When the Data Goes Dark: How a Government Shutdown Left Wall Street Flying Blind

The economy’s still moving, it's just no one can see where.

Three weeks into the longest government shutdown in years, Wall Street finally got the one thing it was starving for, the September CPI report.

Inflation came in at 3.0% year-over-year, a little cooler than economists expected. The market instantly exhaled. Stocks climbed, traders rushed to price in rate cuts, and the financial world started acting like things were back to normal.

But nothing about this is normal.

Since October 1, the Bureau of Labor Statistics has been shut down. No payrolls report. No wage data. No new inflation surveys. The entire foundation of U.S. economic data, the thing policymakers, traders, and corporations depend on to make trillion-dollar decisions is dark.

The only reason we even got the September CPI is because the Social Security Administration legally needed it to calculate cost-of-living adjustments for retirees.

Without that requirement, we’d be completely blind and that’s where the real story begins.

The Collapse of the Data Machine

When the BLS shuts down, it’s not just about missed deadlines. The data itself starts to rot.

The U.S. economy runs on real-time inputs: interviews, surveys, phone calls, field visits, and reports. When that process stops, those moments can’t be recreated later. They’re gone.

The monthly jobs report is a perfect example. It’s built from two surveys: one that tracks business payrolls, and one that interviews households about their job status. The business data can be filled in later. The household data can’t.

That household survey happens during one specific week each month, the week that includes the 12th. Once that window passes, it’s over. When the BLS finally reopens, it’ll have to choose between three bad options:

Ask people to remember what their job status was weeks ago.

Shift the survey to a new week and risk breaking historical consistency.

Or skip the entire month and leave a permanent hole in the data.

The first two options create distortion. The third one breaks continuity. There’s no good way out.

The Inflation Blind Spot

Then there’s inflation, the number everyone thinks is just pulled from a spreadsheet.

It’s not.

Roughly 80% of CPI data comes from field economists who physically collect prices. They visit grocery stores, call hospitals, talk to landlords, and manually track thousands of individual goods and services. When those people aren’t working, the data stops existing.

Sure, a small fraction of CPI can be captured electronically, gas prices, used car values, airfares but the vast majority of the index is still human-driven.

