Why Wall Street Rallies While Main Street Struggles

Unpacking the Disconnect Between Markets and the Real Economy

Wall Street’s Rally vs. Main Street’s Pain

You’ve probably heard it a thousand times on social media, in the news, maybe even at your uncle’s Sunday BBQ, “People are losing their jobs, the economy feels like it’s being held together with duct tape, and everyone keeps arguing if we’re in a recession or just warming up for one”. Yet, almost like clockwork, the stock market keeps hitting all-time highs week after week.

Most of the explanations you hear are the same recycled lines. “The stock market is not the economy.” “It’s all controlled by the rich.” “The Fed will swoop in and cut more rates.” Nothing new there. You’ve heard it a million times. I’m not here to repeat that. I want to dig into the real forces at play and actually break down why this disconnect exists, and then share where I see the markets heading over the next year. So buckle up, these are things you’ve probably never even heard of.

Algos Don’t Care About Your Recession

Let’s talk about fun and exciting algorithms. At their core, algorithms are just sets of rules written in code, step-by-step instructions that tell a computer what to do. In the stock market, that means “if this happens, then buy,” or “if that happens, then sell.” Nothing magical, just machines following rules at lightning speed.

They started out as small assistants. Their job was to help big funds move money without swinging prices around too much. Think of them like interns, fetching coffee, filing papers, doing the small stuff no one else wanted to deal with. But over the years, these interns got smarter. They learned how to scan charts, spot patterns, and trade across dozens of markets at once. Before long, the interns weren’t just helping, they were running the office.

Today, roughly 70% of all trades in the U.S. are fired off by machines. So when stocks suddenly shoot up or tank in seconds, it’s not a trader at a desk hitting buy or sell. It’s code moving billions before you can even blink.

High-frequency trading changed everything. Instead of humans making a handful of trades, machines began firing off millions each day. Picture a casino floor that never sleeps, screens glowing, trades flying, action everywhere. The market became louder, faster, and more fragile. The 2010 Flash Crash showed what happens when the machines all trip at the same time. Prices collapsed in minutes, then snapped back just as quickly.

Over the past few years, the behavior has shifted. Headlines that once shook markets barely move the needle. Job losses, weak earnings, slowing GDP stuff that should matter gets brushed aside. Even major global scares don’t spark the reaction you’d expect. Earlier this year, tensions between Israel and Iran escalated so far that commentators were calling it the closest thing to “World War III.” News outlets went wall-to-wall, but the market barely blinked. The programs stayed locked in on flows and volatility.

Artificial intelligence has pushed them even further. Entire funds are now managed by AI. One ETF, AIEQ, was built on IBM’s Watson and has outperformed the S&P 500 at times. BlackRock has already swapped human stock-pickers for self-learning systems. The old image of investors debating in a boardroom has been replaced by machines adjusting models in real time.

That’s why stocks keep running even when the economy feels broken. Machines don’t care that much about layoffs. They don’t see people struggling to pay bills. They follow rules, patterns, and signals and right now, those signals are still flashing green.

Please read this message to continue: I’ll be honest with you, putting these deep dives together takes a ton of work. That’s why I highly recommend you upgrade. I only charge about $99 a year, while competitors charge over $100 a month for email such as this. There’s so much value packed into each one, and your support not only keeps this newsletter going but makes sure you never miss the insights that really matter.

