The Digital Dollar Bet: Is Circle Building the Operating System of Global Finance?

What Happens When a Fintech Starts Acting Like a Central Bank for the Internet?

If you want to send an email to a colleague in Tokyo, you hit send and it arrives instantly.

It costs you nothing.

It works on Sunday at 2:00 AM just as well as it works on a Tuesday morning.

The internet of information moves at the speed of light.

Now, imagine you want to send that same colleague $10,000.

Suddenly, you are transported back to the 1970s.

You are dealing with SWIFT codes, correspondent banking fees, exchange rate markups and a settlement time of 2+ business days.

In a world of instant information, money still moves at the speed of a fax machine.

This is the problem Circle Internet Group (NYSE: CRCL) was built to solve.

Circle is not your typical crypto company.

It isn’t trying to replace the U.S dollar with Bitcoin, it is trying to upgrade the U.S. dollar into a piece of software.

By issuing USDC (USD Coin), a digital token pegged 1:1 to the dollar, Circle is building the plumbing for a new financial internet.

For investors, Circle represents a fascinating, binary bet.

It is currently a cash printing machine that looks like a bank but it is trading like a volatile technology stock.

To understand if Circle belongs in your portfolio for the next five years, we have to look past the crypto buzzwords and analyze the actual business model, which is currently caught in a tug of war between falling interest rates and rising global adoption.

The Business Model: The Most Profitable “Bank” You’ve Never Used

To understand Circle’s stock price, you have to understand how boring their business actually is.

Strip away the blockchain terminology and Circle operates remarkably like a 19th-century bank just rebuilt for the digital world.

When a customer say, a hedge fund in Singapore or a fintech startup in Brazil wants to use USDC, they wire U.S. dollars to Circle.

Hedge funds in particular rely on USDC because it gives them something the traditional banking system still doesn’t, instant, global liquidity.

They can move money in seconds, rebalance across exchanges 24/7, settle cross border trades without waiting on a correspondent bank and jump on arbitrage opportunities without being handcuffed by wire cut-off times.

That speed becomes even more valuable during currency shocks moments, when the yen drops overnight like we saw last week, a Latin American currency suddenly devalues, or an emerging-market central bank imposes capital controls with zero warning.

In those situations, funds rotate into USDC because it’s a neutral, dollar-denominated asset they can access immediately, without needing a U.S. bank to open in the morning.

For a fund that measures profit in basis points and risk in minutes, that flexibility is worth far more than the interest they give up by holding USDC instead of a traditional deposit.

Circle then gives them digital tokens in exchange. Those tokens circulate freely on blockchains, moving billions of dollars in value across markets every single day.

But here’s the subtle magic behind the whole system,Circle keeps the real dollars.

And they don’t stash that cash in some dark vault like old world bankers. They put it to work.