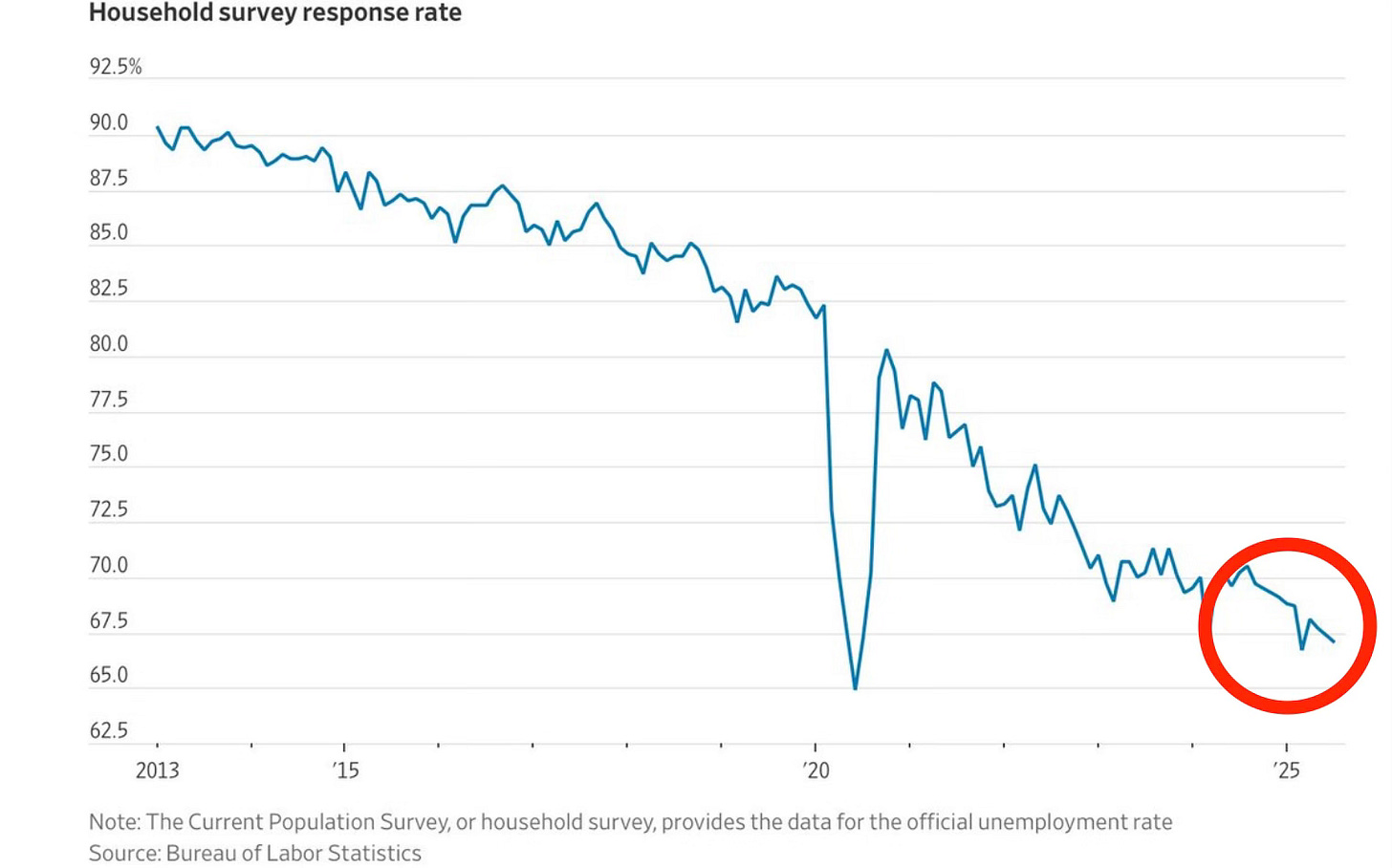

And it’s not just inflation. The monthly jobs data itself is showing cracks. The entire collection process desperately needs an update. Collapsing response rates, outdated “snail mail” inputs, and massive revisions have all chipped away at its reliability.

After the 2013 shutdown, the BLS rushed to catch up by collecting twice the amount of data in half the time. But that shutdown lasted two weeks. This one’s already past three. And the BLS is operating with less staff and tighter budgets than it did a decade ago.

Even a tenth-of-a-percent mistake in CPI translates to billions of dollars in overpayments or underpayments for Social Security. So if the agency can’t gather full data, they’re stuck between two choices: release a compromised report or delay it indefinitely.

