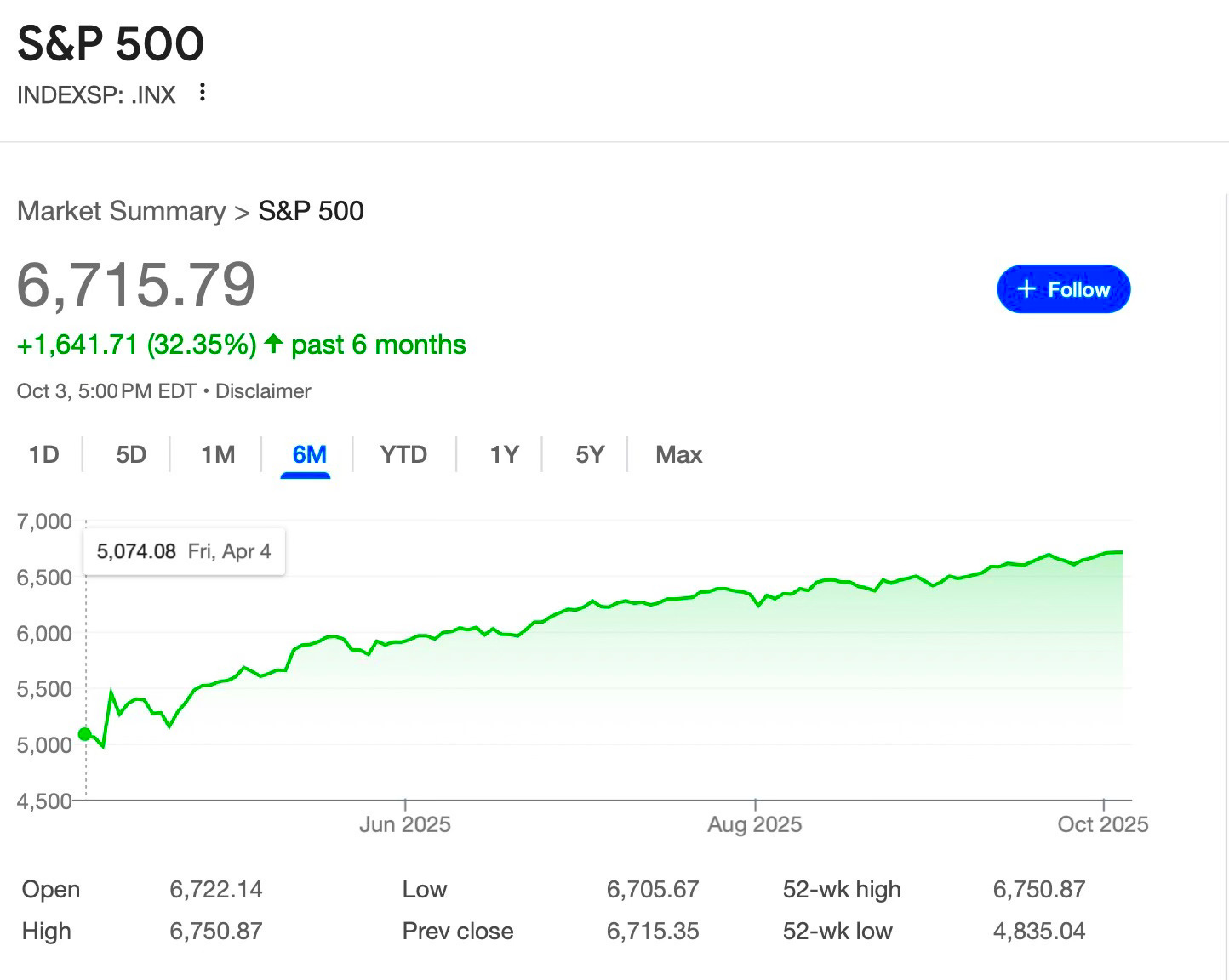

Of course, markets don’t move on history alone. The S&P 500 has already gone on a monster run this year, more than 32% since April, with Q3 adding another 6%. Valuations are stretched, optimism is sky-high, and it’s fair to say we’re no longer in the cheap stocks phase of this rally.

Rotation and Positioning

Big Tech has been the MVP of this market rally for nearly two years. The “Magnificent Seven” Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla just hit a new milestone: together, they now make up 35% of the S&P 500’s total market value, the highest share on record. Their combined market cap has surged to $20.7 trillion, up from 29% of the index in 2023. That’s an enormous concentration of market power sitting in just seven stocks.

But strategists at Bank of America are signaling that the leadership baton might be about to pass. Why? Because earnings strength is starting to broaden into other corners of the market specifically industrials, financials, and materials. These cyclical sectors tend to shine when the Fed cuts rates. Industrials get a boost from stronger business investment, financials thrive when borrowing costs ease and yield curves steepen, and materials ride the wave of global demand. If that shift plays out, it doesn’t mean Big Tech disappears, but it does mean that index funds heavily tilted toward those seven names could underperform if other sectors step into the spotlight.