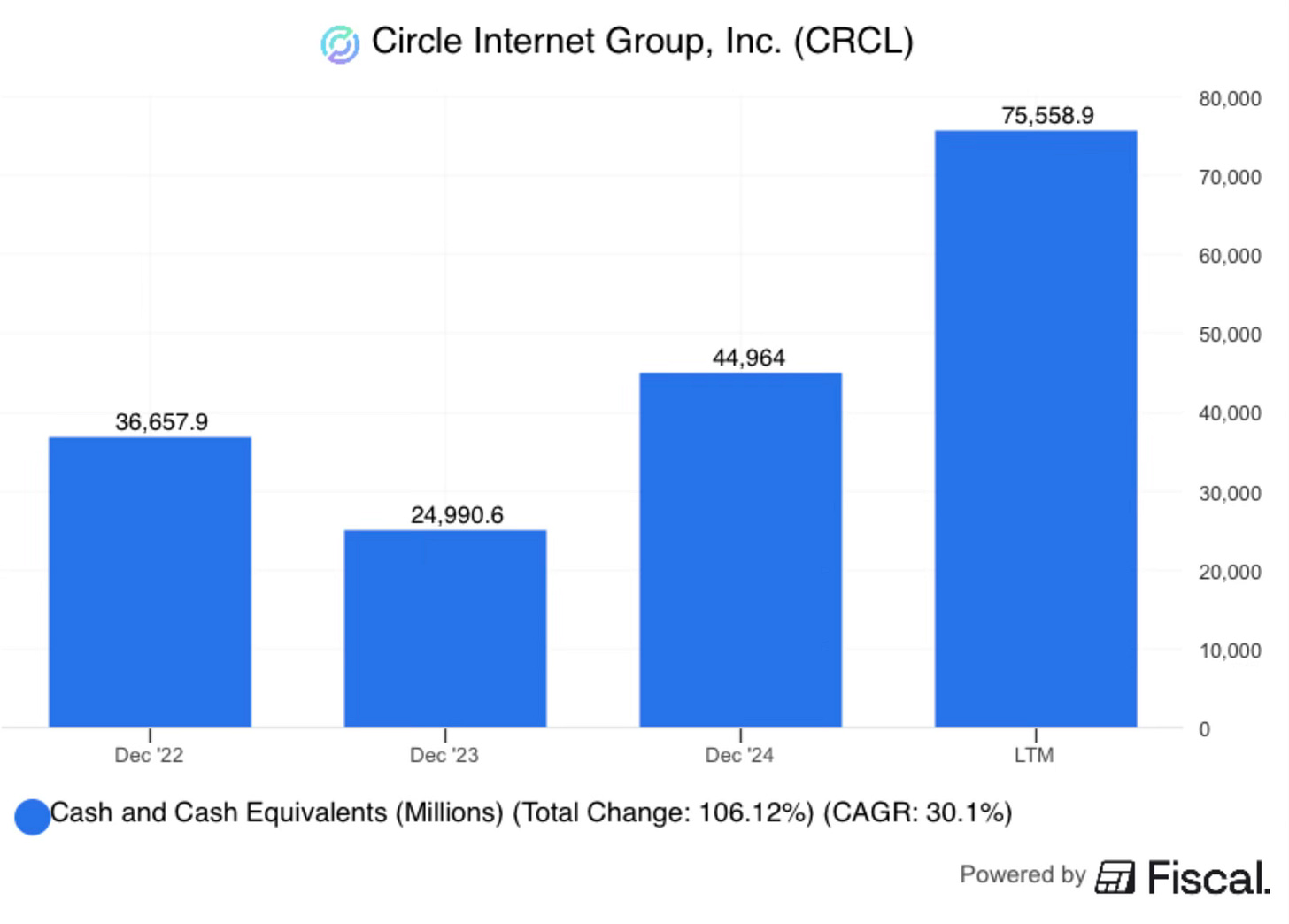

Circle currently holds roughly 75,558.9 million in reserves.

Almost all of it sits in super-safe, short-term U.S. Treasury bills, the kind of assets that pay reliable interest and are considered some of the safest instruments on earth.

And that brings us to the single most important number for any Circle investor: Reserve Income.