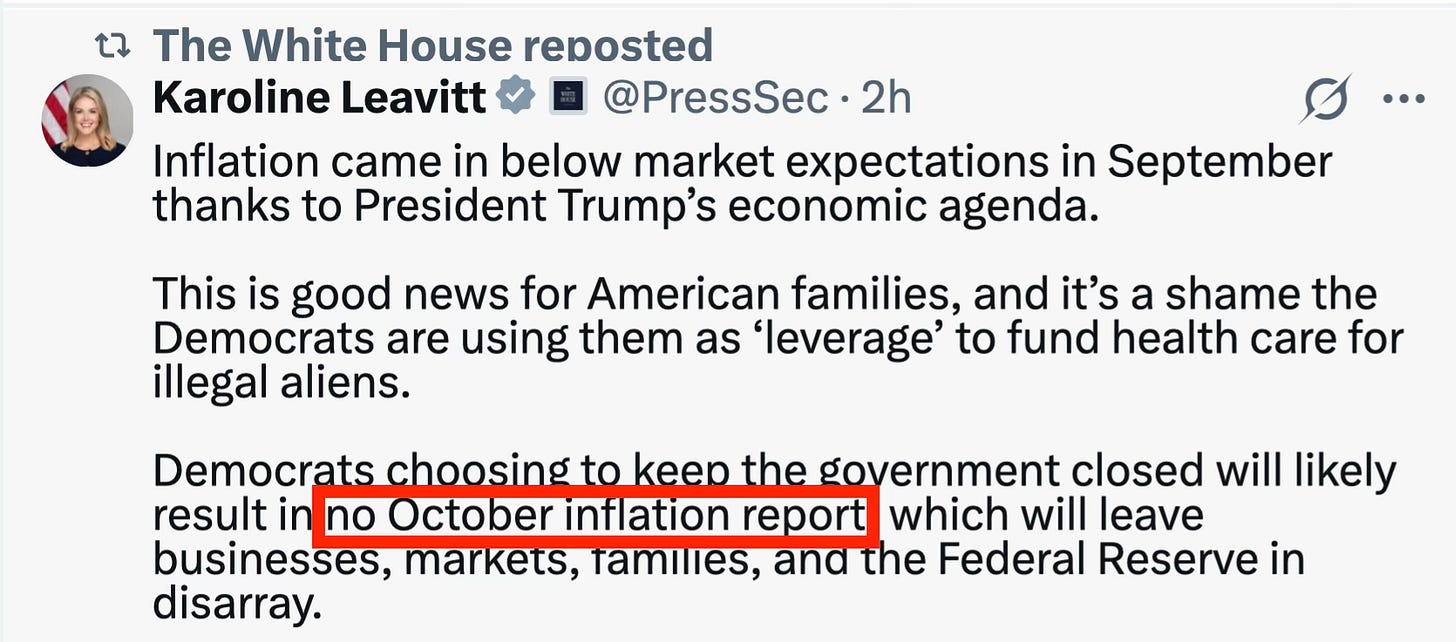

The White House has already hinted that the October CPI may never come out. Which means the Federal Reserve will head into its next meeting with no inflation data at all.

That’s like driving through fog with no headlights.

Apollo’s Alternative Data: Seeing What the Government Can’t

That’s where Apollo Global Management steps in.

While the federal data infrastructure is frozen, Apollo’s private dataset built from alternative, high-frequency indicators has become one of my favorite ways to track what’s really happening in the economy right now.

Their “Alternative Data During the Shutdown” report, tracks several major categories such as consumer spending, labor, inflation and financial conditions.

These aren’t government surveys. They’re real-world signals, credit card transactions, job postings, hotel bookings, and commodity prices, updated daily or weekly.

Let’s look at some of the data sets to get the big picture of what’s really going!

Consumers: Still Spending Like It’s 2019

If the economy were truly slowing, consumer spending would be the first thing to break but it hasn’t.