Fear Is Fading, FOMO Is Building

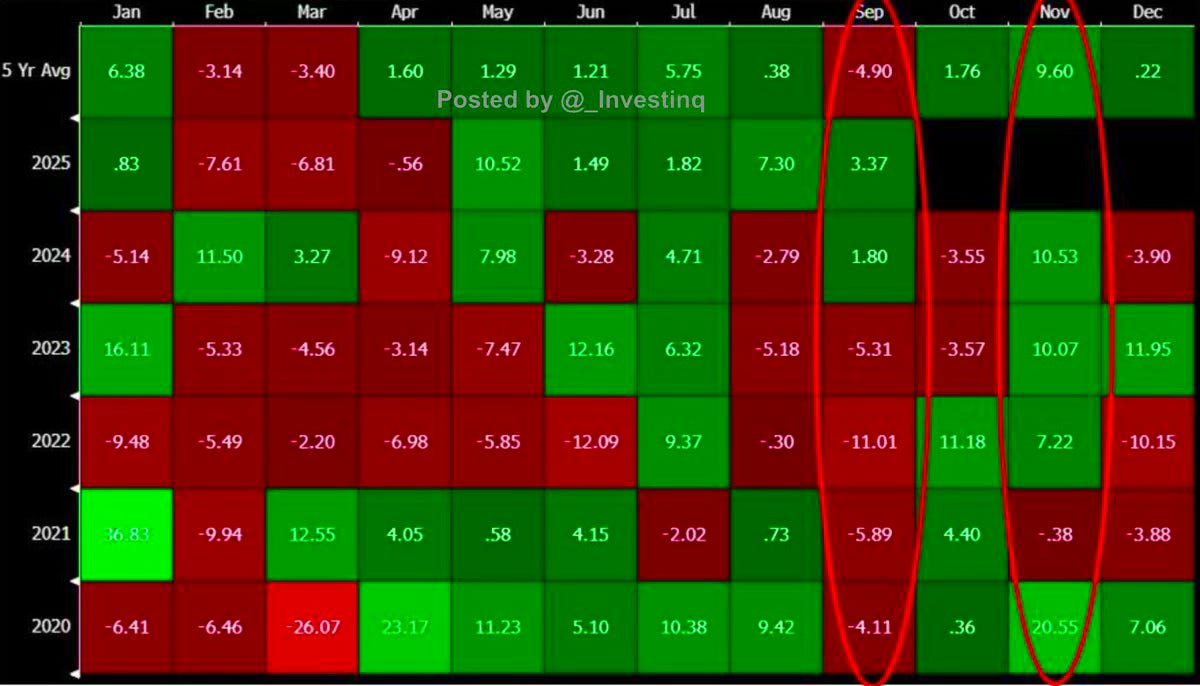

Let’s talk about retail. September usually drags the sector down. For the past five years, it has averaged a 4.9% drop. Traders circle it on the calendar, analysts repeat the stat, and most people treat it as inevitable. This year that story broke. Retail is up 3.9% in September. August was even stronger, climbing 7.3% when history shows it normally sits flat.

That momentum says a lot. Consumers are still out there spending. There’s a shift in behavior. Cash feels weaker, prices keep climbing, and people would rather use their money than hold it. Back-to-school season, late-summer travel, everyday shopping, it all shows up in the data. If that strength carries into the holidays, September’s curse might not show up at all. November has always been retail’s sweet spot, averaging nearly a 10% gain, and strong spending into that season would only add more fuel.

Positioning tells its own story. Traders came into the Fed’s September meeting loaded with protection. Long volatility trades were crowded, hedges were everywhere, and the tone was defensive. The meeting passed, nothing blew up, and now that protection is being pulled back. The unwind doesn’t sit quietly in the background, it creates pressure in the opposite direction. As hedges come off, buying flows into the market. Fear fades, and momentum builds.

Flows confirm the shift. Retail investors, mom-and-pop buyers have poured nearly $23 billion into S&P 500 stocks over the past 30 days. That’s one of the biggest buying sprees on record and looks eerily similar to the surge we saw in February before the sell-off.