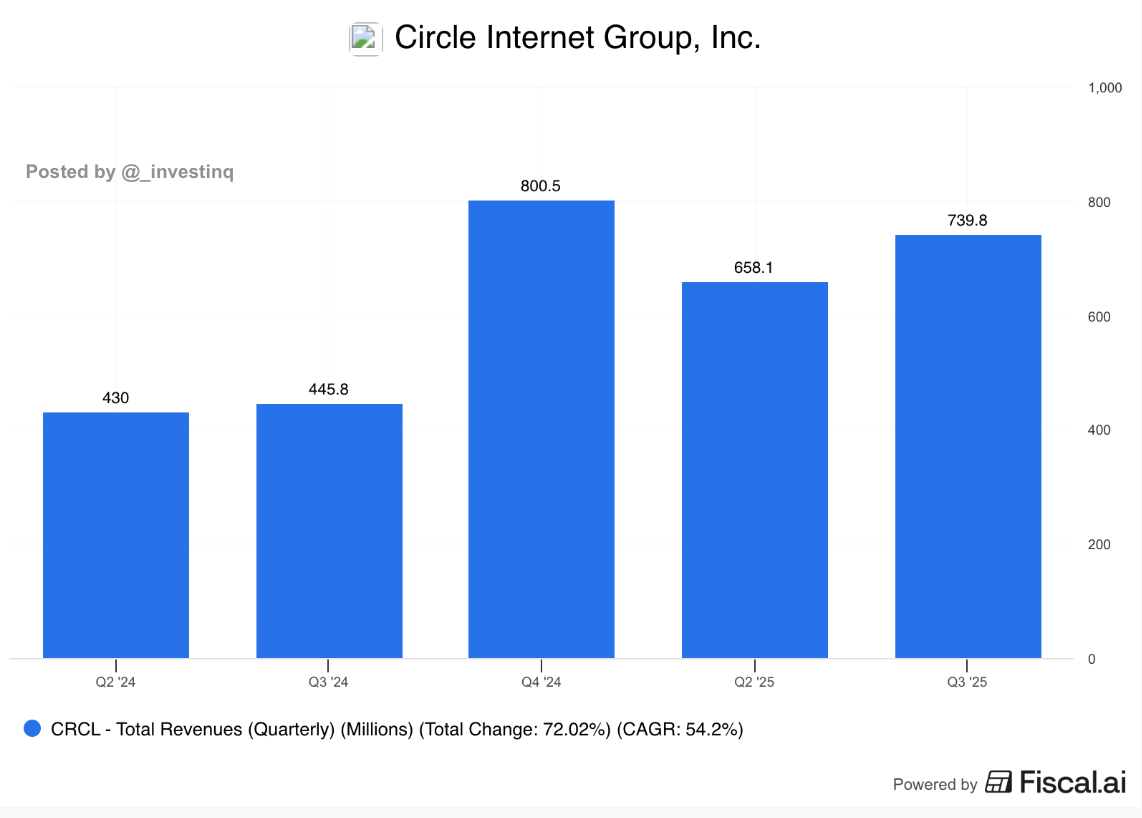

In the third quarter of 2025 alone, Circle generated roughly $740 million in revenue and 96% of that money came from interest earned on those reserves.

Circle functions like a massive money market fund that simply doesn’t pass yield back to its users.

When interest rates are high, as they’ve been recently, the model prints cash.

Circle generates hundreds of millions in free cash flow just by existing.

However, the ceiling is already visible. We have seen revenue slip from a peak of $800.5 million in late 2024 down to roughly $740 million this quarter.

This decline highlights their greatest vulnerability.

That’s the core tension inside Circle’s business, an incredibly powerful model sitting on top of an incredibly rate sensitive foundation.