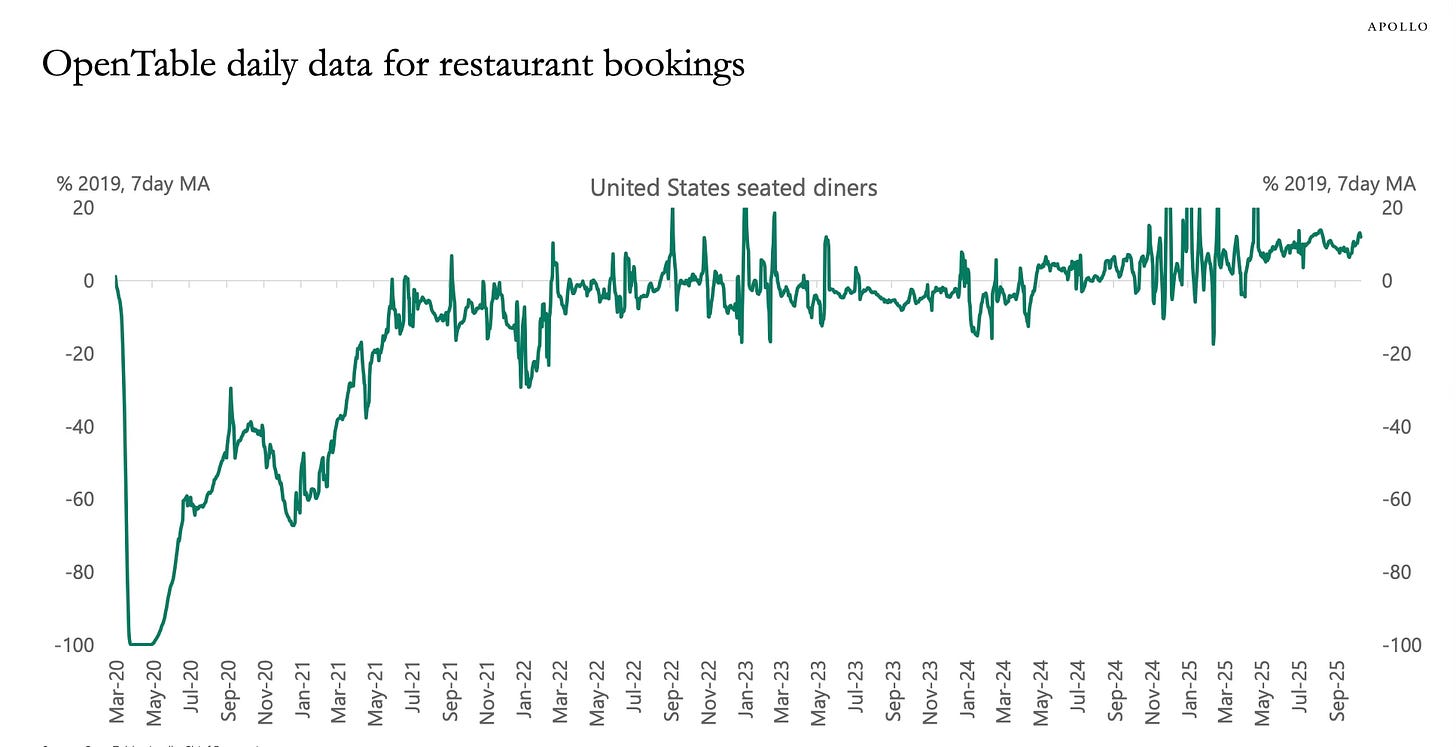

OpenTable reservation data shows restaurant bookings sitting right around pre-pandemic levels. That means people are still eating out, traveling, and living like the recession talk doesn’t exist.

Bloomberg’s debit card spending tracker tells the same story. The average American is still swiping. Redbook’s retail sales index which measures same-store sales at major chains has stayed flat instead of rolling over.

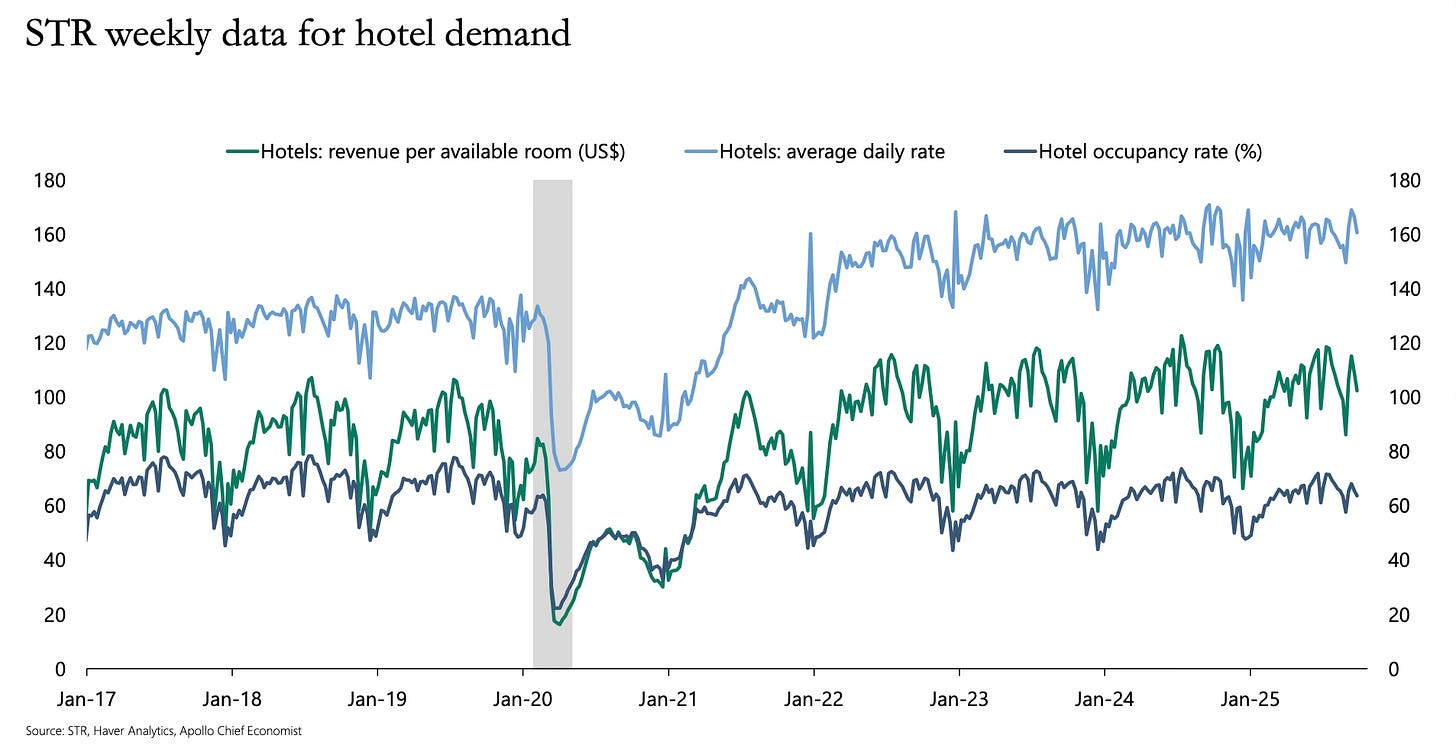

And in hospitality, things look even stronger. STR’s hotel revenue data shows occupancy rates climbing, room prices rising, and total revenue per available room at or near all-time highs. Business travel, leisure travel, weekend getaways, they’re all holding up.