On top of that, hedge fund positioning tells its own story. Morgan Stanley’s data shows hedge funds have cut their exposure to the Mag7 down to the 2nd percentile of the past five years. Translation: funds are holding almost no overweight positions in those names compared to their history. It’s one of the lowest levels of confidence we’ve seen.

And it’s not just about tech, leverage across the board is down. Gross leverage (overall borrowed exposure) and net leverage (longs minus shorts) have both been reduced. Hedge funds are basically sitting light, with smaller bets and less risk on the table. On the surface, that looks cautious, like they’re bracing for volatility or a pullback. But the flip side is important: being underweight means they’ve got plenty of dry powder ready to deploy.

If October delivers the classic late-month dip and seasonal trends flip bullish into Q4, those same funds may have no choice but to chase performance. And when hedge funds chase, they don’t tiptoe back in, they stampede. That kind of year-end re-leveraging is exactly what can fuel a sharp melt-up into December.

Cheap Insurance, Priceless Peace of Mind

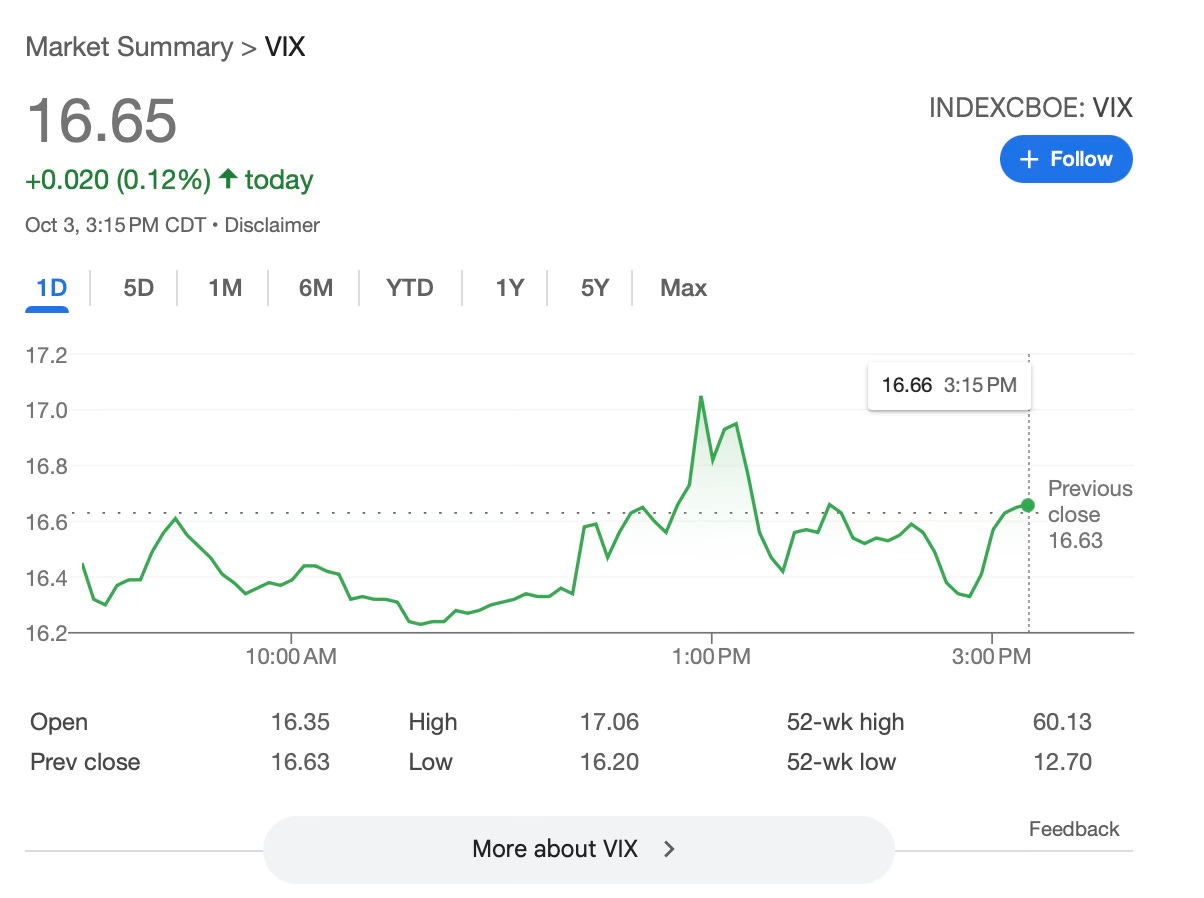

Then there’s the protection side of the story, the stuff no one pays attention to until it suddenly becomes the only thing that matters. Right now, the VIX, Wall Street’s famous “fear gauge” is sitting around 16. That’s well under its historical average of around 19, which basically says traders are expecting smooth sailing. But when the VIX is this low, it means insurance is cheap. You can hedge against a 10% drop in the S&P 500 through December for less than 1% of your portfolio’s value. In a month like October, with a track record for chaos, that’s the equivalent of buying fire insurance when your neighbor just stocked his garage with fireworks.

Here’s the kicker: hardly anyone is buying that insurance.

I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade to read rest of my analysis. I only charge about $9 a month, while competitors charge over $100 for emails like this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.