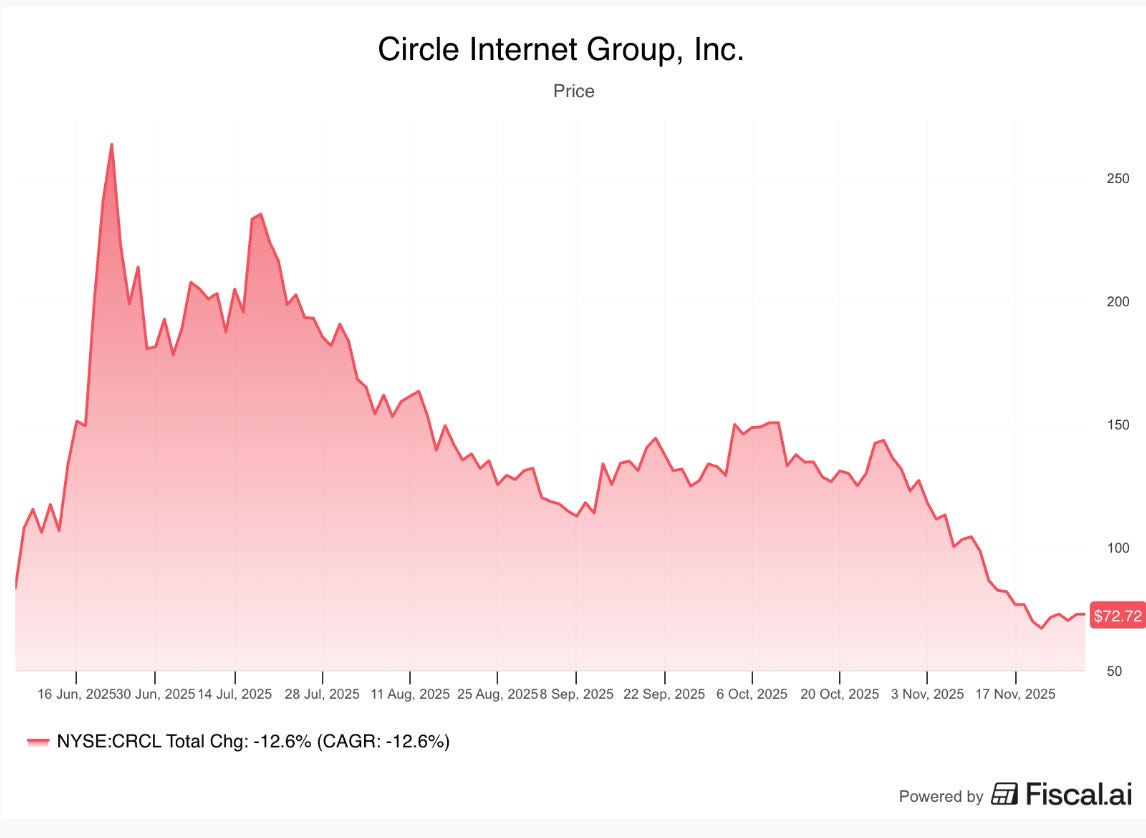

If you look at the price charts for Circle you will see volatility that mirrors the Federal Reserve’s announcements.

This is because Circle’s primary revenue stream is at the mercy of Jerome Powell.

This is the “Rate Cliff” thesis.

With the Federal Funds Rate currently sitting near 3.9%, the ceiling is already lowering.

If the Fed continues to cut rates down to 2% over the next few years, Circle’s revenue will mathematically evaporate unless they can drastically change their business.

A single 1% drop in interest rates wipes out roughly $600 million from their top line annually.

To offset this, Circle has to grow the amount of USDC in circulation faster than interest rates fall.

With current circulation at approximately $75.6 billion, they effectively need to double their user base to $150 billion just to maintain their current revenue levels in a 2% interest rate world.

This is difficult because they are paying a heavy toll to get there because of a metric called Distribution Costs.

This is essentially a revenue-sharing agreement, primarily with Coinbase, the crypto exchange.

Circle pays Coinbase a massive chunk of its interest income in exchange for Coinbase distributing USDC to millions of customers.

