For the First Time All Year, I’m Genuinely Actually Worried

A flawless earnings beat, a broken market reaction, and a perfect storm of risks.

We just wrapped the Super Bowl of earnings and NVIDIA just blew the roof off the entire stadium.

But I’m not going to drag you through every detail of the earnings, that’s not what this edition is for.

All you need to know is simple: NVIDIA crushed expectations and right on cue the bears came out swinging with the usual accounting tricks accusations.

Anyone who’s taken a basic accounting class could see it as fearmongering with no math behind it.

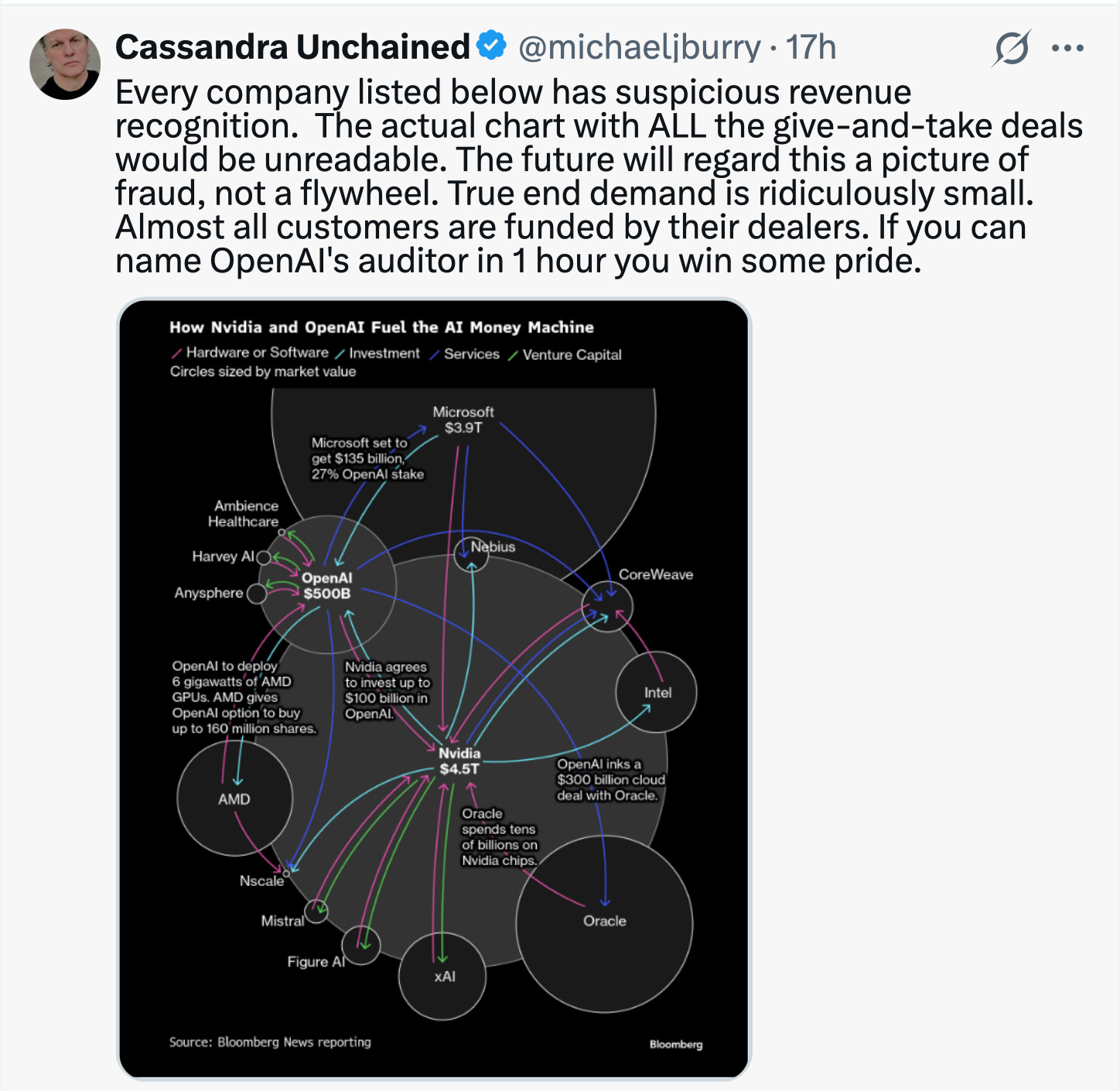

Even our favorite bear, Burry, jumped in and took a shot at OpenAI for good measure.

Listen, I’ll be perfectly honest, there is absolutely some truth in what Burry is saying.

Circular financing is real, and the ecosystem is messy.

But that doesn’t change the reality that these companies are still crushing earnings and will keep spending whatever it takes to keep the AI boom alive.

However, as I warned in previous editions, markets are priced for perfection and when expectations are that high even a flawless Nvidia beat can still trigger a sell off exactly as what we saw this morning.

Great results don’t matter when the bar is already sitting at the ceiling.

There are bigger macro forces shifting beneath the surface and this is one of the first times in the last couple of months where I’m genuinely becoming extremely cautious moving forward.

A Jobs Report, Two Fed Warnings, and One Market Meltdown

Now let’s talk about what actually happened this morning.