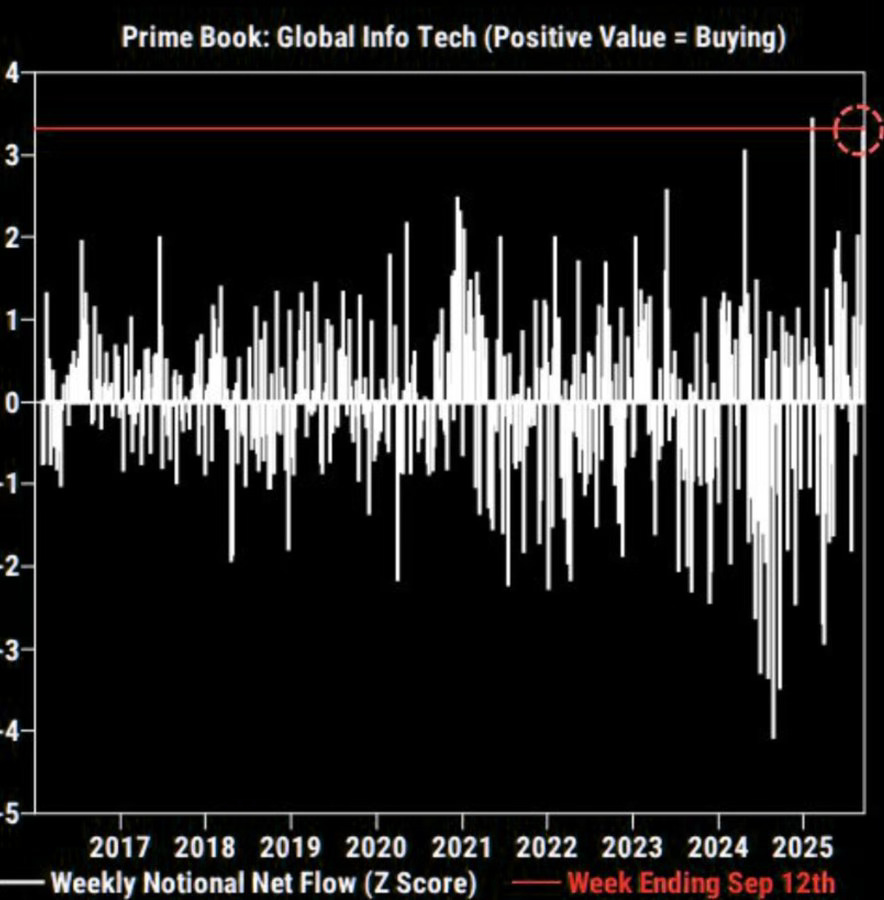

Hedge funds are leaning in as well, scooping up tech stocks at one of the fastest paces ever tracked. When retail is throwing money at the market and hedge funds are piling into tech at the same time, it adds fuel most people don’t see coming.

That’s the setup right now. Seasonality has broken, consumers are holding strong, protection is being unwound, and both retail investors and hedge funds are adding fresh capital. The conversation isn’t about when the crash comes. The conversation is about who gets left behind if markets rip. Important to note that historically, October is the most volatile month for the S&P 500 so position accordingly!