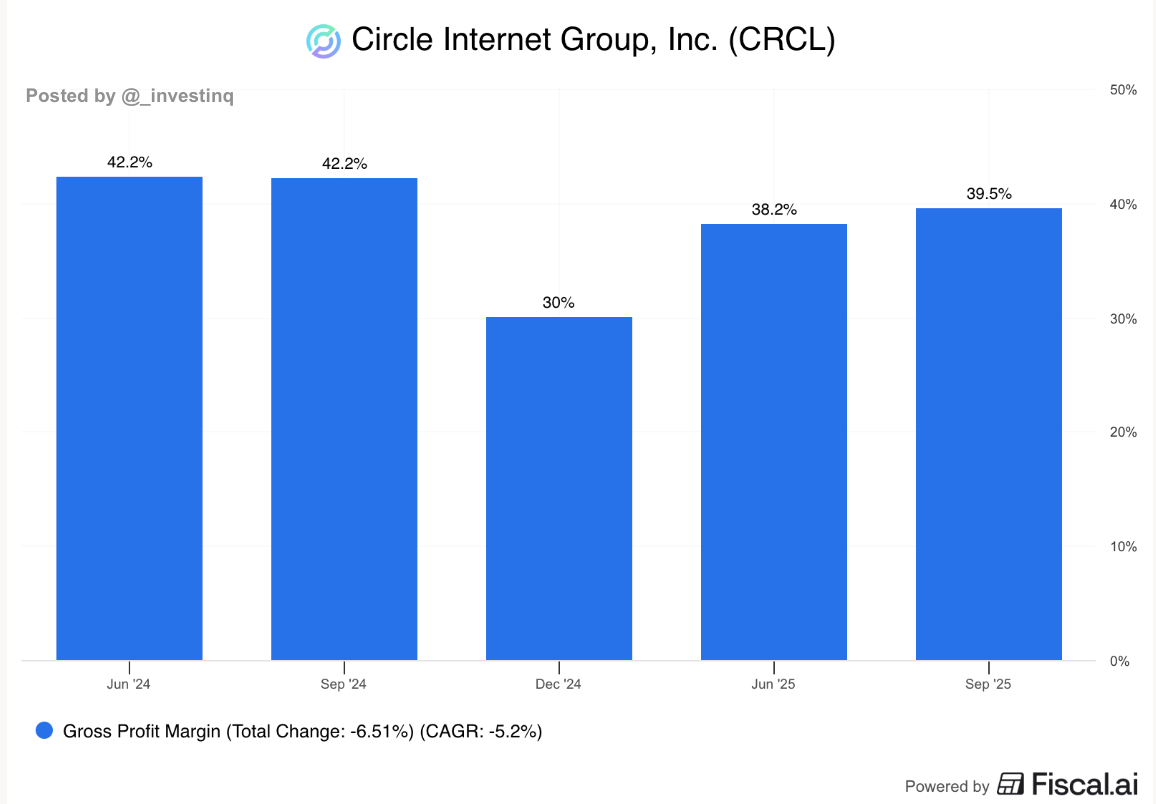

This significantly eats into their Gross Profit margins, which sit around 39.5%.

Side Note: These charts were made with Fiscal.AI, which I use daily for structured financial data and analysis. They’re running a big Black Friday sale, 30% off all plans.

While that’s healthy for a bank, it is quite low for a software company, proving that Circle creates money, but they have to pay rent to the platforms that distribute it.

The Strategic Pivot: From “Interest” to “Utility”

Circle knows it cannot survive forever as just a savings account that doesn’t pay interest.

Management is keenly aware of the Rate Cliff.

This is why the investment narrative is shifting from “how much interest do they earn?” to “what can you build with this?”

Circle is attempting to pivot from a Net Interest Margin business like a bank to a Transaction Services business like Visa or Stripe.

They want to charge fees for using their software, not just earn yield on cash.

They are building what they call the Economic OS (Operating System). This includes:

The Arc Blockchain: A new network designed specifically for financial institutions where Circle could potentially capture transaction fees.

Programmable Wallets: Tools that allow developers to build USDC accounts into their own apps.

Cross-Chain Transfer Protocol (CCTP): A teleportation device for money that lets USDC move between different blockchains (like Ethereum and Solana) instantly, burning tokens on one end and minting them on the other.

If this pivot works, Circle becomes a technology stock with recurring software revenue.

The situation feels reminiscent of Robinhood during its own massive transition. Just as Robinhood had to evolve from a misunderstood, single-revenue trading app into a diversified financial services giant to survive.

Circle is currently undergoing that same painful but necessary metamorphosis from a crypto native yield farmer to a mature software platform.

If it fails, however, they remain a proxy for Treasury yields and their stock price will bleed out as rates fall.

The Regulatory Moat: Why Being the “Good Guy” Finally Pays Off

For years, Circle was the nerdy kid in the crypto class.