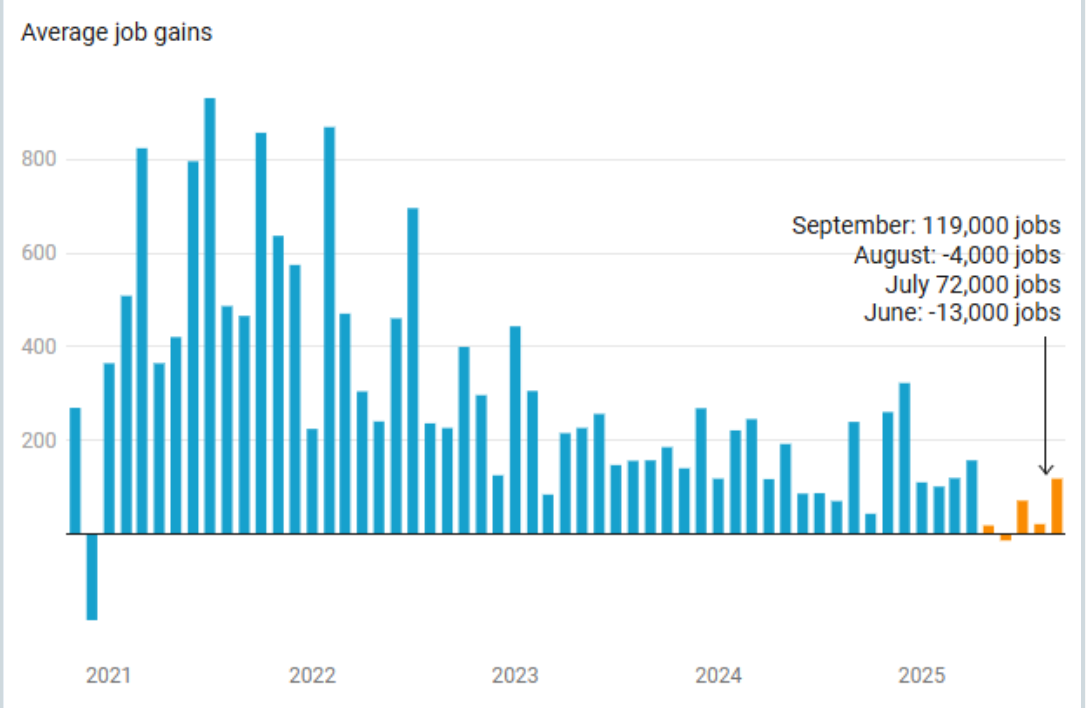

The jobs report came in this morning.

The U.S. added 119,000 jobs in September better than expectations but the unemployment rate ticked up to 4.4%, the highest since October 2021.

And the part nobody is talking about is continuing jobless claims jumped to almost 2 million, the highest since late 2021.

That number tracks people who are unemployed and staying unemployed longer which is the real stress signal.

Whether you believe these numbers coming from the government or not, they weren’t catastrophic.

However, I expect these figures to rise significantly once October layoffs start showing up in the data.

The damage always shows up with a lag but the part I am super worried about? This.

Labor Department announced that the November jobs report won’t come out until December 16th which six days after the Fed’s December meeting.

The market absolutely hates uncertainty, and that’s exactly what this creates.

The Fed will be flying into one of the most important meetings of the year with no fresh labor data which means the default path is no cut because of current conditions.

The only way that changes is if something dramatic happens between now and December 10th that forces their hand.

Market finally woke up to the reality that there will be no cuts.

The Fed Picked the Worst Possible Morning to Panic

As if the market didn’t already have enough chaos on its plate this morning, the Fed decided to toss gasoline on the fire with not one but two perfectly timed warnings.

First from Fed Governor Lisa Cook, and then from Chicago Fed President Austan Goolsbee.

Cook kicked things off by basically reminding everyone that valuations across stocks, corporate bonds, housing, and leveraged loans are looking stretched which is exactly the kind of message the market loves hearing when it’s already sliding.

She also flagged that liquidity isn’t as smooth as people think and noted that AI can stabilize markets or blow them up if models start moving in sync.

Now normally, that alone would’ve been enough to rattle markets but then Goolsbee stepped in and delivered part two.

His message? “The economy is strong, inflation has stalled, and I do NOT feel good about front-loading rate cuts.”

He practically hammered home that the Fed isn’t cutting unless inflation meaningfully moves lower and right now, he thinks it’s not.

But it got even better he literally said the data situation is a “mess” and that the lack of updated numbers makes him more paranoid about inflation.

So the Fed is uneasy, half-blind, and extremely cautious exactly the combo you want to hear on a down day, right?

Now these are all valid concerns and when they’re coming from people sitting inside the Fed, markets take them very seriously.

It’s no surprise this helped turn a normal post data dip into a full blown broader sell off.

So where do we go from here??

The Market Earthquake Arrives Tomorrow And Almost No One Is Ready

Consider Becoming a Paid subscriber to keep reading: These deep dives takes hours of work. Upgrade for just $99 a year (others charge $100+ monthly) to keep this newsletter going and get the insights that really matter.

Keep reading with a 7-day free trial

Subscribe to Investinq to keep reading this post and get 7 days of free access to the full post archives.