AI: The Boom Holding Up the Economy

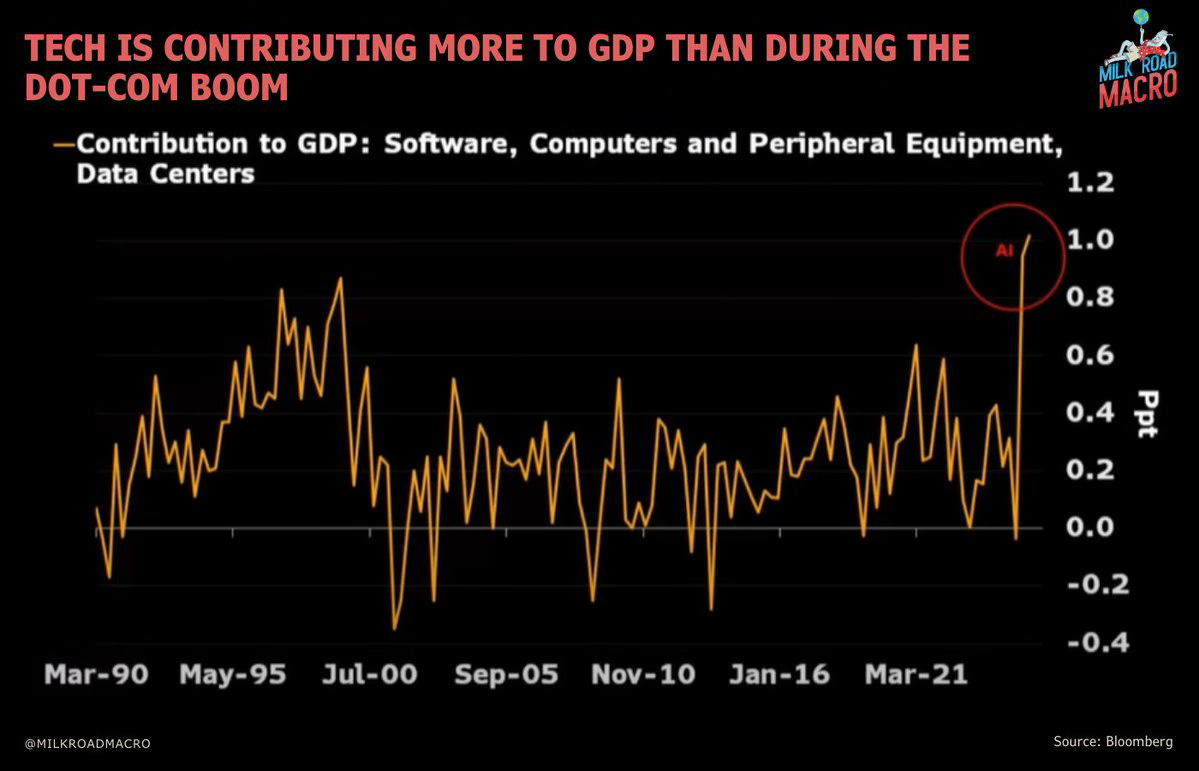

Let’s talk about AI. The numbers don’t lie. The U.S added a full 1% to its GDP in the first half of 2025. That’s bigger than what the dot-com boom managed during its peak. This isn’t just hype on social media or promises in earnings calls, it’s showing up in the data. AI has become the centerpiece of growth while cracks show in the broader economy.