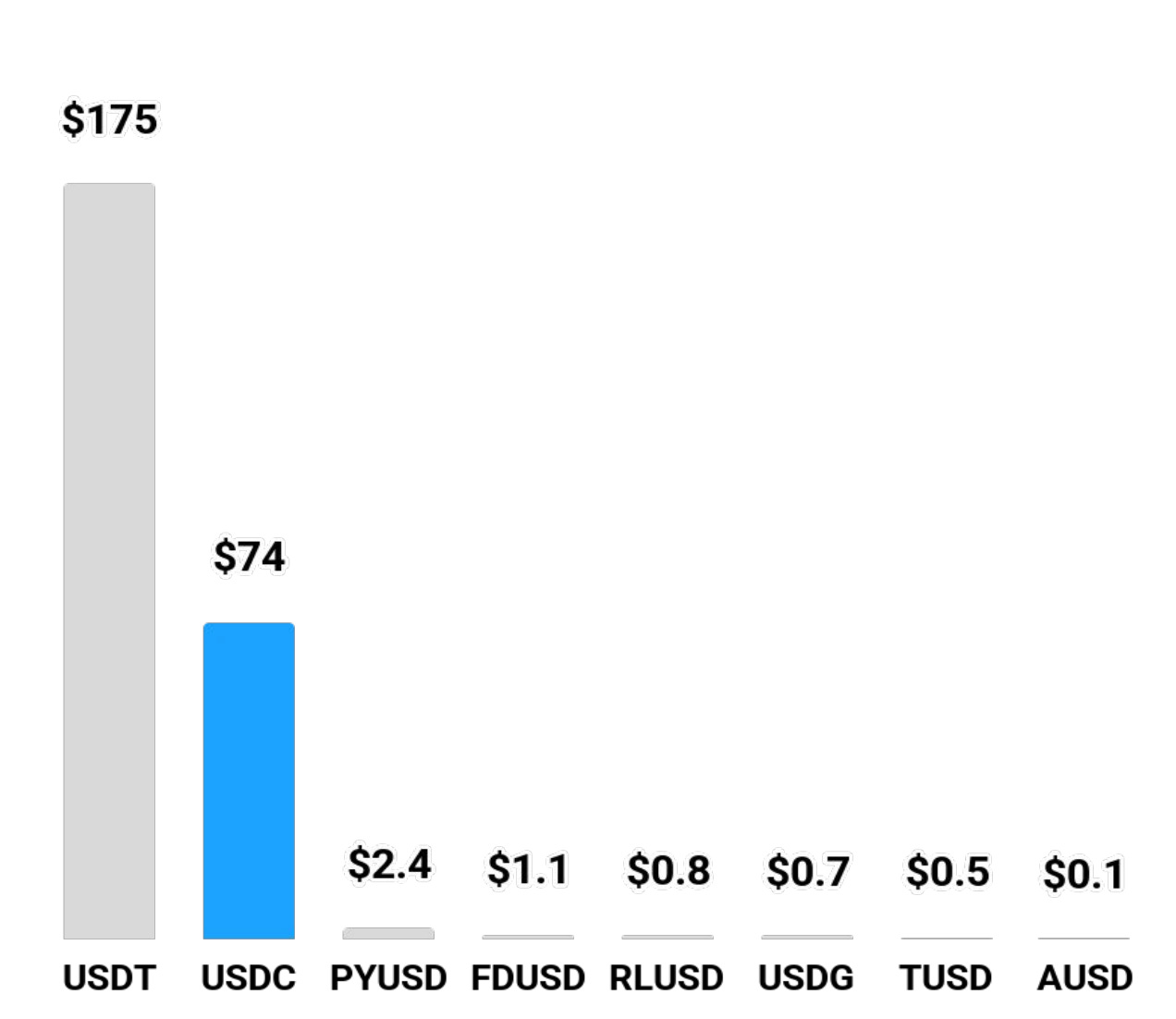

While their biggest competitor, Tether (USDT), operated out of offshore havens with murky financials and refused to do full audits, Circle insisted on being regulated in the United States.

That strategy was expensive and slow.

Tether grew to be three times the size of Circle because they didn’t ask difficult questions about who was using their money but the tide has turned.

The GENIUS Act in the United States and MiCA regulations in Europe are changing the game.

Governments are drawing a line in the sand, if you want to integrate with the Western banking system, you must play by the rules.

This creates a massive regulatory moat for Circle. U.S. banks, pension funds, and payment giants like Visa cannot legally touch an unregulated stablecoin like Tether.

They can, however, use USDC.

This moat was solidified after the Silicon Valley Bank (SVB) collapse in 2023.

Circle temporarily lost access to $3.3 billion of its reserves, causing the USDC peg to slip to $0.87.

It was a near-death experience but they survived, and they upgraded their armor.

Today, their reserves are managed by BlackRock in a bankruptcy remote government fund (the Circle Reserve Fund).

They have essentially become “too big to fail” by integrating themselves into the very fabric of Wall Street.

The Future: AI Agents and the $4 Trillion Opportunity

So, where is the stock price going in a few years?

The Bear Case is simple, interest rates drop to 2%, revenue gets cut in half, and banks like JPMorgan launch their own JPM Coin, rendering Circle obsolete.

In this world, Circle is squeezed between the government and the big banks, and the stock languishes.

But the Bull Case is captivating. It relies on a concept called the Velocity of Money.

Circle is betting that in the future, humans won’t be the only ones spending money.

We are entering the age of AI Agents, autonomous software bots that perform tasks.

An AI agent cannot walk into a Wells Fargo and open a checking account but it can generate a USDC wallet address in milliseconds.

