Why Losing Money Is Suddenly Winning on Wall Street

Welcome to the Zero Dollar Era, where losses are the new leverage.

The Junk Rally No One Saw Coming

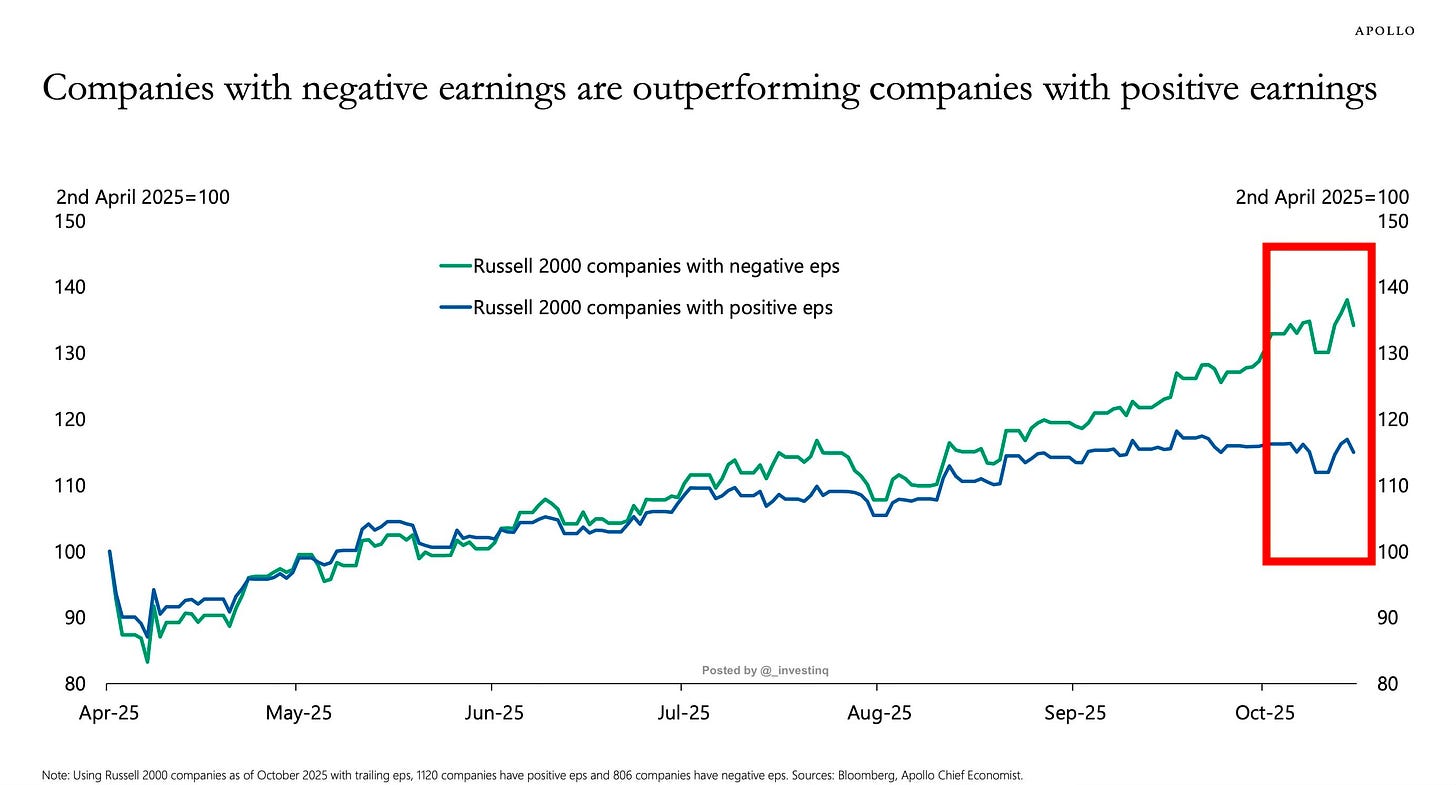

Somewhere between rate cuts and Reddit threads, unprofitable companies started running circles around the ones actually making money. Apollo’s Torsten Sløk dropped a chart that basically says this: since early April, the worst companies in the Russell 2000 have left the profitable ones in the dust. That is not a typo, the losers are winning, and the winners are wondering what just happened.

This is the type of rally that makes analysts stare at their spreadsheets and ask if fundamentals still matter, or if we’re all just trading vibes now. Call it what it is, a good old-fashioned junk rally. The kind where liquidity, positioning, and pure FOMO makes valuation feel like something out of a history book

When Cheap Money Meets Dumb Confidence

Rate cuts did what rate cuts always do, they turned the lights back on for companies that were half-dead. Small caps live on borrowed money, and nearly half of their debt floats with rates. So when Powell trims a few basis points, those interest costs shrink overnight, and suddenly everyone pretends the balance sheet looks fine.

Meanwhile, big companies with fixed-rate debt barely flinch. They don’t need cheaper credit to survive. But small caps? They treat every cut like a shot of espresso. When borrowing gets easier, investors stop caring that the business still burns cash. It’s not about profits, it’s about having enough runway to make it look like you’ll get there someday.

Then came the squeeze. Hedge funds were short the junk and long the quality, a cute idea until junk ripped higher. Shorts got torched, momentum traders piled in, and every algo started chasing the same trades. Suddenly, the companies nobody wanted were up 80%, and the so called disciplined funds were the ones panicking.

July was peak chaos. The most “sophisticated” quant funds were all leaning the same way, long low-vol, short trash. Then the trash rallied, and everyone got margin-called into oblivion. It wasn’t analysis driving markets. It was survival.

The Return of Story Stocks

Every cycle needs a story, and this one’s no different. The AI boom gave investors something shiny to chase again. The economy didn’t collapse just yet, GDP beat expectations, and credit stress just started cooling off. So people started reaching for risk.

They stopped asking “is this company profitable?” and started saying “well, it could be… eventually.” That’s how you get valuations where a company with zero earnings is trading at ten times sales. Price-to-sales ratios are like makeup, they hide everything ugly underneath. It’s the same energy that powered dot-com startups in the ’90s and meme stocks in 2021. The difference now is we’ve added AI buzzwords and industrial renaissance themes to make it sound a bit more sophisticated.

The “Zero Dollar Club”

Read this message to read the rest: I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade. I only charge about $99 a year, while competitors charge over $100 a month for email such as this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.