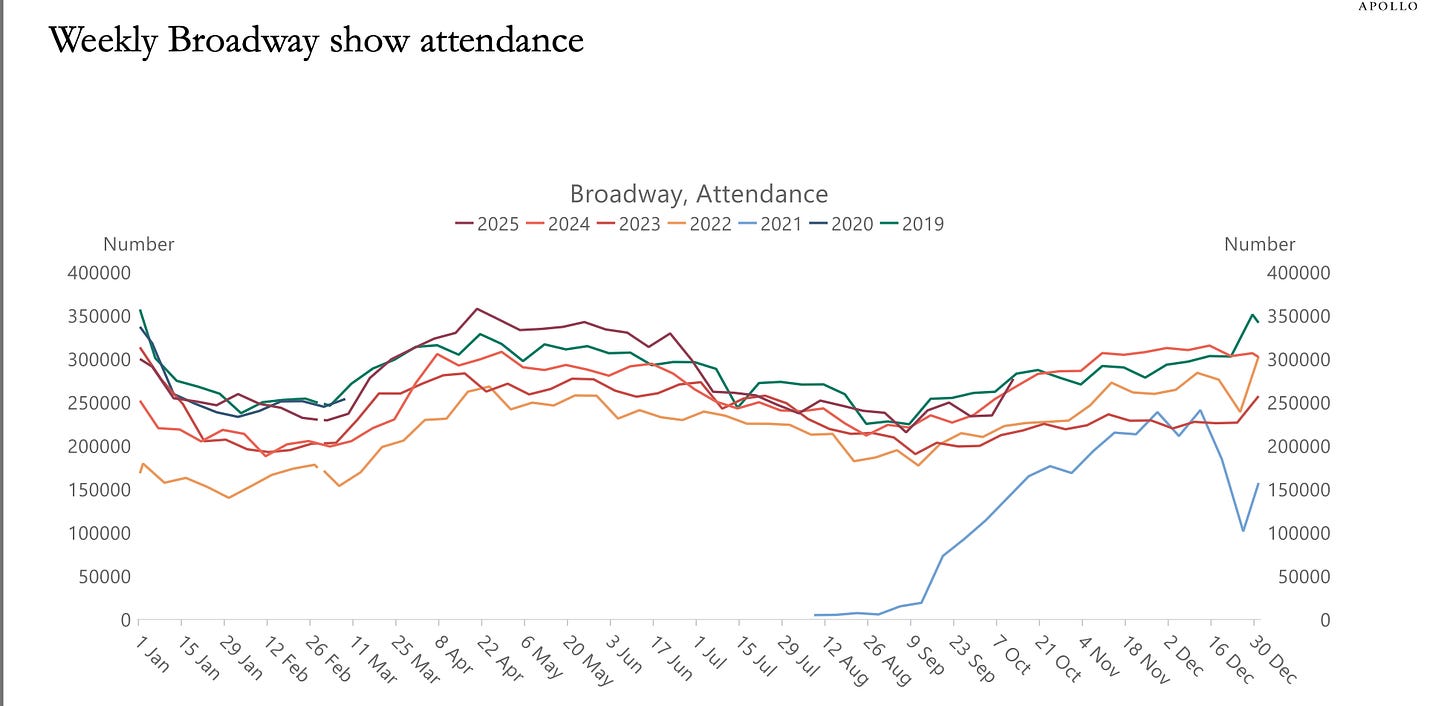

Even the “fun” indicators like box office sales and Broadway attendance have recovered to pre-pandemic volumes. Consumers aren’t pulling back. They’re adapting choosing experiences, not goods, but still spending aggressively.

So while Wall Street debates whether the economy’s cooling, real-world spending data suggests it hasn’t slowed much at all.

The Labor Market: Apollo Says It’s Holding But I’m Skeptical

Before you keep reading, I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade. I only charge about $99 a year, while competitors charge over $100 a month for emails like this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.