Imagine a future where your AI personal assistant books your travel, negotiates with a hotel’s AI agent for a better room rate, and settles the payment instantly in USDC.

Or imagine a self-driving truck paying a toll road automatically, machine-to-machine.

it is already being tested by the biggest players in tech. Amazon’s cloud division (AWS) is already hosting the infrastructure for these serverless payment systems, and startups like Crossmint have actively demoed AI agents purchasing products on Amazon using USDC.

Even Google is experimenting with Agent-to-Agent (A2A) protocols where AI models pay each other for data in real-time.

Circle is building the native currency for this machine economy.

In this scenario, USDC becomes the native currency of the internet.

Even if interest rates are low, the sheer volume of transactions would be in the trillions.

Citi estimates the stablecoin market could reach $4 trillion by 2030.

If Circle captures just 30% of that market, their reserves would grow to $1.2 trillion.

Conclusion: A Binary Bet on Infrastructure

Circle Internet Group is not a stock for the faint of heart.

It is an infrastructure play. And right now, the market is offering a entry point due to a technicality, The IPO Lock-Up Expiration.

The stock is currently trading around $72.72, down roughly 12% over the last year, with a market cap of $17 billion.

This depressed price partly reflects the fear that early insiders will flood the market with shares when their lock-up period expires Dec 2nd.

This creates a unique psychological game for investors.

The market anticipates that employees and early backers, who have been waiting years for liquidity, will sell regardless of price.

This supply shock is what bears are banking on.

We might see Circle dip to lows in the mid-60s as this supply hits, nothing is ever guaranteed.

It would be quite foolish for insiders to aggressively dump shares at these levels given how much the stock has already dropped, but panic selling is rarely rational.

I am watching next week as a critical entry point.

A prudent strategy is to open a starter position here and I have started one at $72.72.

Also, I plan to add more shares if the post lock up selling pressure pushes the price down to the $62–$65 range and if circle continues to go higher, I will start to dollar cost average.

Beyond the technical setup, catalysts for a rebound are lining up fundamentally.

We have a clear Bull Case in AI adoption where autonomous agents will start to use USDC for payments but we also have a massive political tailwind that cannot be ignored.

The current administration has taken an undeniably pro crypto stance.

With the GENIUS Act signed into law, the regulatory cloud that once hung over Circle has dissipated, replaced by a framework that explicitly favors compliant, US domiciled issuers like Circle over offshore rivals like Tether.

Furthermore, with the Trump family’s direct involvement in projects like World Liberty Financial, the political environment for a regulated, dollar backed stablecoin like USDC has never been more favorable.

The administration views the digital dollar not as a threat, but as a tool for maintaining American financial dominance in the internet age.

You are essentially betting that the U.S. dollar is about to get a software update.

Just be prepared for a bumpy ride every time the Federal Reserve Chairman speaks.

If you made it to the end, hit like, restack it, and share it with someone who’d get value from it. Seriously, it helps more than you realize.

Important note: As you know, I track macro trends closely because you can’t consistently pick good stocks without understanding the bigger forces shaping the market. That’s why I’m rolling out a full equity research series, something I’ve mentioned to paid members in earlier editions. Most of these deep dives will be paywalled and the plan is to publish four each month and track every thesis in a live spreadsheet so you can follow the performance in real time.

Disclaimer: Nothing in this newsletter is financial advice. All opinions, analyses, and commentary shared here are my own personal views, based on publicly available information and independent research. You should not rely on any of this content as a recommendation to buy, sell, or hold any security or investment. Always do your own due diligence and consult a licensed financial advisor before making investment decisions.

True horror story 😂

Earlier this year, I transferred money from a Canadian bank account into a U.S. Schwab account, but for the transfer to go through, the funds had to clear through Citibank first. Citibank operates in both Canada and the U.S., and Schwab is one of their clients. Long story short, the funds disappeared, and among the three institutions involved, no one knew where the money was. It took almost four weeks for them to sort it out, with each one insisting they had no record of it or had never received it. So yeah, we definitely need an upgrade.

Another great post. Risks pretty mitigated from hacks from what I understand. Just have to build enough cushion against a run or liquidity crisis. Blackrock helps. Appreciate the info.