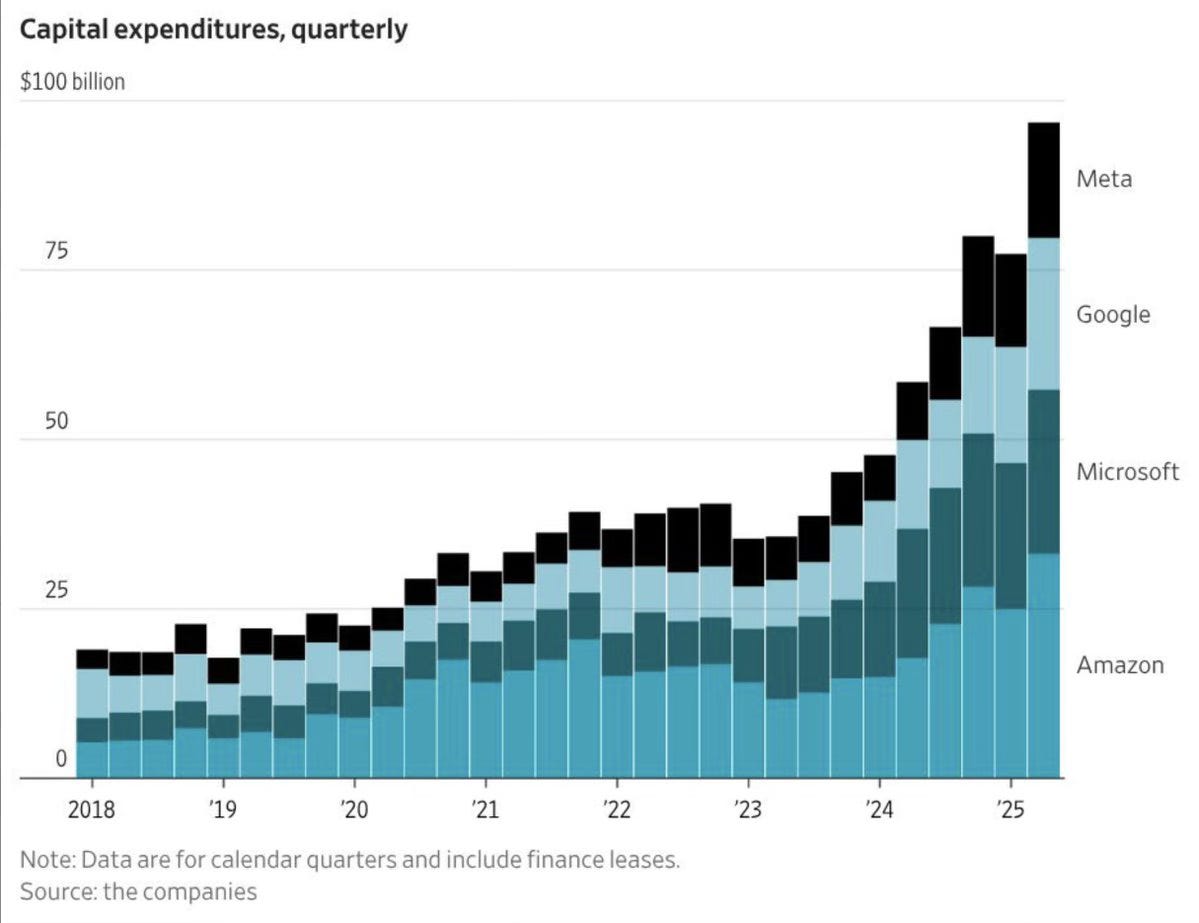

The fuel is corporate spending on a scale we’ve never seen before. Microsoft, Amazon, Google, all of them are pouring money into AI infrastructure. The tab this year is roughly $400 billion. Next year, estimates push it above $500 billion. By 2026, hyperscaler CapEx is projected to hit $433 billion, a 174% jump from 2022. That level of spending explains why GDP still looks strong while other sectors of the economy are soft

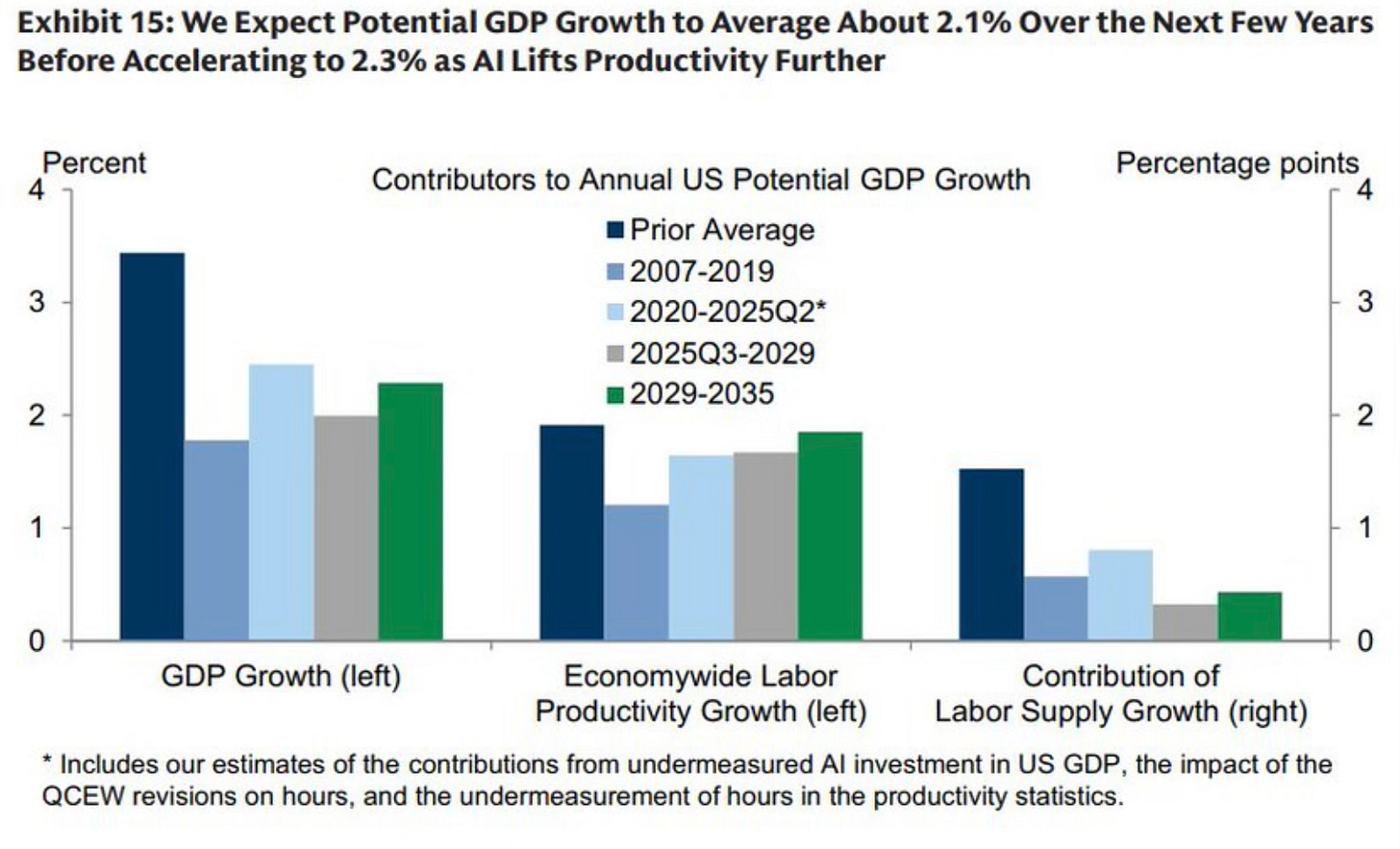

Goldman Sachs estimates AI-driven productivity could lift GDP growth by at least 2.1%. That’s enormous in economic terms. And it’s not just Goldman talking. Deutsche Bank has already warned that without tech spending, GDP would be hovering near recession levels. Nvidia’s chips and hyperscaler CapEx have become the main pillars holding the entire system together

But here’s where it gets tricky. Spending cycles don’t last forever. At some point, companies stop throwing cash at data centers and start demanding a return on what they’ve already built. If that slowdown happens, the economy loses its biggest tailwind. That’s when we should be really worried.

For now, we’re safe. The checks are still being written, the servers are still being built, and AI is still carrying the load. But the moment that fire cools, the story changes. And when so much depends on one boom, the end of the boom is the part no one should brush aside.

So the bottom line is this the market isn’t ripping because everything is fine, it’s ripping because algos don’t care about pain, consumers keep spending, flows are pouring in, and AI is carrying the economy on its back. For now, those forces are enough to keep the rally alive. But when one of them cracks especially AI spending the story flips. Until then, the real risk isn’t the crash everyone keeps waiting for. The real risk is missing the run.

Investinq’s Substack is a reader-supported publication. To receive new posts and support my work, consider becoming a Paid subscriber for just $99 a year!

Sounds like AI is the new tulip 😂 Yay, Holland where I was born, for ushering in the first recorded financial bubble, when prices of tulip bulbs skyrocketed to absurd levels and then crashed. And they’re still recovering 😂😂😂